Think You’re Late To Bitcoin? Think Again

Beware of the “I missed the bus” bias, change your perspective, and enjoy that global adoption is still low to stack cheap sats.

Upon one’s first encounter with Bitcoin, a mixture of feelings, actions, and thoughts usually take place. They might feel empowered to have money they can fully control or satisfied for having secured a piece of the limited amount of bitcoin that will ever exist. But they can also feel both, and often a wide variety of other feelings find a new home in the now-Bitcoiner. However, every person who buys bitcoin feels like they are late — that one bitcoin is now too expensive and number go up (NgU) will not work in the future.

The “I Missed The Bus” Bias

As a Bitcoiner looks back, they realize how much one bitcoin has already increased in value compared to the dollar or other fiat currencies. The first recorded transaction of bitcoin for U.S. dollars happened in 2009 through New Liberty Standard, a primitive bitcoin exchange created by a BitcoinTalk online forum user that went by the same name. In that transaction, 5050 BTC were purchased in exchange for $5.02 paid through PayPal, putting the first recorded bitcoin price at $0.00099.

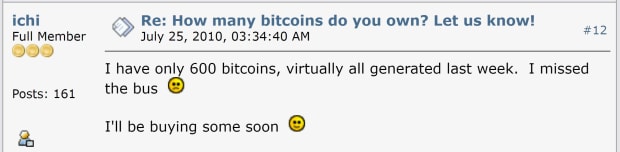

By 2010, bitcoin was more widely traded, and 1 BTC cost around $0.07. It was also in that year that bitcoin was first exchanged for everyday goods. BitcoinTalk member Laszlo offered: “I’ll pay 10,000 bitcoins for a couple of pizzas… like 2 large ones so I have some left over for the next day.” After the transaction, the Bitcoin Pizza Day was established and is widely celebrated to this day. But perhaps one of the most iconic BitcoinTalk posts in 2010 was from a user, ichi, who said they felt like they were late to the party then and didn’t have enough bitcoin.

That’s right — ichi thought they were already late and that 600 bitcoin was not a lot. But in dollar terms, that wasn’t a big stack indeed; 600 BTC would cost you less than $50. However, in the last 11 years, the bitcoin price has increased by over 700,000% to the current $50,000 level. So now, that 600 bitcoin stack is undoubtedly a huge stack. Moreover, it might seem absurd to think that such an asset might keep appreciating in the future, and similarly plausible to believe that if you’ve purchased BTC in 2021, yes, you are late.

But you might be looking at it from the wrong angle. To consider the appreciation bitcoin has had since that forum post is essential but more important is to realize that ichi genuinely felt like bitcoin was already valued too much, causing them to feel like they had missed the bus. Yet, in hindsight, we see that ichi had actually not missed the bus and that their “small” bitcoin stack became a huge one about a decade later. So by thinking you’re late now, you might end up walking through ichi’s steps.

Mind Your Perspective

Something that can be counter-intuitive for newcomers but can help a lot in the process is thinking about bitcoin in bitcoin terms. We might now look back and judge that ichi might’ve been naive to believe that 600 bitcoin were not enough back in 2010, but you see, we do that because that 600 bitcoin has increased in dollar terms. They haven’t increased in bitcoin terms. In bitcoin terms, which solely accounts for the fixed total supply of 21 million BTC, 600 bitcoin were, and will always be, the same amount. The mindset is everything divided by 21 million.

Although it is expected that bitcoin continues to be adopted more widely as time progresses and more people realize its distinctive characteristics and superiority as a store of value and medium of exchange, it can’t be known for sure. So, in 2010, when much fewer people knew about and used bitcoin, 600 BTC were easier to get, compared to 2021 when 1 BTC costs nearly $50k and it seems most of the world already runs a node, CoinJoins regularly, and pay for their haircut with sats through the Lightning Network. But that is not the case; we need to step back and evaluate adoption.

We Are Still Early

In Bitcoiner circles, we can often forget how most of Earth’s inhabitants are still clueless when it comes to Bitcoin. And you don’t need fancy statistics to realize that; note how mainstream media regularly says that Bitcoin has no use as money, citing the already-too-old arguments of volatility and scalability. Bitcoiners already know volatility will take care of itself as adoption grows, and the Lightning Network is already solving scalability; however, the rest of the world does not.

Along those lines, a recent Gallup survey found that only 6% of U.S. investors — defined as adults with $10,000 or more invested in stocks, bonds, or mutual funds — own bitcoin. That is less than 10 percent of an already restricted sample universe — those in one of the world’s most developed economies that also have a considerable amount of money invested. However, adoption can be more significant in other countries. In Singapore, for instance, 40% of citizens said they own bitcoin, and awareness there is vast.

But, stepping back, we notice how Bitcoin is only a little over a decade old. It is nascent money, still finding its way in a complex world with different cultures, backgrounds, and needs. So, Bitcoiners, who have put in work to understand the network, economic incentives, game theory, societal and political implications, and the technical side of the protocol and its nuances, think Bitcoin is already wholly known by the entire world. However, that is not the case.

Most people, companies, and countries will adopt bitcoin as the result of an adoption domino effect. And, naturally, it takes time for new entrants to fully grasp what Bitcoin is, how it can improve humanity, and the things it can—and cannot—fix. But as more people fall down the Bitcoin rabbit hole, society will come to understand the benefits of holding onto the best form of money ever created.

Think In Bitcoin Terms And Stack Sats

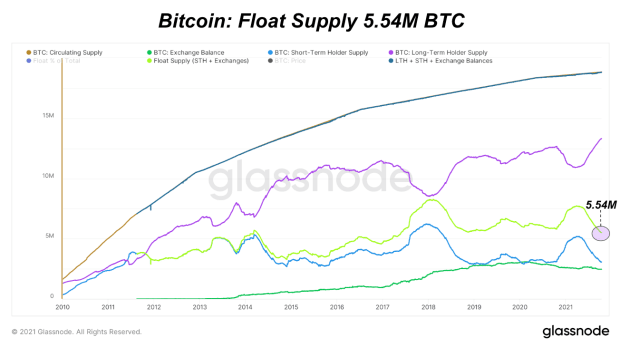

The bottom line is, beware of the “I missed the bus” bias, switch your financial perspective to price everything in bitcoin or satoshis, and enjoy that global adoption is still really low to stack cheap sats. We might not be as early as in 2010, but we are certainly not late. There are over 7 billion people on Earth, out of which over 50 million are millionaires, but there will only ever be 21 million bitcoin. As more companies put bitcoin in their balance sheets, more billionaires notice the uniqueness of bitcoin, and more education is spread on Bitcoin, the more adoption will grow and the less bitcoin there will be for those interested.

Do you remember when the internet wasn’t widely used at home, and mainstream economists saw little value in it, only to suddenly everyone, and every place have internet connectivity, leading us to where we are today? Bitcoin is not yet widely used, and mainstream economists see no value in it, but it is being adopted faster than the internet. So perhaps thinking about that next time you feel like you’ve “missed the bus” might help.