Tokenized RWAs Could Grow to a $10T Market by 2030 as Crypto Converges to TradFi: Report

-

The market for tokenized assets could reach $10 trillion in a “bull case” and $3.5 trillion in the “bear case,” according to digital asset manager 21.co.

-

Crypto is currently undergoing a maturation phase and increasingly integrating with existing financial plumbing.

-

Regulatory restrictions and lack of standards pose challenges for widespread tokenization.

The market for tokenized assets could grow to as large as $10 trillion in this decade as traditional financial (TradFi) institutions continue to adopt blockchain technology, digital asset management firm 21.co said in a report.

“The convergence between crypto and traditional asset classes, including fiat currencies, equities, government bonds, and real estate, is experiencing an unprecedented growth,” read the report. “We estimate that the market value for tokenized assets will be between $3.5 trillion in the bear-case scenario and $10 trillion in the bull case by 2030.”

21.co’s forecast joins a slew of recent reports and predictions about the potential of tokenizing real-world assets (RWA), crypto’s buzzword for placing traditional financial products such as private equity, debt and real estate to blockchain rails.

Bank of America, for example, said in a report that tokenization could transform the existing financial infrastructure, increase efficiencies, reduce costs and optimize supply chains. A Boston Consulting Group report earlier this year estimated that the market for tokenized assets could mushroom to $16 trillion.

Crypto and TradFi converge via tokenization

Crypto is undergoing a maturation phase and more traditional institutions will use blockchains and build products on top of them, said the 21.co analysts. “Crypto is transitioning from frenzy to synergy,” the report argues. “Through this transition, crypto will increasingly integrate with existing financial software and bring RWAs on-chain via tokenization.”

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/CQQDI6JHQNGV7FH6WBM72RNNBQ.png)

Currently, 21.co values the tokenized asset market at roughly $116 billion, with smart contract network Ethereum (ETH) hosting nearly $60 billion of these assets, followed by Tron (TRX) and Solana (SOL).

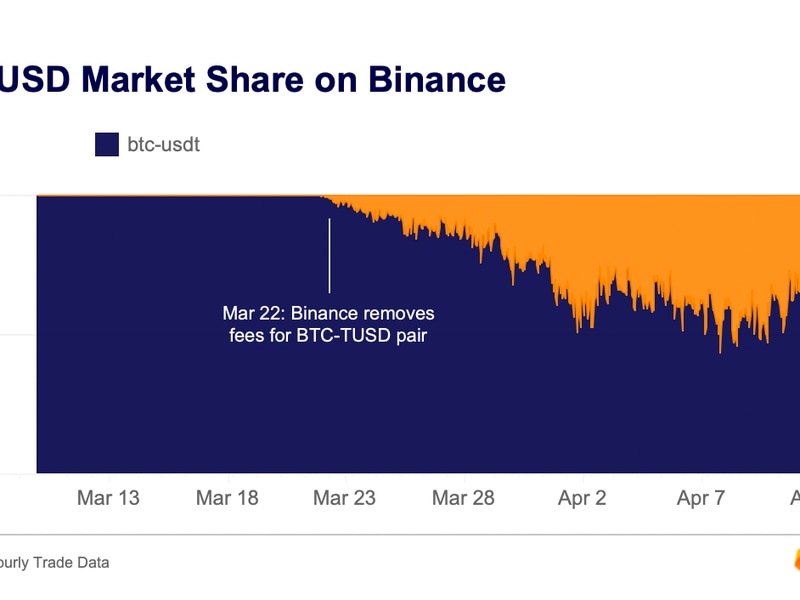

Digital dollars – also known as dollar stablecoins, or cryptocurrencies pegged to USD – are the “first successful tokenization implementation,” constituting 97% of all tokenized assets, the report said.

Other tokenized asset types – including U.S. government bonds – experienced more than 450% growth this year, according to the analysts. Surging interest rates on these traditional instruments fueled the expansion, surpassing yields available on decentralized finance (DeFi) lending markets.

Despite the growth, regulatory restrictions, lack of standardized processes and socioeconomic circumstances such as low internet penetration are among factors that pose an obstacle to widespread, global accessibility of tokenized RWAs, 21.co said.

Edited by Stephen Alpher.