This is Bitcoin’s Biggest Challenge to Resume the Uptrend (BTC Price Analysis)

Bitcoin’s RSI has been rejected from a significant long-term trendline three times. When the RSI hit the mentioned trendline, the price plummeted sharply and was rejected. To provide prospects of positive development in terms of price, the trendline needs to get broken.

Technical Analysis

By Shayan

The Daily Chart

The $37K threshold has become a significant support level for Bitcoin, acting as a substantial hurdle for bears. If this level fails to hold, the price will likely fall to the $34K support. On the other hand, if Bitcoin is to resume its bullish trend, bulls must soon break over the 100-day moving average and restore market confidence.

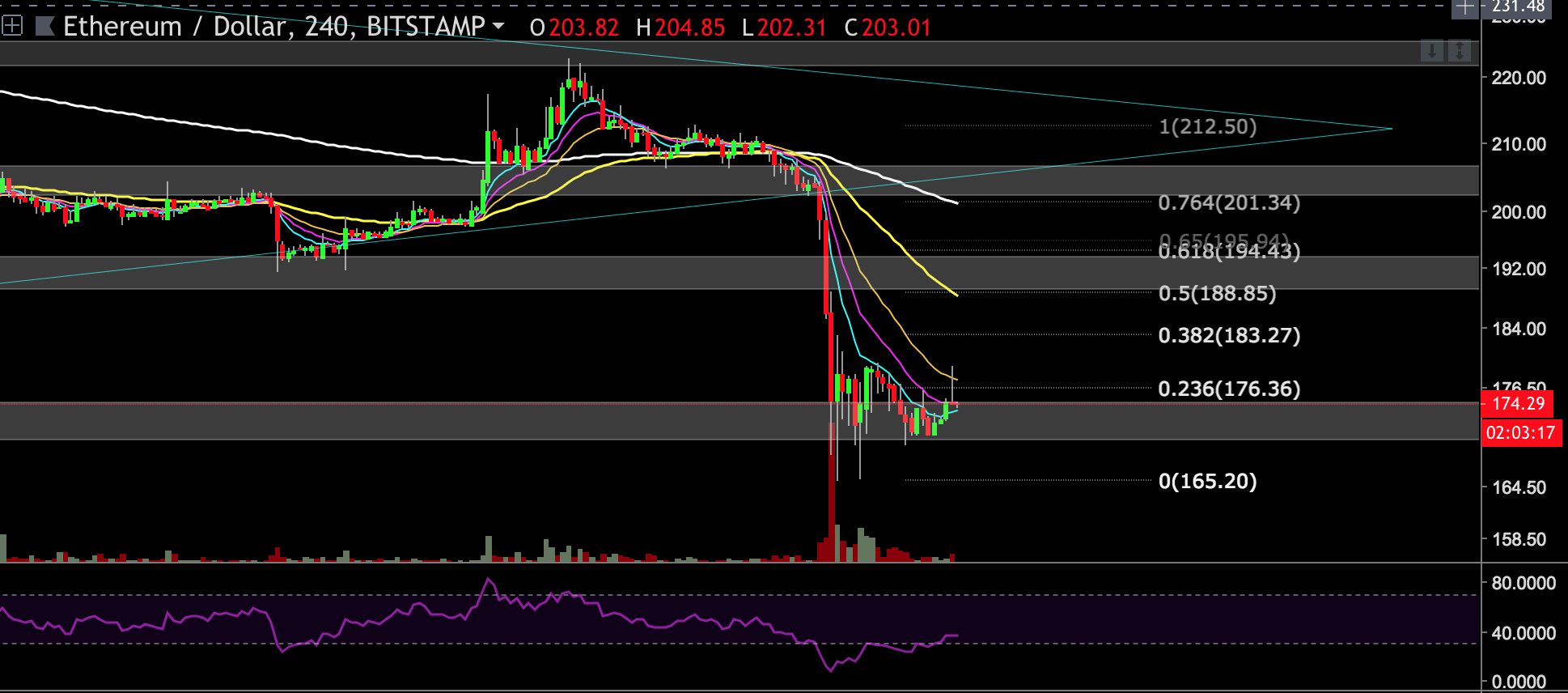

The 4-Hour Chart

Bitcoin has reached the lower trendline of its declining mid-term channel, and it has been held by both the trendline and the $37K significant support level. On the other hand, the cryptocurrency is now consolidating below a short-term declining trendline (Yellow line) and aiming to break above it. The $42K resistance level will be breached shortly if the trendline is broken.

Furthermore, a bullish divergence between the RSI and the price indicates a reversal and a potential bullish leg ahead, increasing the probability of a breakthrough from the stated trendline.

Sentiment Analysis

By Edris

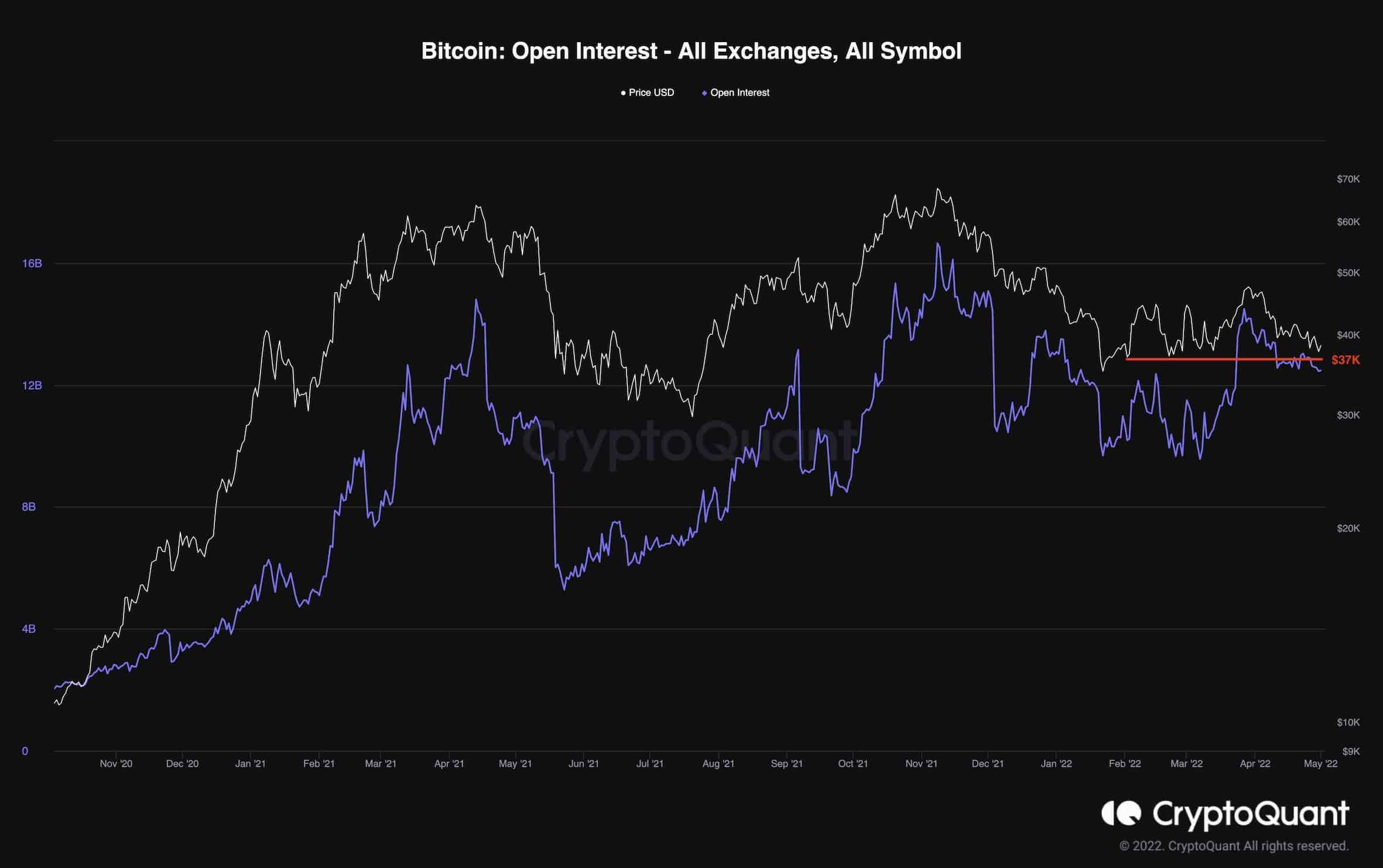

Bitcoin Open Interest

Bitcoin’s price has declined over the past month, dropping more than 20%. Movements of this kind usually lead to substantial futures market flush-outs, identified by massive reductions of open interest. However, the open interest has not decreased significantly during the current downtrend, and it remains much higher than in March 2022, when Bitcoin was trading at these same prices.

Additionally, it is evident that the price has created multiple lows in the $37K zone, and the retail traders would consider this level as solid support. Therefore, it is safer to assume that many long positions are opened at these prices with stop losses and liquidation prices below the $37K level.

If the price breaks below this area, a massive liquidation cascade and rapid price drop could be expected, especially with the current high open interest compared to the market cap. The $37K level is a crucial area to watch in the next few days, as it can determine the market trend for the short term.