Tokenized Credit Platform Centrifuge Plans Institutional RWA Lending on Coinbase’s Base, Raises $15M in VC Investment

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

Decentralized finance (DeFi) platform Centrifuge laid out plans in a blog post Wednesday to build a real-world asset (RWA) lending protocol for institutions on Base, an Ethereum layer-2 network developed by crypto exchange Coinbase.

The protocol will allow verified institutions to onboard RWAs and borrow against their RWA holdings, according to the post.

02:07

Three Crypto Predictions in 2024

00:52

Why Injective’s INJ Has Surged 3,000% in 2023

02:21

Sam Bankman-Fried’s Lawyers Push for FTX Founder’s Jail Release Again; Crypto Coin Listing Crack Down

06:36

Curve Crisis Reveals Cracks in Decentralized Risk Management

“We continue to see significant interest from our institutional clients for easier access to tokenization solutions on-chain,” said Anthony Bassili, Coinbase’s head of allocators and tokenization.

Centrifuge’s plans came to light as the protocol announced it raised $15 million in venture capital investment in an “oversubscribed” fundraising round. ParaFi Capital and Greenfield led the investment, with multiple firms including Arrington Capital, Circle Ventures, Gnosis, The Spartan Group, and Wintermute Ventures also participating.

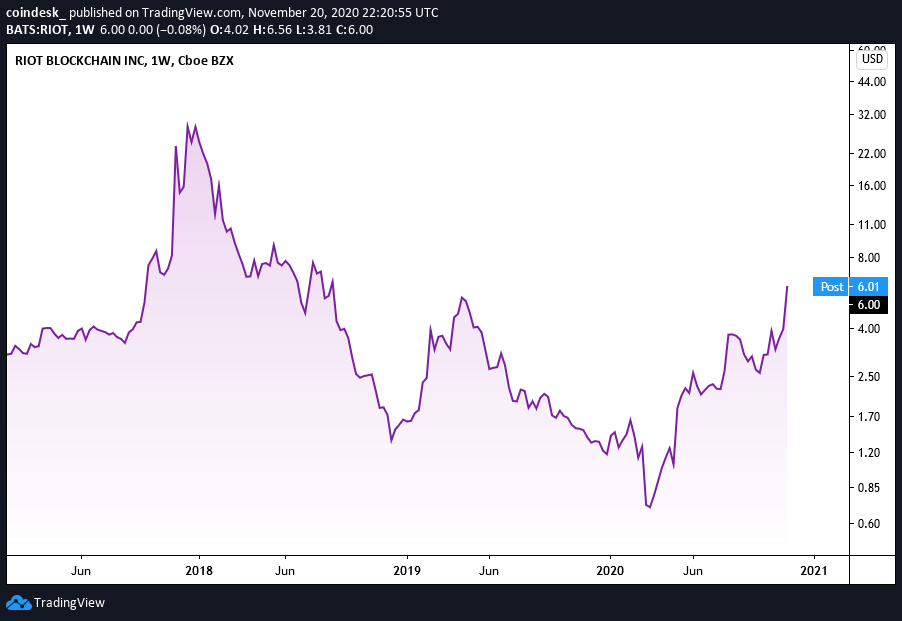

CFG, the protocol’s native token, spiked as much as 14% after the announcement before paring gains, CoinGecko data shows. The token was still up 5% over the past 24 hours, outperforming the sector benchmark CoinDesk DeFi Index’s (DCF) 1% decline in the same period.

The announcement comes as RWA tokenization race is heating up, with digital asset firms and global banks bringing traditional financial products such as bonds and credit to blockchain plumbing to increase efficiency, settlement speed and transparency. The market for tokenized asset could swell to $10 trillion by the end of the decade, asset management firm 21.co forecasted last year.

Centrifuge focuses on bringing structured credit products to blockchain rails, with $270 million active loans on the protocol, rwa.xyz data shows.

“We believe we’re reaching an inflection point in institutional adoption,” Ben Forman from ParaFi Capital said in a statement. “The Centrifuge team is a leader in real-world asset tokenization, taking a deeply thoughtful approach to design decisions around legal, regulatory, and smart contract architecture.”

Edited by Stephen Alpher.