This Bitcoin-Related Token Surges 100% in a Week as Ordinals Experience Massive Demand

TL;DR

- ORDI Token Surge: ORDI, linked to Bitcoin’s Ordinals protocol, surged 700% in 30 days, reaching a high of $22.82, but is noted for high volatility.

- Ordinals Impact: Enabled NFT-like creations on Bitcoin through the BRC-20 standard, leading to rapid development of digital artwork and meme tokens.

- Bitcoin Fees Spike: Interest in Ordinals raised Bitcoin transaction fees to a six-month high of $15.86, benefiting miners with substantial earnings.

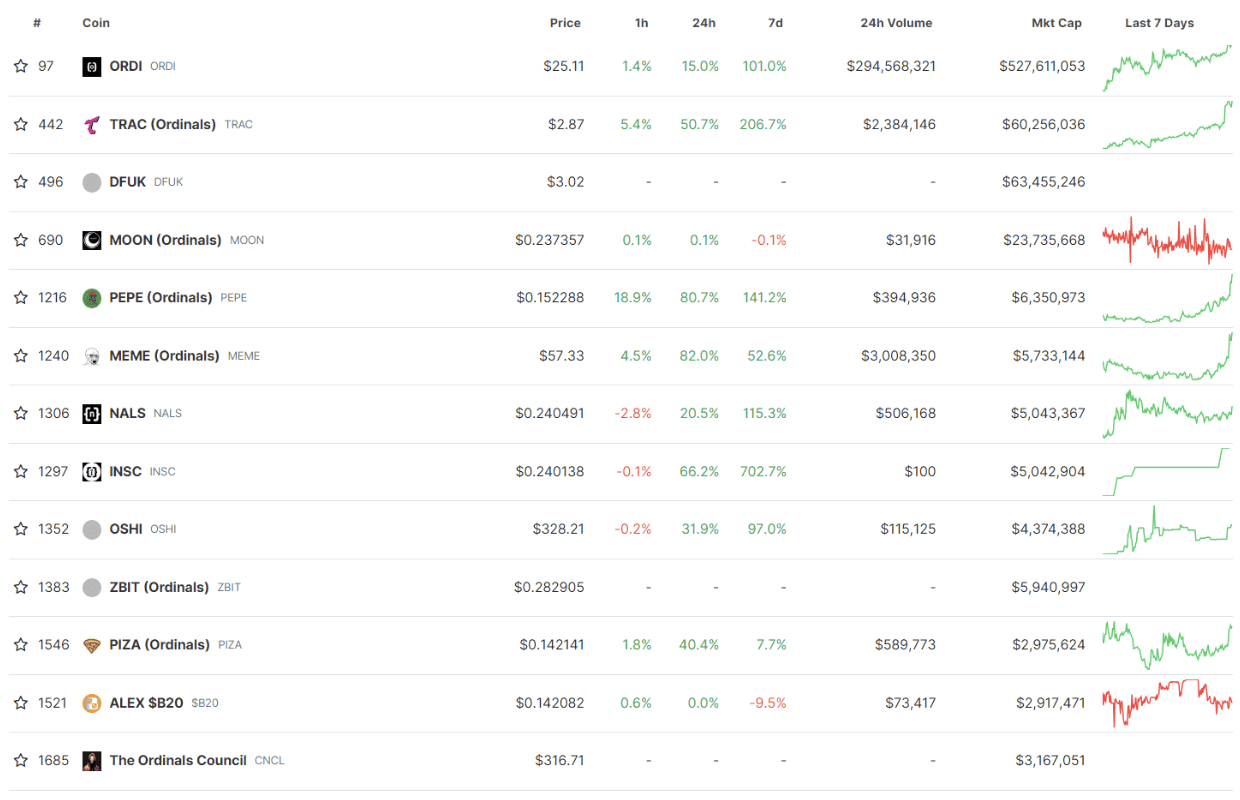

The ORDI token has surged roughly 100% in a week and nearly 700% in the last 30 days, according to data from CoinMarketCap.

ORDI is the main ordinal coin from Ordinals, a Bitcoin protocol that assigns unique data to individual satoshis (SATs), the smallest denomination of a BTC. Bitcoin Ordinals gained popularity earlier in the year as Bitcoin entered the NFT space —but waned as market dynamics shifted.

- Source: CoinMarketCap

ORDI’s price experienced a notable surge, reaching an all-time high at $22.82 on November 15. Despite a slight dip, it found support around $20. Its massive momentum has caught the attention of the crypto community. Still, its volatility poses a high risk, causing Binance to warn users to be careful before interacting with the coin.

The Ordinals protocol followed the introduction of the BRC-20 token standard, enabling the issuance of transferable tokens directly on the Bitcoin network. This sparked the quick development of NFTs —mostly digital artwork— and meme tokens on Bitcoin.

Moreover, most Bitcoin beta tokens have seen exaggerated double and triple-digit gains in the last seven days. But most of these are low-market cap memecoins or experimental projects subject to extreme volatility. Ordinals tokens are the most solid out of BRC-20 tokens, with ORDI having a market cap of nearly $500M.

Interest in Ordinals Causes BTC Fees to Spike

Bitcoin transaction fees, now at a six-month high, have surged over 2,000% since their August low of $0.64, reaching an average of $15.86 per transaction. This increase is attributed to the renewed interest in Ordinals Inscriptions, which resembles NFTs.

Transaction fees on the Bitcoin Network are now at their highest level since the ordinals frenzy back in May pic.twitter.com/aUqU4LL8G7

— Will (@WClementeIII) November 13, 2023

The surge in BTC fees has greatly benefited miners. As CryptoPotato reported, Bitcoin miners have made $44 million in block rewards and transaction fees, which marks the highest levels since April 2022.

The post This Bitcoin-Related Token Surges 100% in a Week as Ordinals Experience Massive Demand appeared first on CryptoPotato.