Three Easy Pieces: How to Teach Your Grandmother Bitcoin

“How do we get our grandmothers to grok Bitcoin like the shadowy super coders we always wanted them to be?”

A defining feature of the Digital Era has been the rise of digital entities of incredible complexity, which manage to maintain such simplicity that your grandmother can use them.

Famously, the iPhone arrives in a box with no user guide. It is so well designed and self obvious in function that a child is capable of deftly navigating the control interface and can fill your camera roll with off-angle selfies, or drain your bank account with a few loose settings in the App Store.

The same applies to algorithmically-based organizations. Google, Facebook, Twitter and Instagram, among others, have highly-intuitive user interfaces. For the lay user, certain strings of words or visual inputs are expected to produce certain types of outcomes, and the “feed” itself has a non-random feel to it that even the most casual scroller can sense.

There’s a machine in there behind the pixels, but you never get to see it directly.

You never really need to.

You don’t crack open your iPhone to understand how to best use it, or peer into the code base of your favorite social media platform to understand which selfies and tweets to post (though every influencer knows which posts will perform well with the algorithm). In this sense, the technical innovation is almost completely hidden, and the simplified experience you get from the product itself reigns primary. One ready example is Google: The innovation was keyword indexing, but the value and experience on the user side was natural language search.

Nobody cares about your comprehensive technical index, but everyone wants to know how to bake a pie or make a martini.

When we consider how product development typically occurs in companies, we run into a problem applying the same use logic to Bitcoin. We would normally run surveys, talk to customers, study usage data and advocate within our organization to build X or Y product or service to better serve the customer.

But the nature of Bitcoin is decentralization. There is nobody to send the survey to, no master list of phone numbers to call. Innovation in Bitcoin is emergent, as opposed to the centralized ideate, build, beta test and launch techniques of most companies around the world.

So how do we get our grandmothers to grok Bitcoin like the shadowy super coders we always wanted them to be? In a world where tech companies have always intentionally developed products and refined them for a set audience (see: the Facebook ”like” button), everything happens exactly via emergence in Bitcoin.

Today, there is no perfect user experience solution for Bitcoin, no killer app that ties everything neatly together, but by presenting and explaining how three key elements of Bitcoin operate in your physical space, I contend that you can begin to teach even your grandmother about Bitcoin over tea and brownies.

Piece One: The Mining Rig

Counter intuitively, we should start our journey with the mining rig.

Whether you head into the basement, out on the covered patio, or into the side yard to open up your Black Box mining enclosure, you should begin the Bitcoin journey with proof of work and decentralization.

Your mining rig is there, converting electricity into digital security and processing the transactions of the entire network, maintaining digital scarcity and immutability alongside hundreds of thousands of other miners scattered around the world. From this vantage point, we grasp decentralization and permissionlessness.

We are participating in a digital game, and this machine runs the code that allows us to play the game. Nobody can stop us from converting our electricity into digital efforts, and we can’t infringe on the right of anyone else to play this game either.

And do we play this game out of the goodness of our hearts? No!

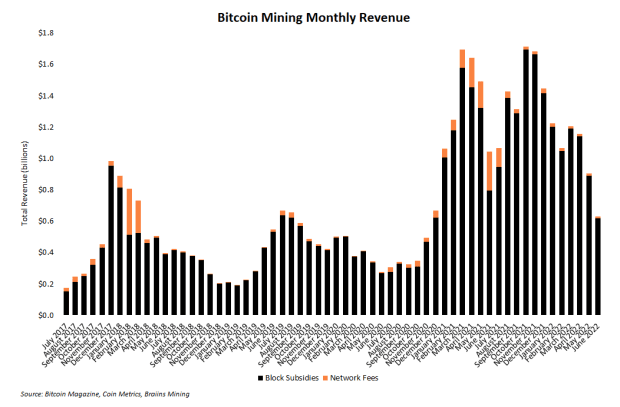

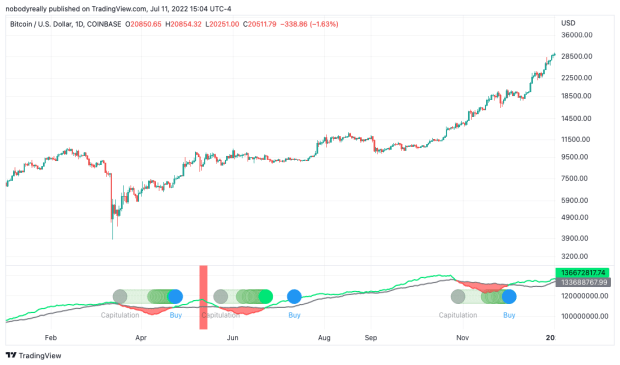

We play this game because by playing the game we secure our own participation while achieving a financial reward for playing. The more efficiently we can play the game, via cheap electricity or climates conducive to mining, the bigger that reward. Everyone knows the rules to play, and anyone who cheats is immediately disqualified from the rewards of the game via the code itself.

We have just described a Nash equilibrium, a state where our incentive is to play the game as efficiently and fairly as we possibly can, because cheating in any way can only hurt us.

So, we see that mining is a game of securing and deploying computing power efficiently and creatively.

Piece Two: The Node

Coming in from the backyard, or up from the basement, we can head over to the router or office, where our node lives.

It may be a Nodl, Umbrel, Start9 or even an old laptop running Linux and Core, it doesn’t matter. What matters is that our node allows us to explore the state of the participants of the game. In this sense, we are the referees of the Bitcoin network.

By logging into our node, we see our current block height and all of the verified transactions that live within each block on the chain. By using a block explorer like mempool.space (often from our node), we can dive into the transaction data that we know to be 100% accurate and verified on the blockchain. (I also recommend https://symphony.iohk.io/ for exploring the Bitcoin blockchain, it is an incredibly beautiful audio and visual representation of Bitcoin)

Here we have immutability and verifiability. Every node runner is keeping an eye on the state of the game being played, and rejecting any transactions that does not operate by the rules of the code. Because of that, they can not only verify every transaction that has happened on the Bitcoin blockchain, but they can have confidence that should they want to submit a transaction to the mempool and be included in a block, it would be executed in accordance with the rules of the game.

We have made real the hard working security team and the ever observant referee, so how do we now actually participate in this transactional game?

Piece Three: The Hardware Wallet (Or Signing Device).

Maybe you’re in the office now, or headed into the safe, or flipping over that fake rock you keep in the plant by your window.

Here we have the hardware wallet, made by various manufacturers with an assortment of bells and whistles. Some look like vintage calculators, some like sleek Apple products, all serving the same fundamental purpose: to protect a digital secret that you and only you must know to transact on the Bitcoin network.

Regardless of your wallet interface, you should have the option to transact on the network using your own node. (Note: Without going down a rabbit hole here, the major difference between using your own node versus a wallet interface that doesn’t require a node is that when you use your own node, you are broadcasting and verifying a transaction yourself, and when you aren’t using a node, you’re trusting someone else to broadcast your transaction, which allows them to see every transaction you are making.)

And what of this “digital secret”?

This digital secret, most often stored as a set of 12 or 24 random words, is what allows you to generate a wallet with public and private keys, the secure digital accounts that allow individuals to use bitcoin.

Nobody in the world has a set of secret words exactly like yours, so in the same way you protect your house with locks and a security system, you must protect your secret words, so as not to leave the front door open and let just anyone inside.

To receive a transaction to our secure digital account, all we need to do is to share the public address (like a P.O. Box or home address) and individuals can send bitcoin to us.

To send bitcoin to someone else, we use our private key to sign a transaction to the recipient bitcoin address (their P.O. box or home address), then we broadcast that signed transaction to the miners we mentioned above, to include our transaction in the upcoming blocks they mine.

By creating and protecting a “digital secret,” we are able to use the Bitcoin network to both store our wealth without anyone being able to take it from us, while also having the ease of use to send it to anyone, anywhere in the world, at the click of a button.

Putting It All Together

In only three physical devices — the miner, the node and the hardware device — we encapsulate the operation of the most powerful value network on the face of the earth, and push ever closer to finding that “killer app” which allows billions of people, of all ages, to rapidly grok Bitcoin.

I don’t believe that we have the metaphors to fully teach Bitcoin to the masses quite yet, but I do believe that we are crossing a communications chasm that links cypherpunks, Core developers and thousands of lines of code with the average life of the average human across the world.

It is our job in an emergent system to build those metaphors and to broadcast them to the network that is humanity, so as to better educate others on the massive positive externalities of secured value and hard money.

This is a guest post by Robert Warren. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.