These 2 Exchanges Lead in Bitcoin Reserve Growth Since FTX’s 2022 Collapse

The FTX collapse of November 2022 continues to serve as a stark reminder of the necessity for rigorous asset monitoring. This event catalyzed a shift toward transparency, with crypto exchanges now disclosing more about their reserves and user fund management.

As November 6th marks two years since the collapse, only Bitfinex and Binance witnessed their Bitcoin reserves grow out of the major exchanges.

Major Exchanges Ramp Up PoR Efforts

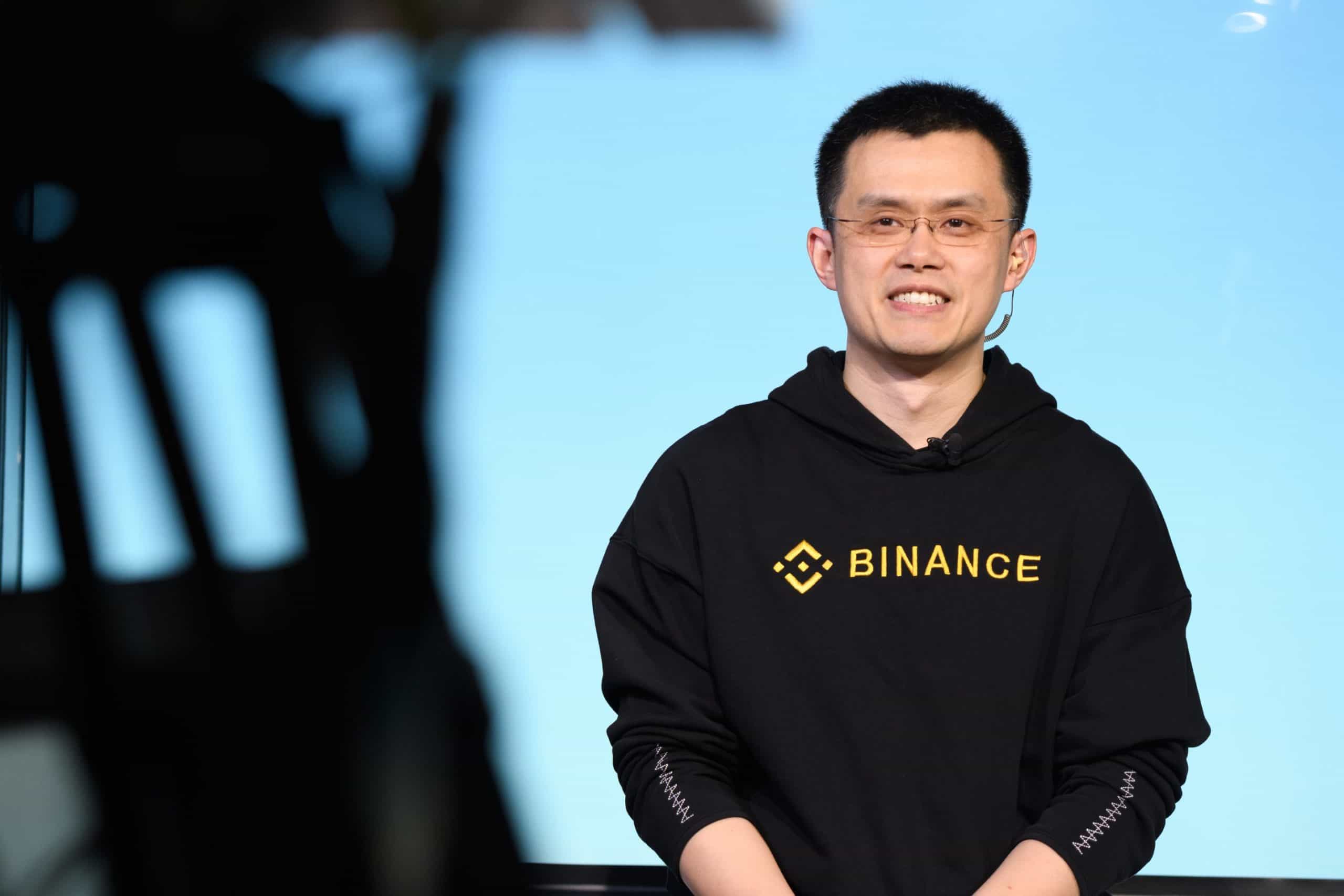

According to the latest report by CryptoQuant, of the major exchanges, Coinbase remains the only one without a public Proof-of-Reserve (PoR) report, while others, like Binance, have adopted comprehensive transparency practices.

Binance, for instance, provides Proof-of-Assets (PoA) through publicly available on-chain addresses, allowing users and stakeholders to verify assets directly. It also enables users to check that their individual account balances are included in the exchange’s overall liabilities.

Beyond Bitcoin and Ethereum, Binance includes additional assets in its reserve disclosures, enhancing trust and market transparency. Binance’s Bitcoin reserves have notably grown by 28,000 BTC (5%) to 611,000 BTC, even amid regulatory scrutiny from US authorities in 2023.

Among the major exchanges, only Bitfinex and Binance have expanded their reserves since FTX’s collapse, with the latter maintaining a reserve drawdown rate below 16%. Platforms such as OKX, Bybit, and KuCoin release PoRs every month, allowing users to audit their reserves to make sure they are solvent.

WazirX First PoR After Cyberattack

While Proof-of-Reserves reporting has enhanced transparency across major exchanges, security challenges remain. WazirX, for example, recently released its first PoR report after a July cyberattack, revealing a sharp decline in its reserves and underscoring the ongoing risks exchanges face.

The report indicates that WazirX’s total assets, including on-chain funds, assets held with third-party exchanges, and less liquid holdings, are valued at $298.17 million. The reduction in assets aligns with the company’s ongoing restructuring after the July cyberattack that resulted in the theft of over $230 million.

As such, WazirX’s PoR provided critical insights into its financial health by verifying that its assets cover liabilities. By tracking changes in an exchange’s reserves, PoR reports help users and stakeholders gauge an exchange’s ability to manage funds responsibly and respond to crises.

The post These 2 Exchanges Lead in Bitcoin Reserve Growth Since FTX’s 2022 Collapse appeared first on CryptoPotato.