The US Dollar Is Soaring While The GDP Contracts

The strengthening of the U.S. dollar and the growth deterioration across major global economies will likely cause more downside for risk assets.

Revisiting The Dollar Bitcoin Relationship

In more recent issues, we’ve highlighted that over the last few months, bitcoin’s price has been a function of larger macroeconomic conditions of rising yields and credit unwinding leading to increased equity market volatility and rising U.S. dollar strength.

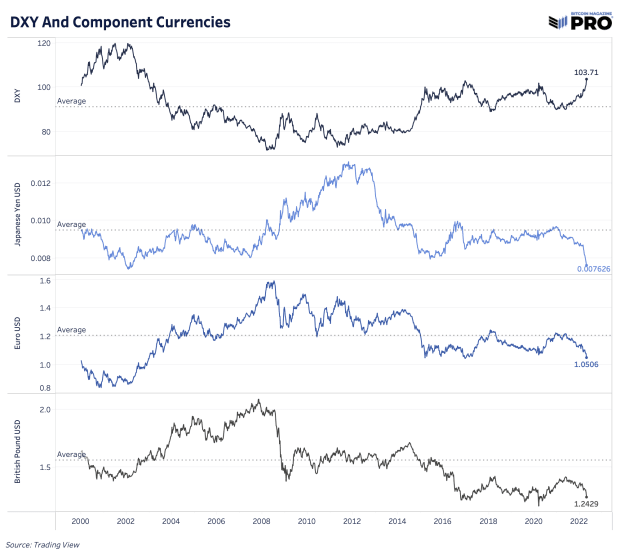

As of late, the Dollar Currency Index (DXY) which tracks the relative strength of the U.S. dollar measured against other key global currencies, is hitting new 20-year highs as major currencies like the euro, Japanese yen and British pound continue to weaken. The latest rise comes as the Bank of Japan triples down on their yield curve control efforts, purchasing an unlimited amount of 10-year bonds every business day to cap yields at 0.25%.

So what does a rising DXY mean for bitcoin and other assets? Even with the dollar devaluing against real goods, services and financial assets, all debtors are forced to sell USD-denominated assets to cover liabilities during deleveraging events.

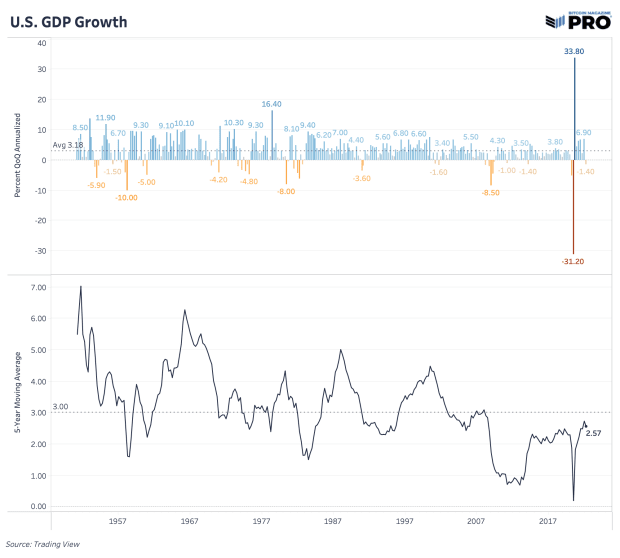

Today, we also get the latest U.S. Q1 2022 gross domestic product (GDP) data showing that the economy contracted by 1.4% compared to 1.1% expansion consensus. The growth deterioration across major global economies that will usher in a market regime shift to a more deflationary environment later this year has been a key assumption in our base case to expect more downside for risk assets in 2022.

If we’re to see broader market expectations for growth cut further this year then that change is likely more downside for risk assets.

Final Note

In our view, the worst is yet to play out for markets and bitcoin. That said, the type of credit unwinding and deleveraging we’re facing today is one of the key reasons that we expect the case for bitcoin to grow in the market as these events unfold.