This is Why XRP Crashed by Massive 45% on Bybit

Ripple’s XRP token has done poorly in the past 24 hours, losing more than 15% of its value in that period. The coin’s performance was further compounded by a massive crash in the XRP/USDT perpetual contract on Bybit, which registered a 45% loss in the early trading hours.

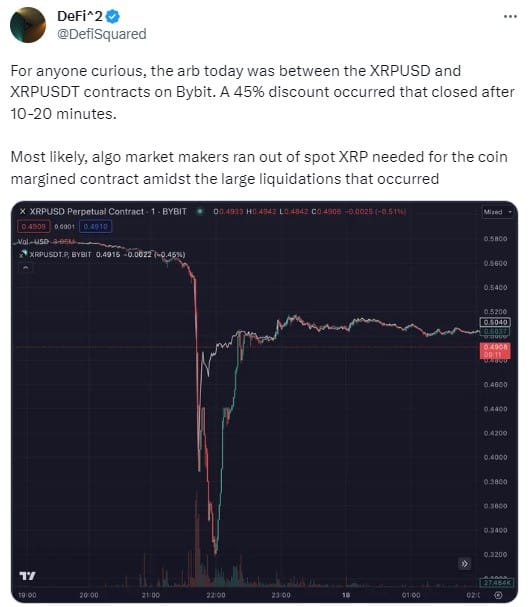

- Now, a renowned Bybit user going by the social media handle “@Defisquared” has offered a possible explanation for the sudden drop in the value of the XRP/USDT pair on the exchange.

- According to them, a steep price difference between XRP/USDT and XRP/USD perpetual contracts occurred after huge liquidations of XRP caused algorithmic market makers to run out of spot XRP required for its coin-margin contract.

- The massive XRP liquidations came as the market reacted to news that Ripple had filed its opposition to a request by the US Securities and Exchange Commission (SEC) to appeal an earlier ruling that found XRP sold on secondary markets were not securities.

- A broader market shakedown that pushed the price of Bitcoin (BTC) down to the $25,000 level also had its effect on the price of XRP, leading apprehensive traders to liquidate more than $50 million in leveraged positions.

The post This is Why XRP Crashed by Massive 45% on Bybit appeared first on CryptoPotato.