The US Needs Hester Peirce’s Safe Harbor, or It Risks Falling Behind

Illustration by Cheryl Thuesday

The US Needs Hester Peirce’s Safe Harbor, or It Risks Falling Behind

Omer Ozden is CEO of RockTree LEX, a multi-country legal and professional services platform focused on the blockchain industry, along with its investment fund, RockTree Capital.

I live in Beijing, where we have a saying: 币圈一天,人间一年 (“Bi Quan Yi Tian, Ren Jian Yi Nian”), which means a day in the life of someone in cryptocurrencies is a year for anyone else.

It is a recognition that, in blockchain, everything moves faster. The internet sublayer and the peer-to-peer nature of blockchain has accelerated time, compared to other industries. In a little more than 11 years, the industry has emerged from grassroots adoption ignited by a white paper to 80 percent of central banks today developing or researching the creation of their own digital currency. Since 2016, an increasing number of nations have taken a top-down approach to accelerate blockchain and cryptocurrency innovation in their own markets with progressive policy to capture the opportunity.

In the US, we have seen a divergent approach from sophisticated financial regulators to tokens: some permissive and some restrictive. In February 2018, Christopher Giancarlo, the former Commissioner of the Commodity Futures Trading Commission (CFTC), advocated before the Senate a do no harm approach to regulating tokens, while the Commissioner of the Securities and Exchange Commission (SEC), Jay Clayton, said every ICO I’ve seen is a security. Across the Pacific, in September 2018, Damien Pang, the head of technology for Singapore’s financial regulator, the Monetary Authority of Singapore (MAS), stated that none of the tokens the MAS has seen in Singapore are securities.

Current American Way

John Maynard Keynes once said: “The difficulty lies, not in the new ideas, but in the escaping from the old ones.”

In America, we have chosen a more restrictive regulatory track, unable to break free from old frameworks. Shortly after the February Senate hearings, significant resources were expended on enforcement actions related to token offerings, not only for fraud, but also for a broad range of activities without allegations of fraud. These included registration violations and technical compliance errors within an uncertain framework, which many projects and lawyers misinterpreted. This period to present day has left our innovators, some of our brightest technical minds and inventive entrepreneurs, with a sense of trepidation. From the industry’s perspective, innovation in one of the most promising areas of technology has been stifled in the United States. This has resulted in US-based projects becoming less globally competitive or stalled because of exorbitant legal compliance costs; as a result some have chosen to leave the country or, even worse, others have simply given up.

Well-intentioned intellectual acrobatics to try to make tokens functional within the purview of U.S. securities laws, such as with SAFTs, SAFTEs, VFTAs, and attempts to reconcile token projects with Regulation S-K (which lays out the detailed information required to be disclosed by issuers related to registering securities) have largely been unsuccessful because it is like trying to fit a square peg in a round hole.

Former commissioners of the CFTC and SEC have warned that digital tokens are “under threat of extinction through regulation in the United States.” As a 20-year securities attorney, I agree. Blockchain provides for the digital transfer of value, and tokens are the representation of this value. Given the importance of tokens to the development and application of blockchain technology, our industry desperately needs relief and guidance.

The Path Forward

My firm was part of a delegation that brought Commissioner Hester Peirce to Singapore in July of 2019 for meetings with MAS, their foreign counterparts, and industry leaders from across the region. During her visit, Commissioner Peirce saw how a highly conservative jurisdiction with a well-formed and sophisticated financial industry, could safely regulate tokens and their offerings through permissive guidelines to promote a dynamic blockchain industry.

Singapore is seen as a leading hub of blockchain innovation because of a top-down approach with sensible regulation for tokens. The same could be said for similar jurisdictions including Switzerland and Japan. Switzerland, on a per capita basis, has 5 times the blockchain startups that the United States does, and attracts some of the best international (including U.S.) projects to domicile there. At the end of this trip, Commissioner Peirce publicly announced her support for a Safe Harbor for token offerings in the United States.

Rule 195, proposed last month by Commissioner Peirce, is the next iteration of that Safe Harbor. This framework includes more detailed requirements for reliance and a new three-year grace period for start-up blockchain projects that are offering tokens with the purpose of being decentralized. It is intended to provide, in her words: “rules that well intentioned people can follow….to enable them to pursue their efforts in confidence that they are doing so legally.”

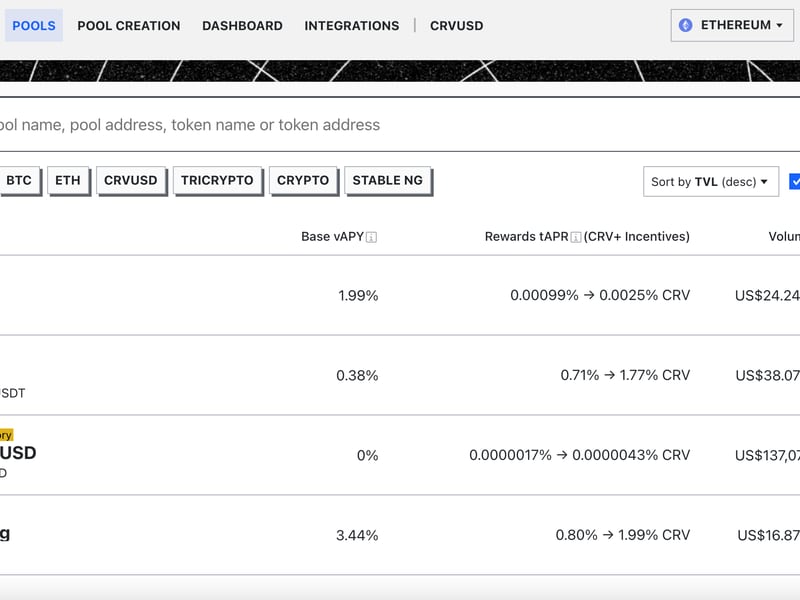

Development teams need not only to distribute tokens, but also actively seek secondary market liquidity, which Peirce identifies in her proposal as “necessary both to get tokens into the hands of people that will use them and offer developers and people who provide services on the network a way to exchange their tokens for fiat or cryptocurrency.”

U.S. federal securities laws are a disclosure-based system, and Peirce reconciles that with the realities of projects issuing payment and utility tokens while balancing the need for material information to be publicly available for purchasers of the token that follows the general concepts of, yet is significantly different from, the requirements of Regulation S-K (which is more applicable to “hand on heart securities” such as equities).

Peirce and others at the SEC have clearly spent considerable time becoming deeply knowledgeable about the practicalities and needs of developing token-based distributed networks from inception to their ultimate functionality or decentralization, and reconciled how that can be tailored and dovetailed with the disclosure-based nature of the regulator’s framework.

The Safe Harbor requires disclosures about the project, initial team members, and their token holdings and significant sales. It is thoughtful enough to also offer relief for the entire cryptocurrency ecosystem, such as providing trading platforms the benefit of the Safe Harbor if they facilitate trading of the tokens.

The SEC’s antifraud provisions still apply to token offerings relying on Rule 195. This gives regulators an enforcement club to penalize fraudulent behavior including material omissions or misstatements in disclosures, or similarly deceptive conduct. This acts as a guardrail for the Safe Harbor, as does the requirement that, if a network is not sufficiently decentralized or functional within the three year grace period, the token would require registration under the Securities Act of 1933 and begin periodic reporting under the Exchange Act of 1934 (10-Ks and 10-Qs). This is an extremely difficult burden for early stage companies to meet and should motivate them to make the best use of their grace period.

Where Do We Go From Here?

The proposal is not perfect. It has some holes that Commissioner Peirce acknowledges need to be filled. For instance, we need to understand how development teams can be compelled further to keep disclosures up to date and timely, and provide information in a timely manner, including sales by team members of five percent or greater of her/his tokens.

We may consider a quarterly or yearly attestation by a member of the development team to the regulated trading platforms that are also relying on the Safe Harbor to trade the token, and a delisting requirement in the absence of such attestation. The complexities and realities of how to actually administer the Safe Harbor, which relies on “good faith” within a securities law framework, is reflective of the lifeline Peirce is stretching to rescue our innovators as tokens sink into the quicksand of the restrictive and expensive securities law rubric.

Ideally, for innovation to thrive, we could lean towards regulation taken up by Japan, Switzerland and Singapore; such as proposed in the U.S. Token Taxonomy Act introduced by Representatives Darren Soto (D-FL) and Warren Davidson (R-OH) seeks to exclude digital tokens from being defined as securities by amending U.S. federal securities laws (among other things). Yet, this is only one of the 27 different bills related to blockchain and cryptocurrencies currently logjammed with Congress regulation and the timeline required to get it passed (if it ever will be passed), is an eternity for the blockchain industry.

Meanwhile, with respect to central bank digital currencies, China’s DC/EP (the digital ‘yuan’, which has been a six-year effort in the making) is the closest to launch. Disruption through blockchain innovation is coming and, under President Xi Jinping’s top-down directive in October 2019 to promote adoption of our industry, has been expedited.

As with most securities rules, the Safe Harbor will likely need multiple iterations to get it right.

China has since announced 10 municipal and provincial Fintech regulatory sandboxes, and now hails 33,000 blockchain projects within its borders. Even the Shenzhen Stock Exchange, which is comparable in market capitalization to the London Stock Exchange, launched its Blockchain Index of the largest 50 companies that have blockchain ventures listed on that exchange.

China, at both the state (i.e. federal) and local levels, is supporting its industry. Likewise Switzerland, Japan and Singapore. Commissioner Peirce should be given credit for seeking out new ideas and studying how other jurisdictions, with entrenched financial institutions and sophisticated financial regulations, have embraced innovation in digital assets while also protecting investors. Commissioner Peirce is now requesting comments on proposed Rule 195.

The SEC shares the ethos of blockchain: that of making code open source and accessible to the distributed contributions needed to help regulators be more efficient and think more practically about rule-making. Typically, draft rules from the SEC will remain open for 60 days for commentary from the public so the legal code can be developed in a manner that considers various permutations and combinations of improvements and vulnerabilities (i.e. how can we make the legal code practically functional and also avoid bad actors ‘gaming’ it).

We are not at that stage yet. Commissioner Peirce on this occasion has proactively released the proposal before it is actually considered by the other Commissioners at the SEC as a future rule.

You can do your part to consider and comment on Commissioner Peirce’s proposal. As with most securities rules, the Safe Harbor will likely need multiple iterations to get it right. Whether relief comes in the form of a clear and permissive SEC ‘No Action Letter,’ or, even better, the Rule 195 Safe Harbor; or an act of Congress much further down the road, the process will still feel painfully slow for those running at blockchain speed (i.e. 币圈 Bi Quan) and uncomfortably fast for many others (i.e. 人间 Ren Jian).

As this bureaucratic process begins to unfold ahead of us, American innovators will be held back limping, leaving, or, most sadly, giving up. This dynamic might ultimately need a “Sputnik Moment” to catalyze a top-down permissive approach to be taken in the United States. Because, as Representative Patrick McHenry, the Ranking Member of the House Financial Services Committee cautioned at the last LIBRA hearings: “the wave of innovation is spreading across the world, with or without us.”

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.