They Didn’t Take The Orange Pill, They Threw It Out

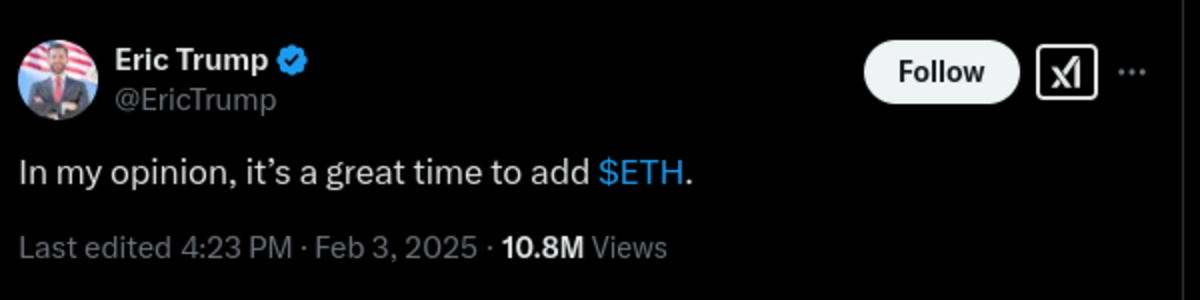

The son of the current President two days ago on Twitter told people it’s time to add Ethereum to their balance sheets. It is mind blowing to see this, given what this cycle represents for Ethereum.

For years people have been predicting the outcome we are seeing play out this cycle. Ethereum’s dominant use case has been as a platform for issuing other assets, and building applications focused on assets other than ether itself. This becoming the dominant use of the network has obvious implications for the necessity of the Ethereum network itself to operate these other applications and assets.

Bitcoiners have consistently pointed this out, and predicted that other cheaper and more centralized networks with the same functionality would eventually obsolete Ethereum, as the chief value proposition of the network in the market has proven not to be Ethereum or ether itself. That is exactly what we see playing out right now with Solana absorbing activity from Ethereum, for everything from memecoins to DEXes now.

This isn’t a new thesis, this isn’t some novel niche idea hidden from the light of day, it is something loudly predicted for half a decade or more. Yet the “orange pilled” son of the President is here publicly stating it’s time to add ETH.

I think this should in a very crystal clear manner demonstrate that none of the Trump family or new administration are “orange pilled” at all. All they have been shown is the opportunity to make money, and they will follow their incentives. That realistically leads to shitcoining.

Shitcoining is the most profitable short-term thing in this space. They will follow the path to easy money. I think this is the cold hard reality that some Bitcoiners don’t want to accept, people are in most cases not better than their incentives. We are not going to have some kind of grand spiritual “Bitcoin awakening” in government. We are just going to see the incentives we’ve watched play out in multiple cycles play out at a larger scale than we ever have before.

What’s amazing to me is how so many Bitcoiners thought sticking our nose into the government would go any other way. We opened the door, and the shit got dragged in behind us.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.