Three Important Factors to Watch for XRP’s Price in the Short Term (Analysis)

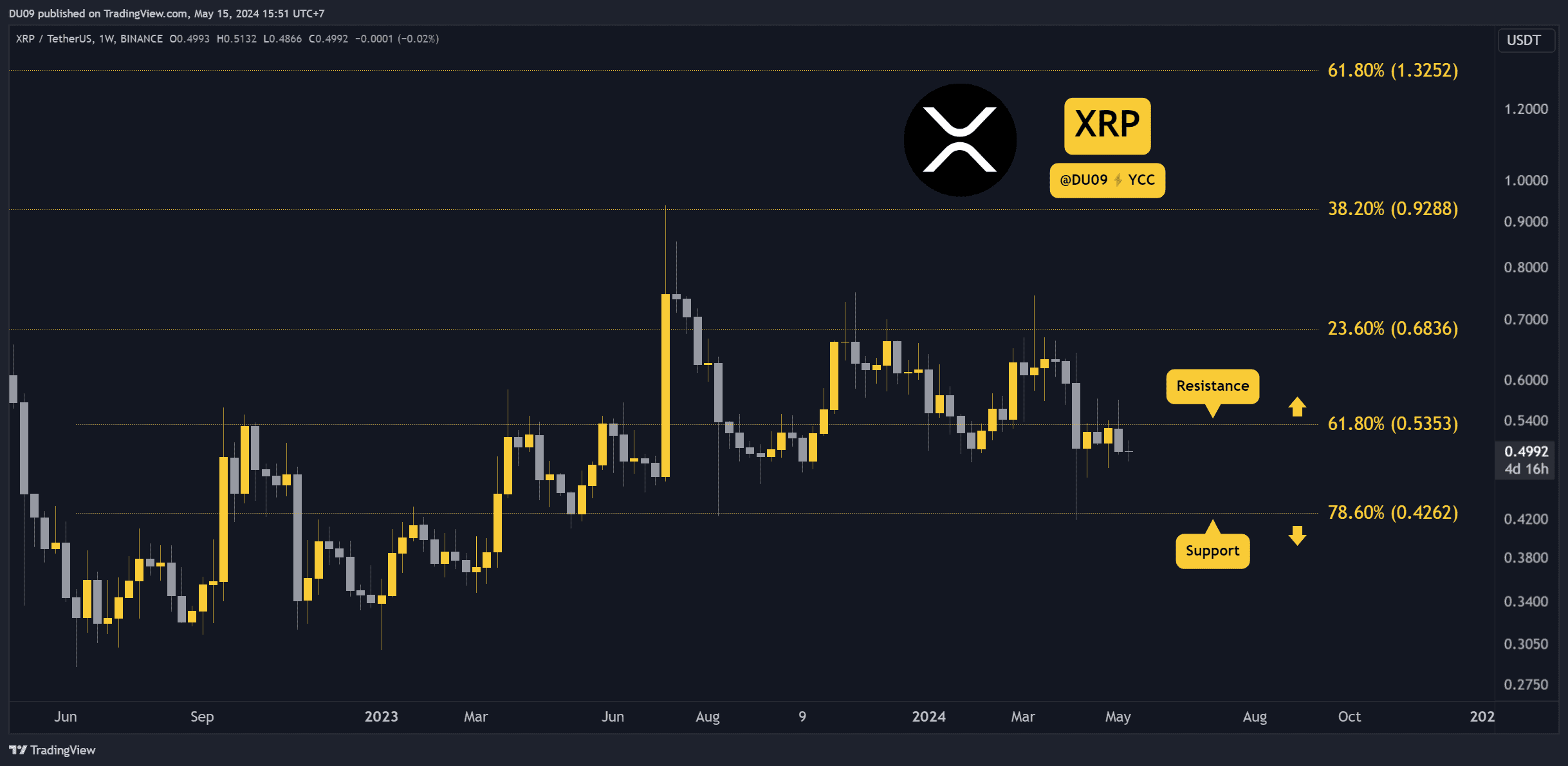

XRP turned bearish after it failed to break the key resistance. Let’s examine a few different technical indicators that may provide important insights into where the market is currently at and where it might be headed next.

Key Support levels: $0.48, $0.43

Key Resistance levels: $0.55

1. Price Rejected at Key Resistance

A second attempt to break the 55 cents resistance was rejected by sellers, and since then, XRP has remained bearish. As long as the buyers don’t find the strength to break this level, it is unlikely for this cryptocurrency to make new highs.

2. Volume in a Free Fall

Since the most recent high in March, the volume on XRP has been falling with consistently lower highs for the past two months. This confirms market participants are simply not interested to return to this market at this time.

3. MACD Bearish Cross

To make matters worse, the daily timeframe MACD made a bearish cross this week. Lower lows are likely in the future, especially if the support at 48 cents falls. Watch the key support, as that will be decisive in the next few days.

The post Three Important Factors to Watch for XRP’s Price in the Short Term (Analysis) appeared first on CryptoPotato.