The White House’s Bitcoin Mining Tax Undermines Itself

:format(jpg)/www.coindesk.com/resizer/XIYVyeLySth3qxcRoYqz9Da1-l0=/arc-photo-coindesk/arc2-prod/public/4XC2ZHHN5BEBHKC2AJGSYOQTSI.jpg)

CoinDesk columnist Nic Carter is partner at Castle Island Ventures, a public blockchain-focused venture fund based in Cambridge, Mass. He is also the co-founder of Coin Metrics, a blockchain analytics startup.

In its bid to marginalize the domestic crypto industry, the White House has unleashed financial regulators, deputized the bank sector, and generally harassed crypto firms here. On top of that, it is now trying to push through a de facto ban of mining in the U.S. with the Digital Asset Mining Energy (DAME) excise tax. The proposed levy would add 30% to electricity costs for miners, which would be enough to turn their economics upside down and force them to leave these shores.

CoinDesk columnist Nic Carter is partner at Castle Island Ventures, a public blockchain-focused venture fund based in Cambridge, Mass. He is also the co-founder of Coin Metrics, a blockchain analytics startup.

The tax sets an extremely dangerous precedent, as it singles out an industry that lawfully purchases electricity, holding the electricity buyers responsible for the carbon emissions of the underlying generation. This makes no sense. It’s not bitcoin miners’ responsibility to decarbonize the electricity they purchase – that falls to the architects of the grid. If the Biden admin can’t get the grid to be sufficiently green, it should focus on that rather than punishing an industry that buys less than a single percentage point of the electricity produced in the U.S. in a given year. Additionally, the proposed tax may not even be legal. Appellate attorney W. Aaron Daniel has argued convincingly that Bitcoin mining is protected speech under the First Amendment, and that a mining ban singles miners out unfairly, as New York State has done already.

Other industries don’t get held responsible for grid emissions this way, just politically disfavored ones like Bitcoin miners. If this precedent is set, any politically disfavored energy consumer will potentially be in the crosshairs. I could easily imagine the next DAME tax targeting data-centers running AI models that aren’t sufficiently woke, or data centers running servers for uncensored social media. And in a future, possible Trump Administration, who’s to say he wouldn’t use a similar approach to cut off the electricity supply of abortion clinics, leftist universities, Disney World, the NY Times, or any other industries or corporations he dislikes? In this country, resources like electricity should be available to all, not used as a political cudgel to attack specific industries.

Regarding the tax itself, it doesn’t even achieve its stated objectives. In fact, it directly achieves the opposite of what its architects envision.

The objectives of the tax are as follows:

-

It would in theory raise $3.5b in revenue over 10 years

-

It would get miners to “pay their fair share” of costs imposed on local communities and the environment

But the tax would actually do the following:

-

It would directly increase the emissions associated with Bitcoin mining, by pushing miners out of the (relatively low-carbon intensity) U.S., into dirtier jurisdictions

-

It wouldn’t raise money, as mining in the U.S. would be uneconomical, and miners would simply choose to leave

-

It would directly empower America’s adversaries, like Russia, China, Venezuela, and Iran – by making (state-sanctioned) mining operations more profitable there

-

It would eliminate the ability of Bitcoin miners to help monetize the renewable buildout in the U.S., and rule them out from assisting with grid stabilization programs that they actively participate in.

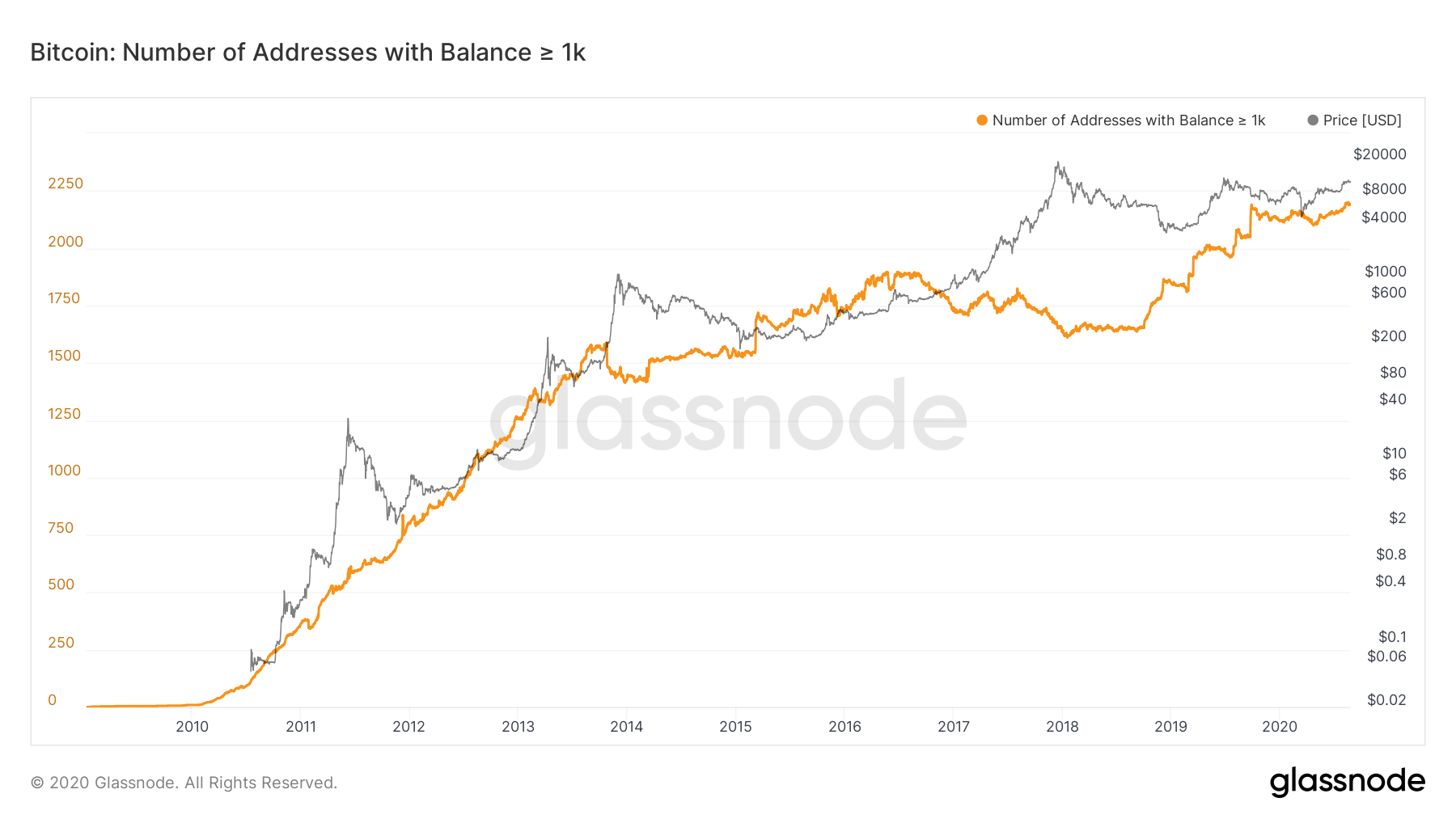

Firstly, and most important, taxing mining in the U.S. does not mean less Bitcoin mining overall. Bitcoin mining is a highly competitive industry, and miners are incentivized to bring capacity online as long as the economics are favorable. China’s Bitcoin mining ban in 2021 did not result in any less Bitcoin mining – the miners simply left China (for the most part) and set up shop elsewhere (including the U.S). Hashrate dipped temporarily after the ban, then came roaring back to a level double the pre-ban amount. The mighty U.S. government is impotent in this case. It cannot persuade the miners to trash their ASICs. It will just mine somewhere else.

In fact, many miners who were using abundant hydro power in the Yunnan or Sichuan provinces moved to Kazakhstan, which has a highly fossil-fueled power grid. Today, the U.S. composes roughly 30-40% of global Bitcoin mining (the best data we have comes from Cambridge University, but it’s somewhat dated and imprecise). The most popular other countries are, in rough order, China (yes, despite the ban, there’s about 17% of hashrate in China), Russia, Canada, Kazakhstan, Indonesia, Paraguay, Norway and Venezuela. We also know that Bitcoin mining directly finances the governments of Russia, Iran, Venezuela and North Korea. These regimes use Bitcoin mining for sanctions evasion, to turn their mineral wealth into cash. Attacking domestic miners in the U.S. hashrate simply means that other miners are more profitable on net, because their share of the pie is bigger.

Supporting the state coffers of these direct adversaries should hardly be a goal of the Biden administration, but that’s what the DAME tax would do.

The authors of this tax – I’m told the ringleader is Heather Bouchey of the White House Council of Economic Advisors – acknowledge that miners can freely move abroad, undermining their policy. But they seem to be laboring under the naïve delusion that governments globally will impose similar levies on Bitcoin miners. This is wishful thinking in the extreme. The Biden Admin claims that “China banned such activity completely in 2021,” but we know there is still meaningful Bitcoin mining in China. And the Biden Admin, which has fewer friends abroad by the day, can hardly expect other jurisdictions to move in lockstep with them. The U.S.’s loss is Russia’s, Iran’s, China’s, and Venezuela’s gain. Additionally, the Biden admin has repeatedly called for more transparency in terms of miner emissions and energy impact – they have clear access to this data if miners are based here in the U.S., but virtually no insight if these miners are domiciled in China or Russia.

And if you look at the emissions profile of these alternative domiciles for miners, they are almost all (with the exceptions of Paraguay Norway, and possibly Canada) characterized by a higher carbon intensity of generation than the U.S. American generation, in the aggregate, is 379 g/CO2e, versus 544 g/CO2e for China, 742 g/CO2e for Kazakhstan, 360g/CO2e for Russia, 623 g/CO2e for Indonesia, and 493 g/CO2e for Venezuela.

These numbers are only indicative, as in practice, mining in the U.S. is generally cleaner than the generic grid at the country level. There is considerable mining for instance in West Texas, which has copious amounts of wind and solar, for which there is insufficient transmission. Other hotspots of mining in the U.S. include hydro-powered mining in upstate New York, hydro in the Appalachians, natural gas/nuclear in Ohio and PA, and stranded flare gas in Wyoming, Montana, and the Dakotas. (Mining with otherwise-flared gas is actually carbon-negative overall).

As for the purported “costs” imposed by Bitcoin miners on local communities, that argument is highly dubious. Bitcoin miners are just data-centers. They don’t produce pollutants or toxic waste. Generally, miners locate themselves out of the way in rural areas where electricity is cheap. Due to the laws of physics, electricity doesn’t travel well, so miners consuming energy in rural West Texas are not depriving someone in Dallas of power.

The net effect of the presence of Bitcoin miners on a modern grid is to cut off the tails of the price distribution: they scoop up cheap (or even negatively priced power) when no one is buying it – helping utilities better monetize – and they turn off when power is expensive, giving power back to households during grid scarcity events. Miners actively participate in “demand response” or “controllable load” programs in grids that have them, helping stabilize grids as they have a unique ability to react quickly to changing grid conditions and dial up and down their consumption as needed. During the grid strain last winter and in summer 2022 in Texas, miners dialed down their consumption, so energy could flow back to ordinary households. It’s no wonder that Texas governor Greg Abbott has praised miners for their benevolent presence on the ERCOT grid.

The Administration’s attitude, as revealed by the DAME tax, exposes its technologically regressive, de-growth agenda

Such is the flexibility of mining from a location perspective that a number of miners, like Iris Energy or Terawulf, are able to make the exclusive use of renewables part of their corporate mandate – something that virtually no other industry can match. And there are some miners like Aspen Creek that explicitly support the buildout of new, additional renewables as part of their mission. Any solar or wind installation it helps finance will provide decarbonized power to ordinary households too. This is hardly something the Biden Admin can complain about.

More generally, the Administration’s attitude, as revealed by the DAME tax, exposes its technologically regressive, de-growth agenda. Biden officials aren’t satisfied with Bitcoin miners using clean power, preferring to try and ban the industry entirely.

Bitcoin miners have the prospect to help stabilize increasingly renewable grids and even economically support new wind and solar installations. They can create a new model of location-agnostic datacenters that are co-located with renewable generation, rather than relying on the old hub and spoke model that requires costly transmission. Bitcoin miners are pioneering the model of bringing demand to the source of generation, but other industries will follow, like green hydrogen, fertilizer production, and eventually, other forms of compute.

Additionally, if the Biden Admin wants to carry out their “electrify everything” plan, which is a necessary component of decarbonization, tit will need multiples more generation than we have today. Someone will have to pay for this. How, then, is a novel source of demand for electricity, especially renewables, considered a bad thing?

The Biden Administration’s rejection of a buyer of energy that is location-agnostic, interruptible, and uniquely suited to purchasing new renewable sources of power is totally at odds with its own stated objectives for the transformation of the grid. As for the tax, it doesn’t achieve any of its stated aims, and empowers America’s enemies. Clear-eyed policymakers should reject it outright.

Thanks to Ethan Vera for his contributions to this article.

Edited by Ben Schiller.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/XIYVyeLySth3qxcRoYqz9Da1-l0=/arc-photo-coindesk/arc2-prod/public/4XC2ZHHN5BEBHKC2AJGSYOQTSI.jpg)

CoinDesk columnist Nic Carter is partner at Castle Island Ventures, a public blockchain-focused venture fund based in Cambridge, Mass. He is also the co-founder of Coin Metrics, a blockchain analytics startup.