This Is How Many Traders Were Liquidated as BTC Soared to $43K and ADA Jumped by 20%

Bitcoin, alongside the rest of the market, skyrocketed on Wednesday evening to its previous peaks registered this month, with BTC soaring past $43,000.

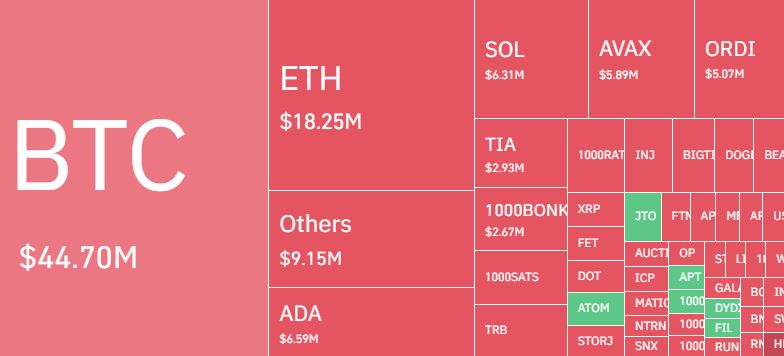

This has led to a large number of liquidated positions, with bitcoin taking the lead with over $44 million.

Bitcoin’s price had declined to under $41,000 after several consecutive days of heading south. However, the asset resumed its bull run on Wednesday and jumped by more than two grand in hours.

This resulted in spiking above $43,000 for the first time since the Monday retracement. Most altcoins followed suit, some in an even more spectacular fashion.

Currently, Cardano (20%), Solana (11%), Avalanche (13%), Polkadot (11%), and several others stand with double-digit gains.

As the graphic above shows, the total value of liquidated positions within a 24-hour period exceeds $120 million.

Somewhat expectedly, BTC is responsible for the biggest share of that pie. Moreover, the single-largest wrecked position involved the primary cryptocurrency and was worth over $2 million. It took place on Bybit.

CoinGlass data further reveals the total number of wrecked traders, which is close to 50,000 (47,761 as of writing this article). Of course, most of them were from short positions – worth over $90 million.

The post This Is How Many Traders Were Liquidated as BTC Soared to $43K and ADA Jumped by 20% appeared first on CryptoPotato.