They Saw Everything We Did For a Year: Exclusive evidence by an ICO maker about the SEC’s Efforts

The US Securities and Exchanges Commission (SEC) has been relatively new on the trails of companies who have launched their ICOs in the United States or ICOs that were open to investments from US citizens. Recently, the federal agency had announced on coming-up actions against multiple ICO makers. Recently, not only ICOs were targeted by the SEC, but also airdrops.

In this year’s continuous bear market, investors and traders have lost 80% – 90% on average, investing in ICOs. We can only estimate that unlike the bullish year of 2017, the motivation to convict ICO makers is skyrocketing.

“They don’t want another Bernie Madoff”

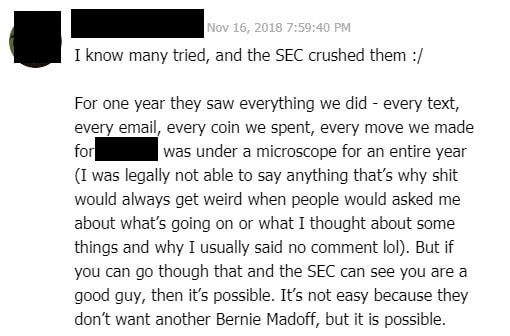

The following evidence, had been witnessed by our team, and been sent on Telegram by an ICO maker from the past year:

“I know many tried, and the SEC crushed them. For one year they saw everything we did – every text, every email, every coin we spent, every move we made for XXXXXXXXX was under a microscope for an entire year (I was legally not able to say anything that’s why shit would always get weird when people would ask me about what’s going on or what I thought about some things and why I usually said no comment lol). But if you can go through that and the SEC can see you are a good guy, then it’s possible. It’s not easy because they don’t want another Bernie Madoff, but it is possible,”

When the executive was asked why the SEC targeted their company, one of the reasons mentioned was “that trolls were mass reporting the company (which did the ICO) because “the team didn’t pump its token.”

Multiple investigations against ICOs

The SEC also recently launched a subpoena against the crypto lending platform SALT and also against ShapeShift’s CEO Erik Voorhees. The reason for the subpoena was the same as in Airfox’s and Paragon’s recent case – an unregistered ICO.

Therefore, the SEC is investigating whether the tokens in SALT’s $50 million tokensale could be considered as securities. Voorhees is a target of the SEC in this case since the ShapeShift CEO has been allegedly listed as one of the directors at SALT before the lending platform launched its ICO.

Decentralized exchanges are also on the SEC’s radar

On November 8, 2018, the SEC charged EtherDelta founder Zachary Coburn for operating an unregistered national securities exchange. The SEC disliked that securities – at least the federal agency defined them as in its 2017 DAO report – were among the 3.6 million tokens that were exchanged on the decentralized exchange during 18 months. The SEC also pointed out that EtherDelta was neither a registered national securities exchange nor qualified for an exemption. The case ended with Coburn paying almost $400,000 to the SEC.

The post They Saw Everything We Did For a Year: Exclusive evidence by an ICO maker about the SEC’s Efforts appeared first on CryptoPotato.