Three Bullish Shiba Inu Signals as the SHIB Price Eyes a Rebound

TL;DR

- Shiba Inu saw a surge in token burning and large transactions, indicating higher whale interest.

- Netflow trends suggest reduced selling pressure, while RSI levels hint at potential room for price recovery.

The Bullish Indicators

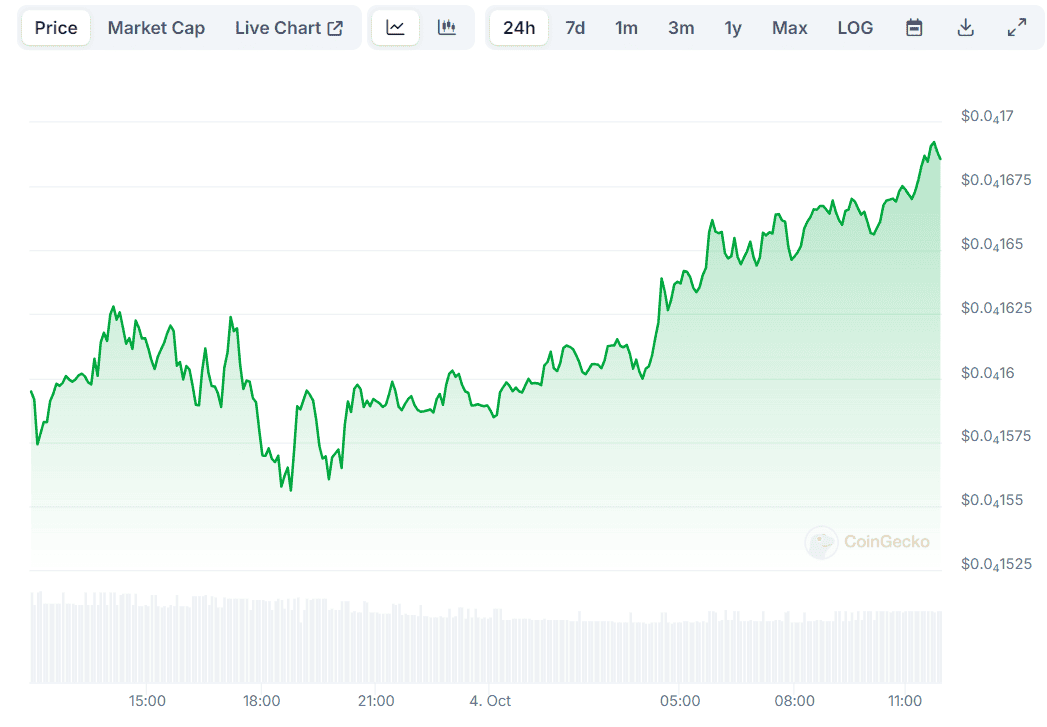

The second-largest meme coin, Shiba Inu (SHIB), has experienced enhanced volatility recently. Its price pumped to a three-month high at the end of September but retraced substantially at the beginning of October when the entire cryptocurrency market bled heavily.

The past 24 hours, though, have been quite favorable for SHIB, which spiked by nearly 7% (per Coingecko’s data) amid an overall resurgence of the meme coin niche.

Shiba Inu’s revival coincides with the rise of some important metrics part of the ecosystem. The first is the successful execution of the burning program. The team and the community destroyed over 2.3 billion tokens throughout September, representing a 250% increase compared to the figure in August. Moreover, the burn rate is up more than 5,000% in the past week.

The effort aims to reduce SHIB’s circulating supply and potentially trigger a price rally (assuming demand stays the same or rises). The total burned tokens since adopting the mechanism equal over 410 trillion, leaving approximately 583.5 trillion in circulation.

Next on the list is the momentum indicator Large Transactions, which, according to IntoTheBlock, has jumped by 12.5% in the last 24 hours. It tracks the number of transactions exceeding $100,000, often signaling increased whale activity. The involvement of such big investors could spark enthusiasm across smaller players and hence trigger the flow of fresh capital into the ecosystem.

Last but not least, we will touch upon SHIB’s exchange netflow which has been negative in the past four days. This could be interpreted as a shift from centralized platforms toward self-custody methods and could result in a reduced immediate selling pressure.

Bonus: the RSI

Another metric worth observing is the Relative Strength Index (RSI), which has been on a downtrend for the past few days. It measures the change and speed of price movements as readings above 70 typically signal overbought conditions that can be a precursor of a correction. On the other hand, anything below 30 might be viewed as a buying opportunity,

The ratio spiked above 80 toward the end of September. However, on October 2, it dropped near the bullish zone of 30 and is currently standing at around 45.

The post Three Bullish Shiba Inu Signals as the SHIB Price Eyes a Rebound appeared first on CryptoPotato.