Tokenization News Roundup: the ‘Next Trillion’

The idea of tokenizing real-world assets – everything from homes, gold, art and collectibles to instruments like U.S. Treasuries and contracts – is gaining pace. Each week, we’ll be rounding up the most important news, offering you a snapshot of developments in this burgeoning space. (For an explainer on real-world assets, please see our article here.)

The Story: Crypto industry heavyweights including Coinbase, Circle and Aave have built a working group to encourage others to bring traditional financial assets on-chain. The Tokenized Asset Coalition aims to bring the “next trillion dollars of assets” into crypto through education and advocacy for tokenization, targeting both the world of decentralized finance (DeFi) and TradFi.

The Takeaway: While advocacy groups are not new to crypto, it is somewhat unusual to see an organization sprouting up to champion a specific sector. But the Tokenized Asset Coalition scores points for working with corporate entities, DeFi incumbents and relative newcomers to tokenization, which may help them win over crypto natives who have not always been open to the vector attacks that real world assets may bring. Of course, banks almost need no convincing: the Boston Consulting Group recently found tokenized assets could hit $16 trillion by 2030.

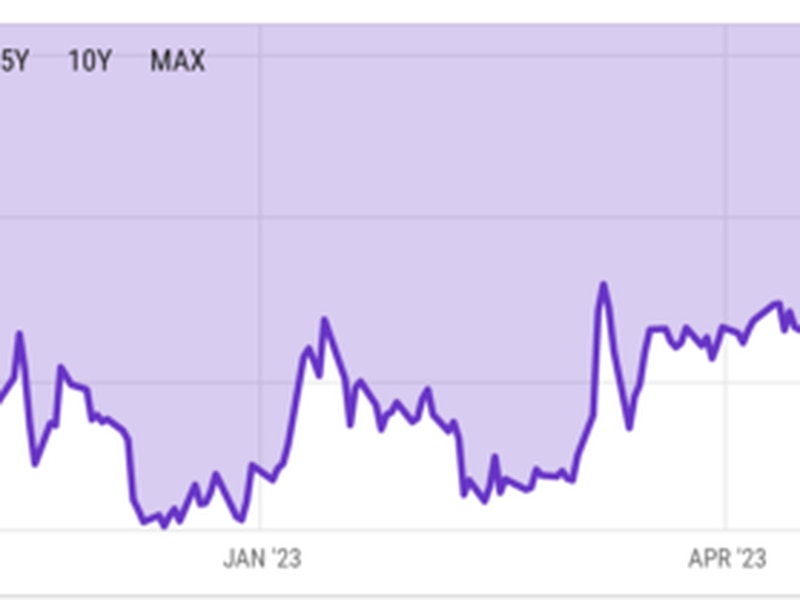

The Story: South Korea’s largest financial group Mirae Asset Securities is working with Ethereum scaling platform Polygon Labs to build RWA infrastructure. In particular, Polygon will act as a technical consultant for the recently founded Mirae Asset Security Token Working Group, which includes several other crypto and non-crypto companies working to build tools to issue, exchange and distribute tokenized securities.

The Takeaway: Tokenization is no doubt a cross-chain phenomenon, but a few blockchains including Polygon are emerging as early leads. For instance, the Monetary Authority of Singapore is using Polygon for its experimental tokenization initiative Project Guardian, as is top tier asset manager Franklin Templeton for its blockchain financial products.

The Story: The London Stock Exchange Group, the operator of one of the oldest stock exchanges in the world, has drawn up plans to offer blockchain-based versions of traditional financial assets. Though it isn’t interested in cryptocurrency per se, it has gotten religion over the benefits of tokenizing assets. The company is now considering spinning up a new digital assets unit for the blockchain-based markets business and is in talks with regulators across the U.K. government.

The Takeaway: LSE Group’s Head of Capital Markets Murray Ross told the Financial Times the company hit an “inflection point” after studying blockchain and found that “digital technology” can make trading “slicker, smoother, cheaper and more transparent.” It’s just the latest stock exchange to realize how tokenizing securities on-chain can improve performance for everyone. (Though interestingly, this week, the World Federation of Exchanges trade association published results from a survey of stock exchanges conducted before FTX imploded, and found that more than half were already offering or had planned to offer crypto-related products or services.)

The Story: Chainlink’s initial experiments with interbank messaging system Swift have been successful, according to an Aug. 31 press release. The two firms, in conjunction 12 financial partners including BNP Paribas, BNY Mellon, The Depository Trust & Clearing Corporation and Lloyds Banking Group, successfully transferred tokenized value across multiple private and public blockchains using Chainlink’s Cross-Chain Interoperability Protocol.

The Takeaway: Banks in particular are increasingly interested in tokenization, and having the interbank communications standard, Swift, already engaged in pilot programs is affirmative. “For tokenization to reach its potential, institutions will need to be able to seamlessly connect with the whole financial ecosystem. Our experiments have demonstrated clearly that existing secure and trusted Swift infrastructure can provide that central point of connectivity, removing a huge hurdle in the development of tokenization and unlocking its potential,” Tom Zschach, chief innovation officer at Swift said in a press statement.

The Story: Visa is expanding its use of the USDC stablecoin to Solana to speed up certain types of cross-border payments, but its announcement revealed how fully integrated crypto is into Visa’s stack. The payments giant has used the Circle-issued stablecoin on Ethereum since a pilot program in 2021 for treasury management purposes. It is also piloting global debit and credit card payments programs with merchant acquirers Worldpay and Nuvei, an interesting new use case tethering blockchain to the real world.

The Takeaway: Visa, which claims to be one of the first major financial firms to tap Solana, is “leveraging stablecoins” to provide a “modern option” for clients to move money around, Cuy Sheffield, head of crypto at Visa, said in a statement. The cool thing is these funds are starting in Visa’s treasury, meaning they’re fully onboarded into the crypto economy. The stablecoin market can potentially grow to $2.8 trillion in the next five years as global financial and consumer platforms tap the tokens on public blockchains to power value exchange on their platforms, research firm Bernstein has said.

The Story: SOMA Finance, a decentralized exchange, is planning to raise $5 million through the “first legally issued” digital security token sale to global and U.S. retail investors later this month. Interestingly, the SOMA token will pay out dividends from the protocol’s trading revenues, meaning it represents an actual claim on the business — or in the words of the press release the token will be “a non-cumulative, participating preferred stock” of SOMA.finance. The sale will be conducted using a regulated crowdfunding model called Reg CF.

The Takeaway: Regulated token sales have had their time in the sun in the past, like Reg A’s brush with popularity before companies realized it was largely a dead end. SOMA’s token offers real utility in the sense of delivering cash flows, which may give it a leg up. And is essentially an attempt to tokenize a company’s operations. Also of note: SOMA is a joint venture between MANTRA and Tritaurian Capital, the latter of which is a registered broker-dealer, member of the Financial Industry Reporting Authority (FINRA) and first non-alternative trading system (ATS) broker-dealer to be approved for a license to sell digital private placement securities using blockchain technology.

The Story: A consortium including crypto firms 2Tokens and Assetblocks as well as Dutch banks Rabobank and ABN Amro has been selected as one of the first 20 participating projects in the European Blockchain Sandbox, with a plan to build euro-denominated deposit tokens and blockchain wallets. Ledger Insights reports: “The tokenization will use Assetblocks’ solution to represent a tracking stock backed by renewable energy sources. Investors will buy NFTs representing a partial ownership interest in solar, wind and battery parks, which entitles them to receive profits. As a security, the NFT falls under MiFID II regulations.”

The Takeaway: The pilot program is looking into different settlement options for tokenized assets like its energy shares, and is reportedly considering trialing “whitelisted wallets” at the participating banks as well as stablecoins. ABN Amro is no stranger to blockchain, and even assisted in a tokenized bond issuance this year, but it does seem notable for financial firms to be interested in this alternative use of tokenization. Assetblocks CEO Meindert Jansberg said it best in the press release: “By collaborating with ABN AMRO and Rabobank in this regulatory sandbox, the project aims to help create a common understanding of the true possibilities of tokenization in a fully compliant way.”