Third-Largest Whale Now Holds More Bitcoin Than MicroStrategy: Adds $18M of BTC Amid Crash

We’ve been tracking the behavior of the third-largest bitcoin whale for quite some time now, and it appears that today it achieved a considerable milestone. The entity now holds more BTC than Michael Saylor’s MicroStrategy.

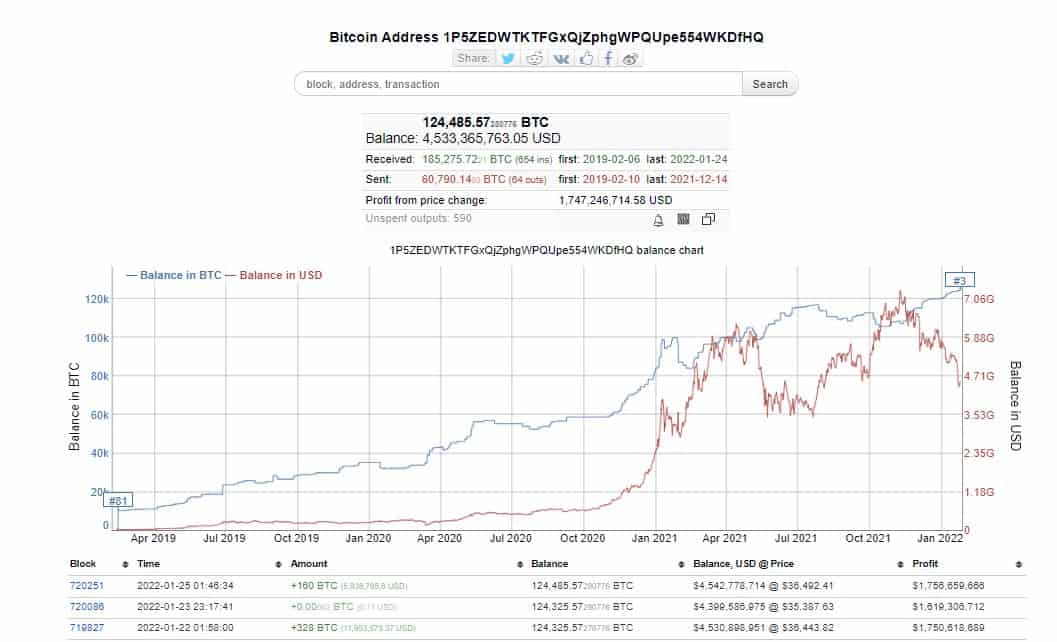

- The third-largest Bitcoin whale has been on a buying spree lately. The entity has taken advantage of the recent plummets in the price and has added more to his stash.

- On Saturday – January 22nd – the whale added 328 BTC worth almost $12 million. Today – January 25th – the entity also bought 160 BTC more, worth almost $6 million.

- What is more impressive, though, is that now this entity holds more BTC than the publicly-traded company MicroStrategy.

- The tech firm spearheaded by one of Bitcoin’s most vocal proponents – Michael Saylor – has 124,391 BTC.

- This became clear on December 30th, 2021, when the company revealed that it had purchased another 1914 BTC. At the time, they paid $94.2 million for it.

- This latest buy brought the total number of bitcoins that MicroStrategy holds to 124,391.

- At the time of this writing, the third-largest whale holds 124,485 BTC.

- According to MicroStrategy’s latest announcement, their average price on the BTC they’ve purchased is approximately $30,159.

- On the other hand, the third-largest whale has a cost basis of about $22,000 per BTC and sits on a profit of about $1.75 billion at the time of this writing.