This is Bitcoin’s First Target for a Potential Recovery (BTC Price Analysis)

Despite the relative calmness in the market, the price action is not showing signs of a robust recovery. Although the US stock closed yesterday with a green candle and the DXY index has gone down for the past three days, Bitcoin has not been successful in stabilizing above the critical $30K level. Fear and doubt still dominate the market.

Technical Analysis

By Grizzly

The Daily Chart

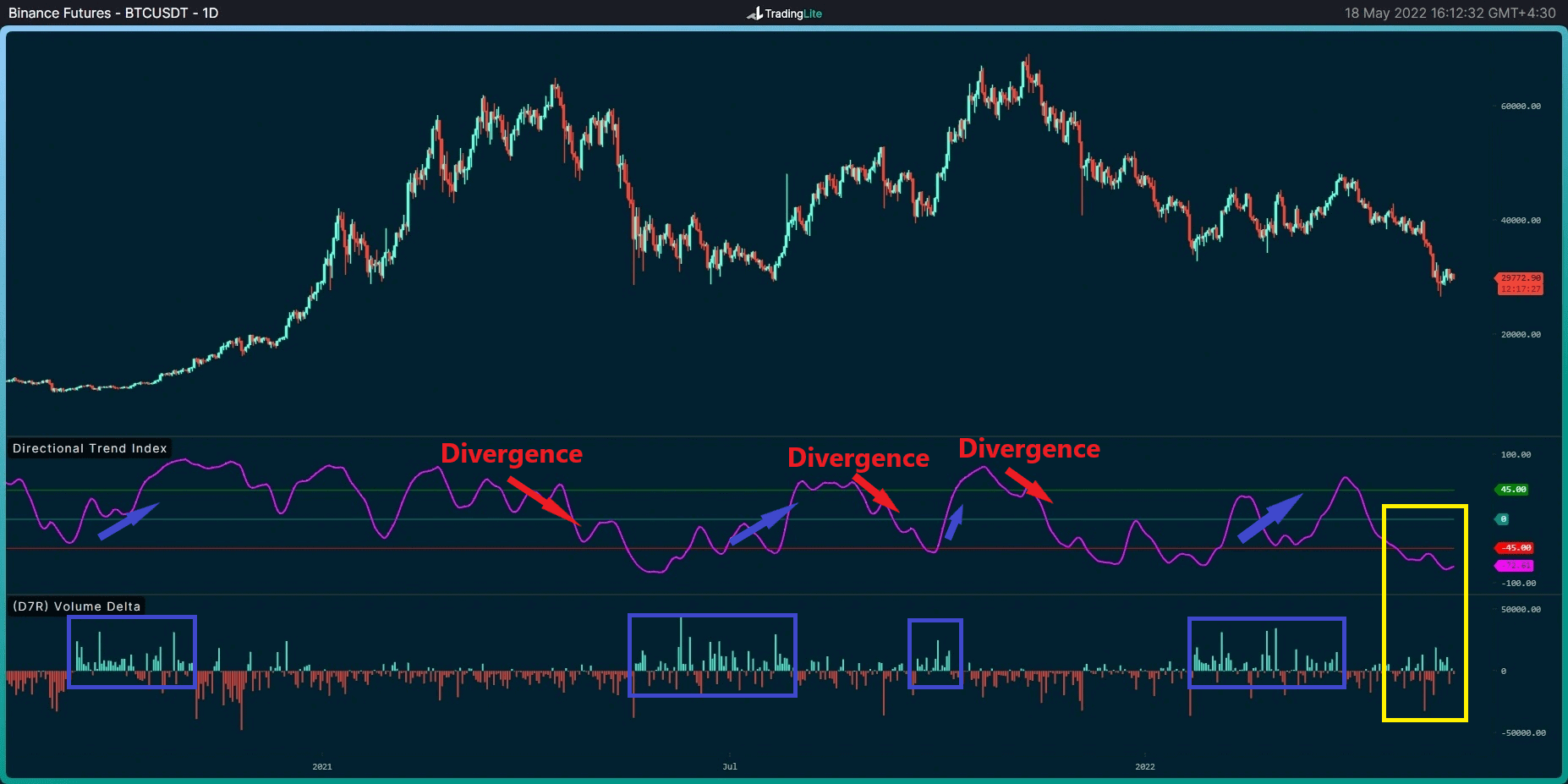

The Binance-Futures price and order-book chart are shown below on the daily timeframe.

Considering the historical trends over the last two years, the upward trends usually have been accompanied by an increase in the Volume Delta, which indicates the dominance of takers-buy pressure alongside an increase in the Directional Trend Index (in blue). On the other hand, downward trends have often occurred with divergence in the Directional Trend Index and the dominance of takers-sell pressure (in red).

Throughout this week, the takers-sell pressure has been gradually diminishing. To some extent, takers-buy orders have also entered the market (not significantly), which has caused histogram bars to turn green in the volume delta. But the directional trend index is still moving below the red line, indicating the trend’s weakness.

Suppose the taker buyers start to buy aggressively, and the directional trend index breaks the red line and the blue one. In that case, the reversal of the trend will be confirmed according to this strategy. Otherwise, BTC is likely to remain bearish as there are no signs of a turnaround.

Key Support Levels: $28,700 & $25,400

Key Resistance Levels: $31,700 & $32,900

Moving Averages:

MA20: $33,611

MA50: $38,620

MA100: $39,986

MA200: $44,835

The 4-Hour Chart

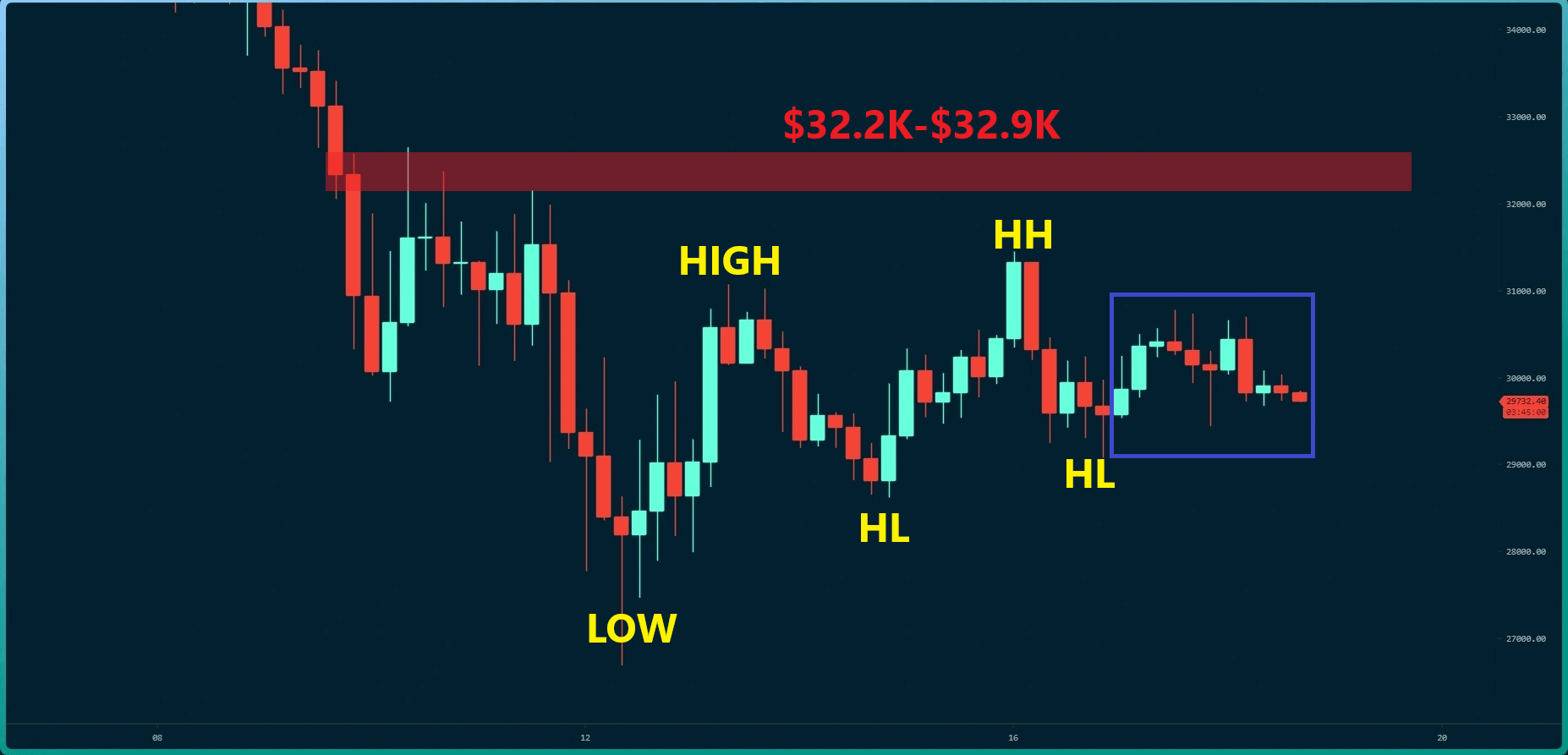

On the 4-hour timeframe, the bullish structure shows some weakness in its last wave. If the bulls can hold the previous higher low at $29K and then push the price above the red resistance zone, it can be expected that an uptrend momentum will be formed in the short term. Otherwise, the lower levels might likely be tested again.

Bitcoin currently struggles with 4H MA50 (as resistance) at $ 29K. The RSI indicator is also moving up in the bearish zone and is close to the baseline, confirming the lack of bullish momentum.

On-Chain Analysis

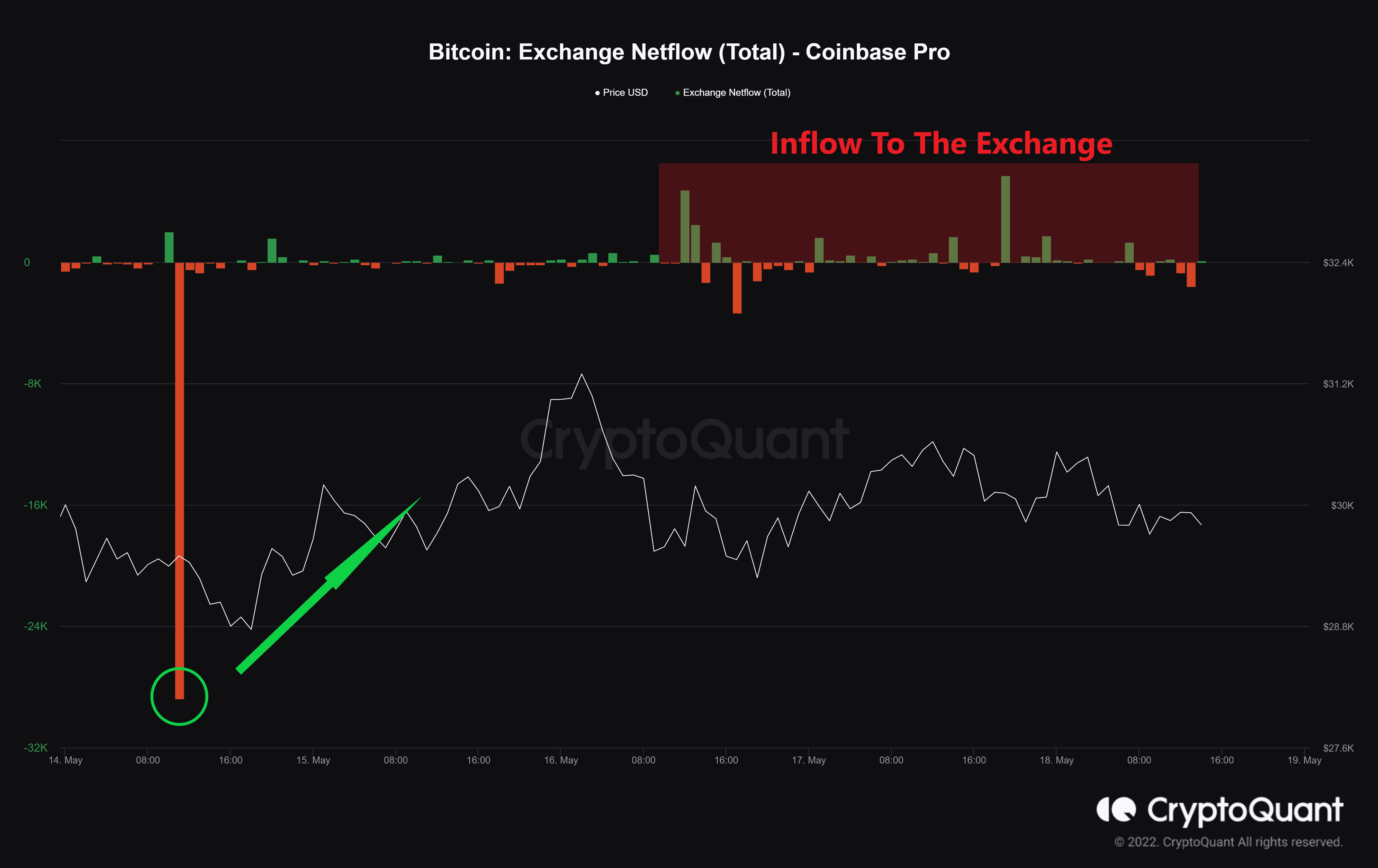

Exchange Netflows

Definition: The difference between coins flowing into and out of the exchange. (Inflow – Outflow = Netflow). A positive value indicates the reserve is increasing due to net inflow.

- For spot exchange, a high value indicates increasing selling pressure.

- For derivative exchange, a high value indicates possible high volatility.

BTC inflow into the Coinbase exchange in the last two days has exceeded the outflow. Just the same way that the withdrawal of 29493 bitcoins from the Coinbase on May 14 caused a short-term uptrend, one must be careful about this particular inflow to Coinbase and reduce the risk according to any unusual regime of significant inflows.