There’s at Least one More Major Market Capitulation: Datadash Explains

Popular Youtuber Nicholas Merten (DataDash) argued that investors have not rushed to “buy the dip” on worries of the inflation numbers, which clocked in lower than the expectations earlier today.

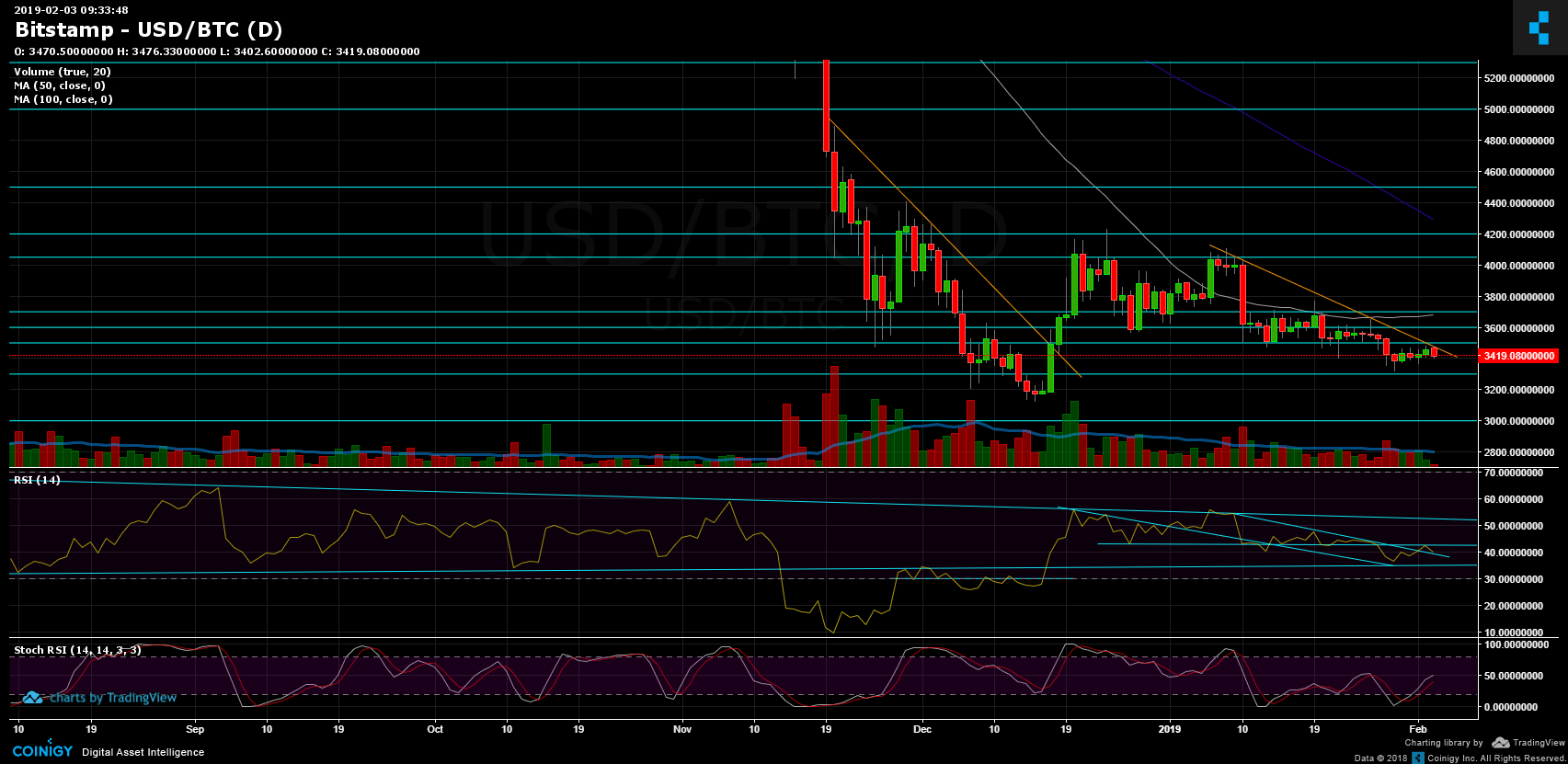

Based on his research, the number of people buying and selling BTC has been dropping each week recently, which indicates that its price will likely continue to fall.

More Pain Coming

In his most recent video, Merten claimed that the traditional bear market for bitcoin is yet to begin. He envisioned that the FTX collapse will not be the last adverse event in the industry as Genesis or a platform that nobody expects could suffer the same fate:

“We’ve still got one or two major dominoes out there yet to fall. Is it going to be Genesis, is it going to be the entirety of the digital currency group, is it going to be a major exchange that we least expect? There’s a lot still rotting under the table. The capitulation, the contagion more specifically, is still real.”

The additional turbulence that an event of this kind could trigger might push bitcoin’s price further down. The asset has already lost over 62% since the beginning of the year.

The FOMC meeting, which will be held later this week, is another event that investors are waiting for. Most consumers expect the Federal Reserve will raise interest rates by 50 bps. However, Merten argued that the financial institution might change its intention once seeing the results of the CPI report.

“Why are people not buying the dip? The reason, in my opinion, is what’s coming up here next week, and it has to do with the upcoming inflation numbers from the CPI report as well as the Fed at the FOMC meeting,” Merten said.

Inflation and Bitcoin

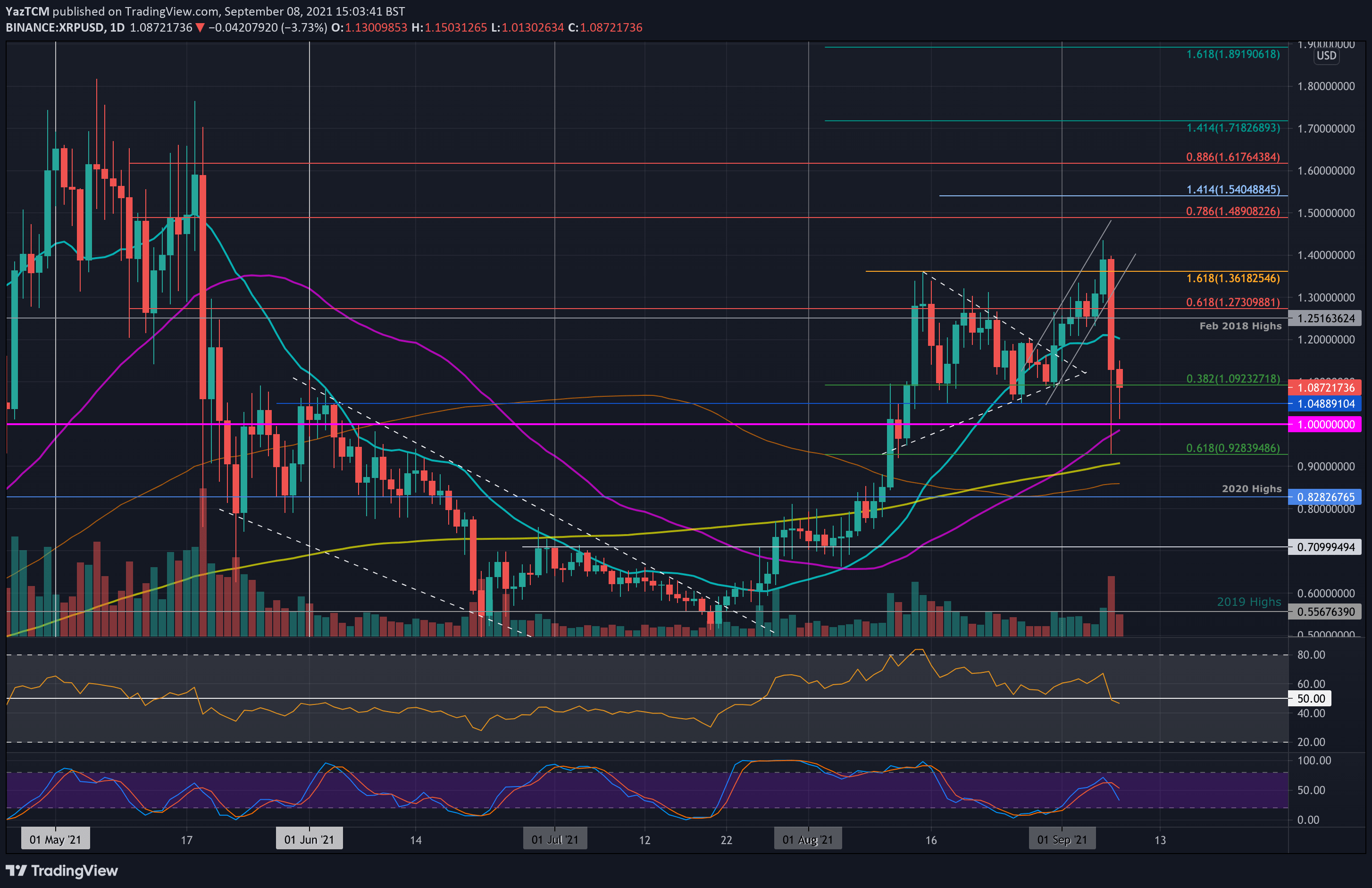

Contrary to the assumptions of some that the leading cryptocurrency could serve as a hedge against inflation and its price should go up in that environment, this has not been the case so far.

The COVID-19 pandemic and the measures that reduced the impact of the health disaster, including the mass printing of fiat currency, have taken their toll, and most countries have experienced a significant inflationary crisis during 2022. The rise in electricity costs, as well as the military conflict between Russia and Ukraine, have also added to the issue.

The inflation rate in the USA surpassed 9% in June, a record high for the past 41 years. Bitcoin tumbled.

During the following months, though, inflation slowed down its temps, and BTC reacted positively to the news each time.

The post There’s at Least one More Major Market Capitulation: Datadash Explains appeared first on CryptoPotato.