The Unbearable Tragedy of The B Word

The B Word Bitcoin conference was a travesty of discourse that failed to advance the conversation on Bitcoin as a technology in any meaningful way.

“Here’s why I disagree…”

Surely, those are words you’ve heard in a conversation before. Respectful, terse. An affirmation that what is to follow is to be a rebuttal, a series of words that offers some critique on what you, as a human being worthy of response, have just expressed.

Sadly those words and any like them were all but absent from The B Word conference on Wednesday. Billed by Square CEO Jack Dorsey as “The Talk,” the event promised (however vaguely) the semblance of a reasonable conversation about Bitcoin that also included Elon Musk. It could be argued such a thing seemingly took place.

I say seemingly, of course, because as I reflect on the hour-plus of content assembled, I feel it dishonest to portray it as any other than a travesty of discourse, one that went so far as to render the experience akin to watching the images of three inert human bodies, in three different realities, discussing the view from three entirely different universes.

Questions were asked. News happened. (SpaceX holds bitcoin. Elon owns ETH!) Yet, nowhere in the over 60-minute affair was there discourse on the “elephant in the room,” nor a consensus even on the species of the elephant, nor, perhaps even, that elephants existed.

I feel exasperated thinking about it. I feel saddened by the fact that I feel I need to write this. But above all — I feel. I really felt something resulting from the conversation, and I can only describe it as a hollow, awful disappointment about the state of discourse around Bitcoin…

SHUT UP YOU IDIOT, WE OWE YOU NOTHING!

Yes, I know. It’s my fault for having expectations. But let us humor me and assume that I am allowed to think that things can or should matter, that the energy exerted by our useless meat bodies and the doomed celestial rocks Musk is intent on colonizing have meaning…

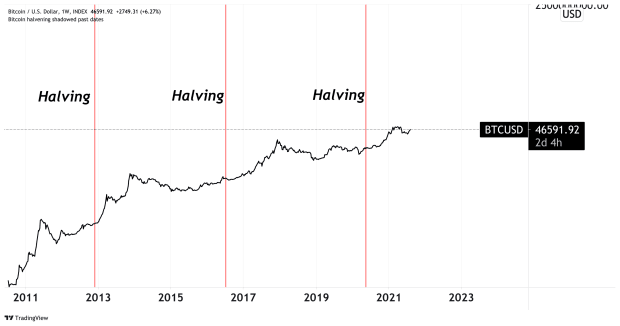

That I feel anything at all in the wake of watching this is perhaps a triumph of branding, and the success of Bitcoin evangelists in shifting the narrative surrounding cryptocurrencies. It really has felt of late that Bitcoin has been on the cusp of being understood and that the mirage of “competing blockchains” might diminish with it.

And here it was, an event for institutions — called The B Word! — that promised to shed light on why businesses should consider Bitcoin as something other than a useless funny money slowly draining all remaining resources from the earth.

In other event sessions, this was on display with eloquent evangelists like Lyn Alden and Nic Carter advancing arguments for Bitcoin as an economic system that have never felt stronger.

Yet, on the biggest stage so far this year — in a panel titled “Bitcoin As A Tool For Economic Empowerment” no less — we were shown the massive extent to which we’re failing to advance arguments for why Bitcoin, alone among competing technologies, is best poised to solve this.

In the wake of the event, I can’t even say for sure whether I believe anyone on that stage — even Dorsey — would agree with this statement. But, you might be saying, this was discussed in other talks! This information is out there! It would have taken too long!

I remain firm in my belief that legitimate conversation could have been facilitated.

- Elon. Bitcoin’s developers have deliberately made design choices to decentralize the operation of the software. Are you aware that criticisms you have presented are not taken seriously in its scientific community?

- Jack. You mentioned that you believe Bitcoin is superior because of its community. How do you feel about the communities of other cryptocurrencies?

- Cathie. You’ve invested in multiple cryptocurrencies. Do you believe institutions should invest in dogecoin, why or why not?

WE WON THE FIGHT ON TECHNICALITY, THE GOOD NEWS IS PROOF!

That is true, anon. And I’m sorry for not mentioning it first. The headlines are all positive! Tesla will accept bitcoin again “probably,” so that’s no longer a concern. “Musk is on Bitcoin’s team.”

Who knows? Maybe this was all a big ruse to massage Musk’s ego in public, to wear him down like a raging bull through the force of his own exertion.

Still, my biggest problem is that I don’t understand how Musk walks away from this conversation with any change in view. Until the end, he continued to use the word “cryptocurrencies,” and sought to frame the conversation as one about “crypto” in general.

Is this an unreasonable stance? I have no idea why Musk would think so. Indeed, at times he seemed to be searching for an explanation as to why no one else was saying the same. (Cathie Wood, an investor in Grayscale’s Ethereum Trust, was oddly silent on the matter).

As I exclaimed during an after-the-fact Twitter Spaces, Musk showed up! He talked openly about his personal cryptocurrency holdings in a way that would make any PR team shudder.

For me, Musk at least emerged as sympathetic. He is a man who merely wishes to have his intellect entertained, but nowhere on the panel was he able to find a willing conversationalist.

It’s almost best to summarize the panel as an act of violent non-aggression, in which Musk was ignored and talked around as if he was too dangerous to be engaged with.

To begin, a review of the actually interesting things that Elon Musk said:

“I understand Lightning is doing well in some small countries.”

“The reality is the average person is not going to run a Bitcoin node.”

“The money has to get translated into real products and services.”

To review, these are really interesting comments for the following reasons:

- They are all about Bitcoin AS A TECHNOLOGY

- They suggest Musk is trying to evaluate Bitcoin AS A TECHNOLOGY and that he is trying to understand what separates it from other cryptocurrencies.

- They suggest his evaluation on Bitcoin AS A TECHNOLOGY is heavily influenced by Silicon Valley norms on the idea crypto assets at large are legitimate technologies.

Still, the closest the conversation came to engaging with this view was when Musk argued dogecoin was likely to win because it was the most “ironic” and because he likes dogs.

Let us illustrate the extent of the pushback, by quoting from memory, Dorsey’s lazy response: Bitcoin is also irreverent.

What the actual quote is does not matter, really, honestly. The logic at play was almost insulting, akin to a live demonstration of the “I Made This” meme in which someone convinces someone else they gave them an idea….

THE REAL WINNING WAS THAT WE DIDN’T LOSE

Let’s put aside for a second that cogent discussions on Bitcoin are valuable or possible at all.

I’ll accept that that might be too high of a bar on which to evaluate the panel, and that for the sake of humoring the concept of “4D chess,” I’ll adopt the following thesis: Musk is quite simply too much of a loose cannon, and the event was meant to “diffuse the fire.”

That is to say, the goal was to get bitcoiners to stop hating Elon, get the press to stop talking about it, and for everyone to move on with their lives through subjecting the greater populace to 70 minutes of sheer inhuman boredom that in no way hurt their respective stock prices.

If that was the goal, then, “on balance,” I’d have to admit it was a success.

Dorsey waxed philosophically about how people in Africa have bad payment systems and Wood spoke about what an “honor” it was to meet Bitcoin developers. Bitcoin reminds Dorsey of the internet! He thinks Bitcoin could bring world peace! Musk hates governments!

Such agreement. Wow!

The idea that any logical person could admit such goals can be achieved in many ways, with perhaps different technologies, was shown the door.

Instead we were given Bitcoin by association, Bitcoin by insistence, Bitcoin by our refusal to entertain anything else. What does the B word even mean?

SORRY, I BLACKED OUT

I, too, look forward to attending “The E Word.”

Elon Musk picture from Twitter.