The U.S. Government Seems to Be Closing in on Bitcoin Mining

The U.S. Department of Energy (DOE) is taking a closer look at bitcoin {BTC} mining. Is this cause for alarm?

More specifically, the Energy Information Administration (EIA), a statistics agency under the DOE, will survey the electricity use of selected U.S.-based miners over the coming six months starting next week, after putting out an “emergency collection of data request.”

This is an excerpt from The Node newsletter, a daily roundup of the most pivotal crypto news on CoinDesk and beyond. You can subscribe to get the full newsletter here.

Given the phrasing of an “emergency” order and the current administration’s crypto-critical stance, many are worrying that the information collected will be used to inform potentially harmful policies to the mining industry. In its public filing, the EIA cites the possibility of “public harm” from crypto mining for collecting the data.

“EIA is policy neutral agency that does not create policy, implement policy, enforce policy or comment on policy. EIA spokesperson Morgan Butterfield told CoinDesk in emailed responses. “Results from the data we collect will help inform our path forward regarding a regular three-year clearance during the next six months.”

But being policy-neutral doesn’t necessarily mean the survey won’t influence policy. There’s reason enough to believe that simply by running this survey the EIA is asking questions about the larger purpose of Bitcoin and whether it benefits society, and already has an answer in mind.

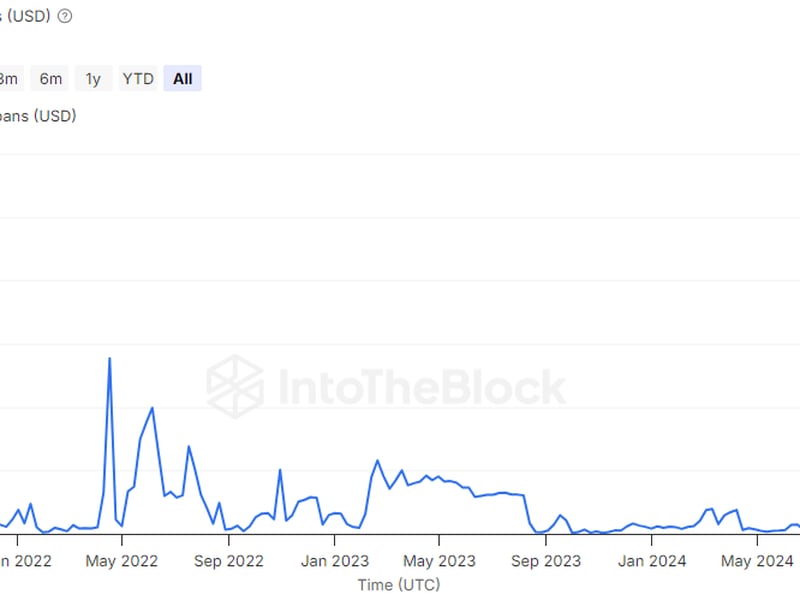

For instance, the justification for the emergency order, granted by the Office of Management and Budget, was the recent crypto price rally, which saw bitcoin climb over 50% in a matter of months, which the EIA said would “incentivize more cryptomining activity, which in turn increases electricity consumption.”

“Given the emerging and rapidly changing nature of this issue and because we cannot quantitatively assess the likelihood of public harm, EIA feels a sense of urgency to generate credible data that would provide insight into this unfolding issue,” it said. Butterfield said 82 firms, operating approximately 150 facilities, were selected to represent the ”universe of cryptocurrency companies” across the country.

The agency pointed to a cold snap that hit Plattsburg in 2018, to justify the risks crypto poses to the public. “The combined effects of increased cryptomining and stressed electricity systems create heightened uncertainty in electric power markets, which could result in demand peaks that affect system operations and consumer prices,” it wrote.

Since then, New York State has passed a two-year moratorium on opening new crypto mining facilities unless they are powered entirely by renewable energy. Texas, which was a major benefactor after China passed a nation-wide crypto mining ban, has also sought to slow down the mining industry. Crypto miners in Texas work directly with the state-owned grid operator and get paid to power down during periods of peak demand or moments of network stress.

To be fair, a public version of the survey shows the EIA is asking fairly routine questions of mining firms, including how many and what type of chips they’re running, their electricity consumption at the facility and how much goes directly towards mining.

“We will specifically focus on how the energy demand for cryptocurrency mining is evolving, identify geographic areas of high growth, and quantify the sources of electricity used to meet cryptocurrency mining demand,” the agency said in a statement. The reports are due on the last Friday of the month until the end of July, after which it may be renewed.

Further, there’s an argument to be made that having high-level statistics like this will benefit the country and the industry, given that it’s more detailed information, straight from the horse’s mouth.

At the moment, the best data we have for the mining industry’s footprint come from the Cambridge Bitcoin Electricity Consumption Index, which gives hypothetical lower- and upper-bound estimates of the Bitcoin network’s daily energy consumption, essentially by extrapolating out from the current hashrate.

But you have to ask, why run the survey now? Why was the most recent run-up in bitcoin prices a cause for an emergency but not others? It’s worth noting that the Biden administration has prioritized reducing the country’s carbon footprint. And that crypto-critical Senator Elizabeth Warren (D-Mass.) asked federal regulators to have crypto miners disclose their emissions and energy use.

Bitcoin mining will likely become a popular topic of debate in the media in the run-up to halvening event, the programmatic reduction in the “bitcoin subsidy” paid to miners that happens every four years. It’s not yet clear how the halvening will impact the mining sector beyond making less-efficient mining equipment unusable in the short-term. Some are expecting the crypto carbon footprint to grow in the coming years, while others see it shrinking.

Moreover, in recent months, there has been something of a public reckoning on Bitcoin’s environmental cost, particularly after the second-largest network, Ethereum reduced its energy consumption by 99% through a single upgrade. While some organizations like Greenpeace are pushing for Bitcoin to abandon energy-intensive mining, some are starting to see the sector as a boon to environmentalism.

For instance, Cambridge recently revised down its estimates for Bitcoin’s annual energy use, and institutions including MIT and KPMG have put out reports arguing the network could help “balance” electricity grids, subsidize renewable energy development and be useful in greening the economy.

Mining is an energy-intensive process — the cryptographic algorithm Bitcoin runs, proof-of-work (POW), was designed by computer scientists to disincentivize spam, Sybil and denial-of-service (DoS) attacks on networks by adding costs to interacting with a server, typically in the form of computer processing time put towards solving a mathematical puzzle.

Some observers opposed to the mining process, often describe bitcoin mining as “wasted” energy, but it’s not — the energy is purposefully spent as a sort of token or a form of proof. The problems bitcoin miners compete to “solve” don’t mean anything in that they don’t add to the body of human knowledge or contribute to something productive like Folding@home, but they do have value – securing the network.

And that’s the tricky part: valuing Bitcoin. What is bitcoin worth? The standard response is to look at how the market values it, which at time of writing is around $42,000. But most of the real debates around Bitcoin’s intense energy footprint have little to do with bitcoin’s price; rather they center around Bitcoin’s costs and benefits.

I wish I could say the EIA’s survey would help us better understa those costs and benefits. However, the survey writers seem to have already answered their own question about whether Bitcoin poses risks to the general public and are looking for data to support that conclusion.