Traders look for Bitcoin price daily close at $41K to confirm bullish reversal

Bitcoin’s range breakout boosted sentiment but traders are waiting for a daily close above $41,000 before taking more decisive action.

Bitcoin started the week with a strong breakout to $40,900, but today bulls are trying to hold Bitcoin price above the $40,000 level.

As the price broke from the $31,000 to $39,000 range on June 14, traders speculated that setting a daily higher high and a close above $41,000 would set BTC up for a move to $47,000, but a lack of sustained buy volume and the much-discussed possibility of a death cross between the 50- and 200-day moving average are factors that could be keeping traders cautious.

According to Simon Peters, an analyst at eToro:

“Bitcoin is at its highest level since May, a notable recovery but the crypto asset has yet to convincingly break through – and most importantly, close above – the $41,000 mark.

While sentiment has improved and futures premiums have recovered after nearly entering backwardation last week, analysts are unable to confirm that the bull trend has resumed.

Peters said:

“We’ve seen the price face resistance earlier in the year at this level when it was trading around what was then an all-time high, and I would really need to see a stronger increase to feel optimistic about the price recovering and possibly pushing onto $50,000 and beyond.”

Sentiment has improved but the market is flat

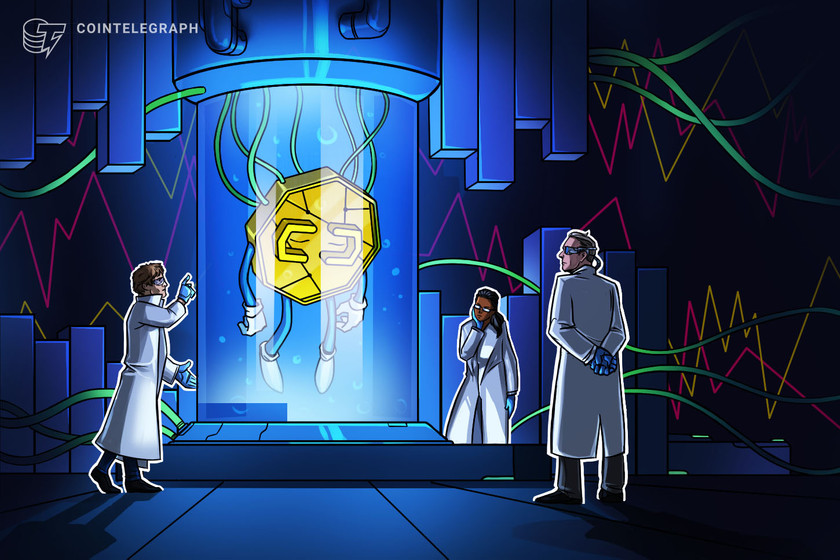

Regarding the lack of follow-through from Bitcoin’s June 14 pump, Cointelegraph analyst Marcel Pechman shared the above chart and said that while the 25% delta skew is no longer signaling that extreme fear exists in the market.

Pechman said:

“Arbitrage desks and market markers are currently uncomfortable with Bitcoin’s price as the neutral-to-bearish put options premium is higher. However, the current 7% positive skew is far from the 20% exaggerated fear seen in late May.”

Even though day traders are on the fence about the status of the trend, a number of on-chain metrics, including the Hodler Net Position Change, show that investors still view the recent dip to $30,000 and Bitcoin’s current price at $40,250 as excellent purchasing opportunities.

HODLer Net Position Change has flipped green for the first time since October. pic.twitter.com/0hhjXrSdmF

— William Clemente III (@WClementeIII) June 15, 2021