Tokenized Treasury Funds Pass $2B Market Cap Amid BlackRock’s Explosive Growth

-

Tokenized Treasury notes passed $2 billion in market cap after rapid growth from Blackrock’s BUIDL and other issuers.

-

This comes only five months after the funds hit the $1 billion milestone in March.

Less than five months after hitting $1 billion in market capitalization, tokenized Treasury notes have doubled in size again, crossing the $2 billion level on Saturday, according to data from RWA.xyz.

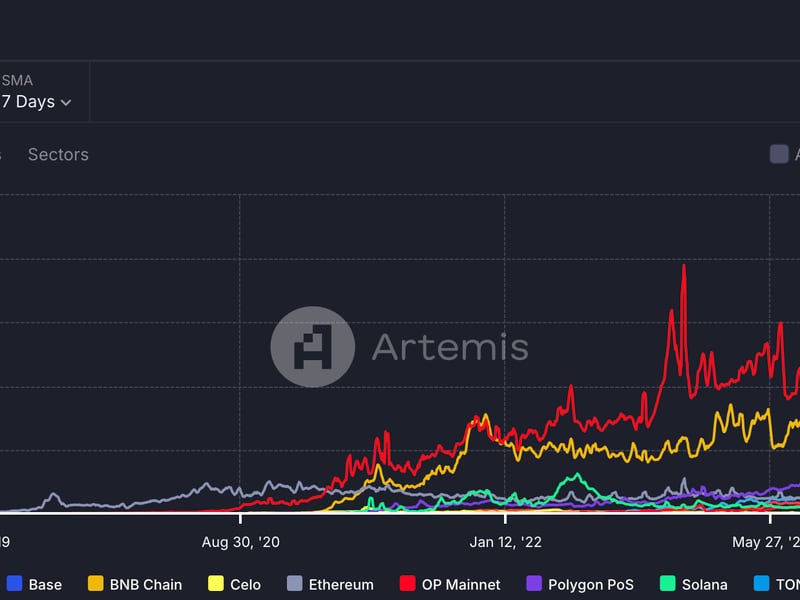

Tokenized Treasuries are digital representations of U.S. government bonds that can be traded as tokens on blockchains such as Ethereum, Stellar, Solana, Mantle and others. While $2 billion is an impressive milestone for the recently launched funds, there is far more potential given the Treasury market’s massive size of $27 trillion.

The largest one, BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), is a big factor in this year’s soaring market cap. ust six weeks after its late March launch, BUIDL became the largest tokenized Treasury fund at $375 million in market cap. Assets now stand at $503 million. Competitors include Franklin Templeton’s OnChain U.S. Government Money Fund (FOBXX) and Ondo’s U.S. Dollar Yield (USDY), both of which have also seen explosive growth.

Most of the recent growth, however, came from smaller issuers, rwa.xyz data shows. Hashnote’s offering mushroomed nearly 50% to hit $218 million over the past month. Meanwhile, OpenEden’s and Superstate’s products grew 37% and 18%, respectively, during the same period, both nearing $100 million market cap.

Tokenized Treasury funds have become a popular investment vehicle for crypto traders looking to diversify their holdings and take advantage of the rapid rise in Treasury yields over the past few years while also being able to settle transactions at any time.

The 10 year U.S. yield currently stands at 3.81% versus 1.5% four years ago. Similarly, the 2 year yield has risen to 3.92% up from near zero levels in 2020 and 2021.

Edited by Stephen Alpher and Krisztian Sandor.