Third Halving Turns Out to Be Non-Event for Bitcoin’s Price

Third Halving Turns Out to Be Non-Event for Bitcoin’s Price

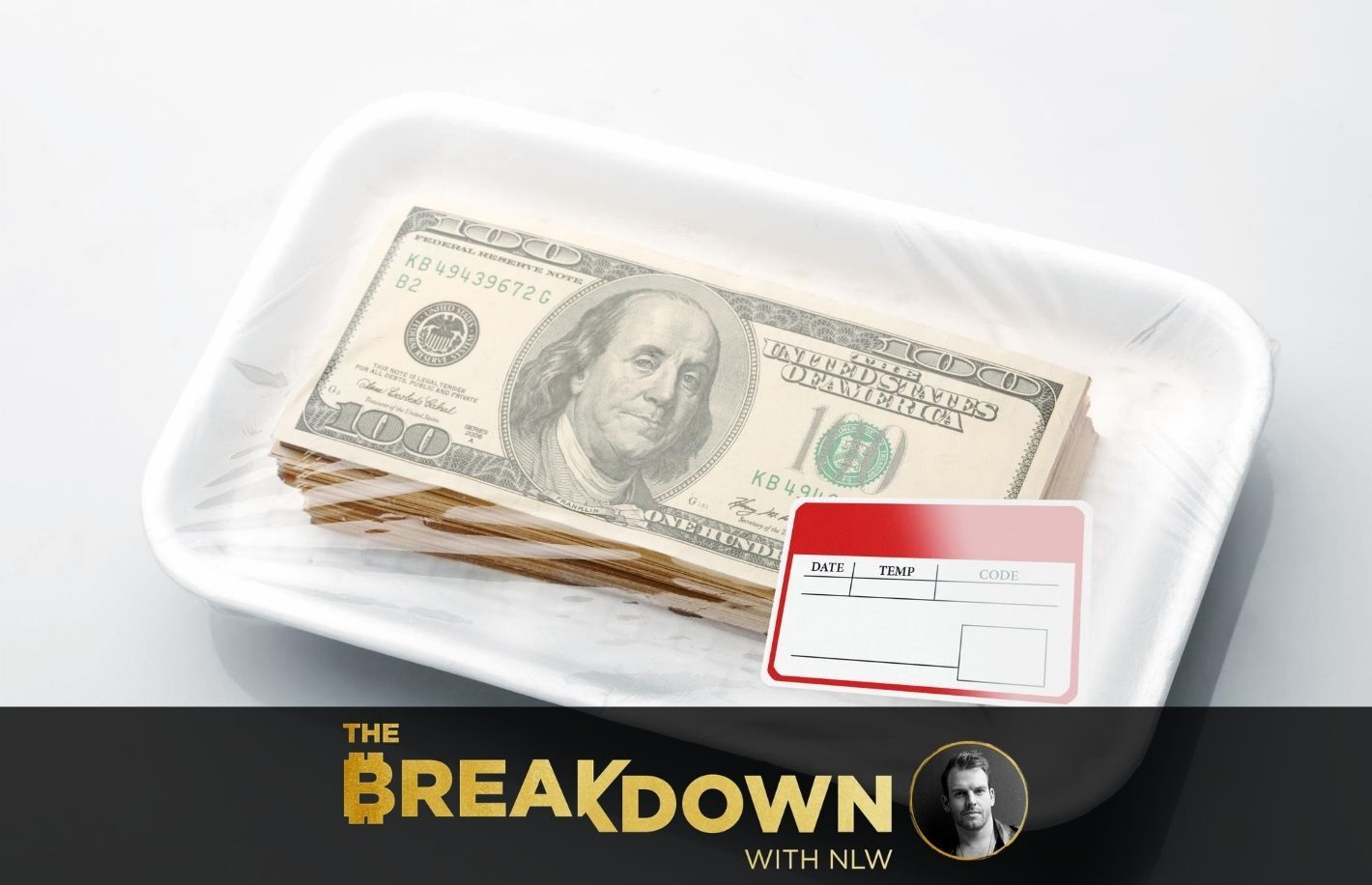

Bitcoin’s price volatility has declined following the network’s third mining reward halving event on Monday.

The reward per block mined on bitcoin’s blockchain was reduced to 6.25 BTC from 12.5 BTC at 19:23 UTC, when the cryptocurrency was trading near $8,500. Since then, prices have been restricted largely to a narrow range of $9,500 to $9,820.

The quiet post-halving price action stands in stark contrast to the solid two-way business in the $1,000 range of $9,200 to $8,100 observed during the 24-hours ahead of the supply altering event and the buoyant price action seen over the last 13 days. The cryptocurrency leaped from $8,000 to $10,000 in the nine days to May 7 before falling back to $8,100 by May 10.

Bitcoin’s implied volatility, the market’s expectation of how volatile the asset will be in the future, has also dropped sharply following halving.

Bitcoin’s volatility on one-month options, which measures the calculated, or implied, mid-rate volatility for an at-the-money (ATM) option, is now seen at 80%, according to data provided by crypto derivatives research firm Skew. The figure had clocked a high of 102% before the halving, Meanwhile, the three-month volatility gauge has also declined to 80% from 93% pre-halving.

Event priced in

Bitcoin’s lackluster response to the halving is hardly surprising as the event has been extensively discussed over many months and was factored in by the market.

Speaking at CoinDesk’s Consensus: Distributed virtual conference, Cynthia Wu, head of business development and sales at digital assets financial services firm Matrixport, said, “Halving was already priced in and the cryptocurrency could trade in the range of $8,000 to $10,000 in the near term.”

Bitcoin reversed the sell-off from $10,000 to $3,867 seen in the first half of March in the 8 weeks to May 7. The spectacular rise was at least in part fueled by the bullish speculative buzz surrounding the halving. There was evidence of both small and large investors accumulating coins in the run-up to the event. However, an additional price bump failed to materialize, in line with Wu’s comment.

Some observers might predict a price drop in the near term, as the halving has doubled the cost of bitcoin production and made older generation mining machines like Bitmain Antminer S9s unprofitable. As a result, some hard-pressed miners could potentially shut down and offload their bitcoin holdings to recover the cost, adding to bearish pressures around the cryptocurrency.

“S9s miners have already lived longer than expected and bitcoin’s price will have to double for these machines to become viable again,” said Alex de Vries, founder of financial and economic news portal Digiconomist and blockchain specialist, while speaking at Consensus: Distributed on Tuesday.

De Vries, however, added that the hash rate – the computing power dedicated to mining the bitcoin network – is unlikely to suffer a significant drop, as many mining entities are upgrading to the latest generation devices.

In the short trm, the uptick in the cost of mining will likely be compensated by the availability of cheap hydroelectric power resulting from the rainy season in China’s Sichuan province, which contributes more than 50% of the network’s total hash rate. Since the halving, the drop in the hash rate has been moderate. The metric is down just 4% to 128.873 exahashes per second, according to bitinfocharts.com.

Looking ahead, bitcoin looks likely to trade in the range of $8,000 to $10,000 for some time, as suggested by Wu. It’s worth noting that the 200-day average is located near $8,000. If prices violate the widely tracked support, stronger chart-driven selling may be seen. That could lead to a deeper decline toward $7,400.

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.