The Turkish Tribal War Against Bitcoin

Bitcoin could help rectify malinvestment and unsustainable development, if only embraced by a currently hostile Turkish government.

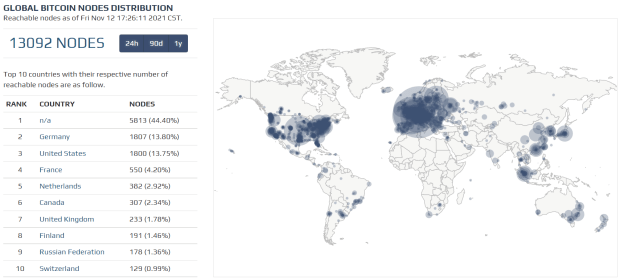

Turkish President Recep Tayyip Erdoğan said, “We are in a war against cryptocurrencies,” on September 18, 2021. Merriam-Webster defines war as “a state or period of fighting between countries or groups.” I am guessing that the war Erdoğan mentions here is a war between Erdoğan’s tribe and Bitcoin, as the citizens of the country are embracing bitcoin more than ever. On January 15, 2021, the number of people investing in the Turkish Stock Market went past 2 million for the first time. By April 24, 2021, there were more than 5 million users registered to the two biggest Turkish bitcoin exchanges. One would wonder how a 12-year-old technology manages to attract more people than the Istanbul Stock Exchange that has been active since 1985 with the full support of government institutes. The answer lies in the Turkish lira and the reputation of the central banking system of Turkey.

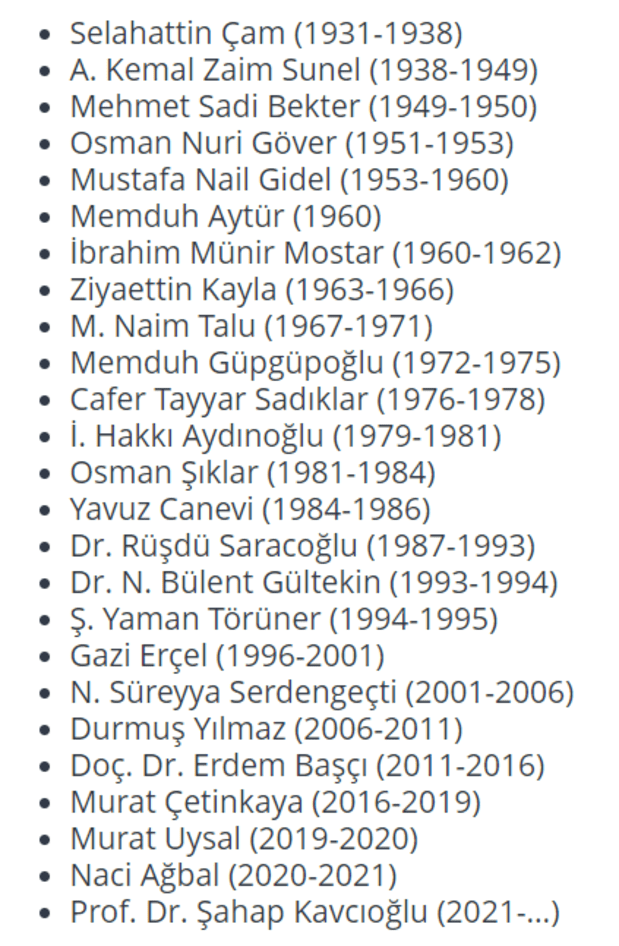

The Turkish Central Bank is identified as an independent bank. Unfortunately, the bank’s independence is very questionable. Turkish President Erdoğan appears to be acting as a chairman in disguise for the bank. The central bank had a total of 21 chairs between 1931 and 2019. This gives the chairs an average time of 4.2 years per person. Murat Uysal was appointed as the chair in July 2019. Uysal was sacked from duty in November 2020 and Naci Ağbal was appointed instead of him. Ağbal held his position until March 2021 and that position was filled by Şahap Kavcıoğlu. In the last 26 months, the bank had three different chairmen.

Image source

The reason why Erdoğan is interfering with the bank is that he wants to artificially lower the interest rates to open credit windows for Cantillonaires, mainly for the ones that are in the construction industry. Inflation data is used to calculate interest rates. If the interest rate for the Turkish lira is lower than the inflation rate, nobody will park their money in the form of the Turkish lira and people will choose alternative assets like gold, dollars, bitcoin and real estate. As the demand for the Turkish lira diminishes, its value also diminishes, causing more inflation since Turkey is a country with a net trade deficit and is dependent on exports priced in foreign currencies. Simply speaking, decreasing interest rates lowers the Turkish lira’s value, causing inflation, and inflation results in a need for hiking interest rates again.

With the results above, one would wonder why the president forces the central bank to lower interest rates? The answer is more complicated than it seems to be. It lies in creating cheap credit for the construction companies, aka the Tribe I have mentioned at the beginning of this writing. Something similar to what happened in China with construction has been happening in Turkey. China’s growth was fueled by its growth in the construction industry. There were a lot of projects going on simultaneously and the demand was always there. This is a video from 2016 explaining the Chinese ghost cities:

Beijing, at some point, tried to slow down the construction bubble by putting a limit of one property per married couple. People divorced on paper and kept living together in order to own two separate properties. One of the other reasons for this construction bubble in China was that a stream of construction was in favor of the local governments. They would issue permits and get paid in return. Beijing and Chinese leadership were aware of this unnatural supply and demand and they also intervened to prevent shadow banking and the creation of money via credits.

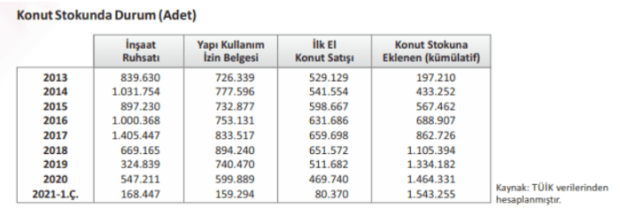

Unlike Beijing, the Turkish government actually tries to keep the construction bubble inflated. In June 2020, the government banks HalkBank, Ziraat Bank and VakıfBank were instructed to lower their interest rates for mortgage loans for new apartments to 0.64% per month — 7.68% per year — and add a period of no payment for the first 12 months. During that time. anyone would be able to get 10% interest paid for their capital in their savings account. So, the banks were pushed to give out cheap credit at 7.68% during a time in which they were paying their customers 10% interest rates. This was a direct incentive for people to buy new property. Government incentivizing home sales comes with its problems. The artificially pushed demand ends up increasing house prices significantly and destroys the price equilibrium of the market. All these efforts moved the market, but the number of homes that never had an owner in Turkey still rose to 1,543,225 in the first quarter of 2021 from 1,464,331 in 2020. This is a huge stockpile of property waiting to be sold. For reference, in November 2020, 268,385 homes in England had been empty for at least six months.

Why Construction (Small Fish)?

Construction is rather easy money, especially if you are given special treatments. Let’s say two people have adjacent land of 1,000 m² with the same construction conditions that are each valued at $4 million (construction up to 50% of the land and a maximum of seven stories of construction is allowed in the region). Let’s say Person A builds a housing complex with a base of 500 m², four houses of 125 m² per floor and seven floors with a total of 28 homes. Person A sells each house for $1,000,000 for a total of $28 million. The minimum wage is cheap in Turkey ($325 per month) and construction costs are minimal compared to a lot of other places. Let’s assume that the construction of these apartment blocks costs $7 million. Including the land, Person A needs to sell 40% of the apartments to break even.

Person B then goes to the municipality and asks for an extension on the construction permit.

It is important to remember that nothing in life comes for free. Person B makes a generous — and unregistered — donation to the municipality. In return, he gets to build on 75% of the land and can go up to 14 floors. So, he starts constructing on a 750 m² base gets 6 houses of 125 m² per floor and gets to build 14 floors which give him 84 homes. Let’s assume the construction part of the project costs him $15 million, the land was $4 million, same as Person A but an additional cost of $2 million for his generous donation. For a total cost of $21 million, Person B can get up to $84 million in return. He now only needs to sell 25% of the houses to break even.

With a significantly improved profit margin, Person B can even sell for less than Person A. Financing these projects is another part and it is where things get spicier. So Person B’s land value increases to around $10 million with the additional construction permits. He can go to the bank, place a mortgage on the land and get around $10 million of credit. Now he has the land and he has $10 million in cash. He starts building the complex, and as soon as he starts building, he starts selling the apartments that help him further finance the complex. In Turkey, some suppliers also get paid with apartments instead of fiat money. Construction steel usually costs around 7% of the total cost of a building. In our case, ($15 million * 0.07) construction steel costs a little over $1 million. He can pay the steel manufacturer maybe $200,000 and an apartment in return as payment. Basically, it is possible to have land, get the land upgraded, a fraction of the initial investment needed and you can build the complex.

There were over 450,000 registered construction contractors in Turkey in 2020. By comparison, there are 3,550 (as of 2020) in Germany and 52,592 (as of 2020) in the U.S. It is clear to see that there is a good incentive attracting people to the construction industry in Turkey. So, as mentioned in the above example, there is some money flow to the municipality. This money helps fund local political groups, political youth groups and, of course, finds its way to the upper levels of the political party of the municipality. This, unfortunately, doesn’t only happen with Erdoğan’s party. However, as Erdoğan’s party has control over different government establishments, they face less resistance moving through bureaucracy. There is a popular saying in Turkey, even said by strong supporters of Erdoğan’s Akparti, “They steal but at least they do get things done.” As long as there are incentives to steal with zero downside, people will steal.

Why Construction (The Big Fish Edition)?

Aside from the local construction projects, the real game is in government construction projects. Government tender laws have changed 191 times in Turkey since 2003. With an average change of 10.6 per year or once in every five weeks, just to follow the government tender law is a full-time job.

Turkey also has a lot of projects which President Erdoğan considers to be “mega” projects. Some of these projects include Istanbul Grand Airport ($12 billion airport project, considered to be the biggest Airport in the world),

Image source

Eurasia Tunnel (a tunnel that goes under the Marmara Sea, connecting European and Asian parts of Istanbul), Marmaray (a railroad that goes under the Marmara Sea connecting Istanbul), Yavuz Sultan Selim Bridge (the third bridge that connects the Bosphorus Strait), Osmangazi Bridge and Çanakkale Bridge. All these mega projects have government-guaranteed usage contracts.

Government-Guaranteed Usage Contracts?

The image below is an image of the Çanakkale Bridge. The last active mega project.

- The expected cost of the bridge is $924 million (793 million euros).

- Credit terms are 15 years of payment with no payment in the first five years.

- 45,000 guaranteed vehicle passes (Government pays if the actual number of cars passed is under 45,000 a day).

- Payment per pass is roughly $17.48 plus tax (15 euros plus 18% value-added tax or VAT).

- The consortium of companies that got the bid will operate the bridge for 16 years.

So, the operators of the bridge are guaranteed to make a revenue (in euros) of 15 x 45,000 = 675,000 euros per day, 246,375,000 per year, and 1,231,875,000 in five years. They will start paying back for their credit of $924 million (793 million euros) after they generate roughly $1.43 billion (1,231,875,000 euros) which is mostly profit.

Image source

The main problem here is the guarantees and the guarantee fees. Osmangazi Bridge, for example, has a daily guarantee of 40,000 vehicles per day. It has been operating since July 1, 2016. The first half of 2021 was the first time they managed to average above 40,000 vehicles per day (42,000 vehicles on average). However, the original contract for the bridge was $35 + 18% VAT. The consortium currently charges the users $17 + 18% VAT and the $18 of difference is subsidized by the government costing an extra $684,000 per day and around $250,000,000 per year.

On top of that, they recently started to build city hospitals. Currently, 13 of them are operating and the Turkish government guarantees to pay 70% of the patient capacity. Last year, 15% of all the Ministry of Health’s budget was spent on the payment of these hospitals. There are eight more under construction and, when completed, the total capacity will increase to 22,221 patients from 17,842. So, if the Ministry of Health gets the same budget upon completion of these hospitals, they will be spending 18.6% of its budget on these hospitals.

The list, unfortunately, goes on and these are huge compounding liabilities for the future. They are all projects that provide good short-term economic data. A lot of people are employed via these projects, they help the country show short-term growth, but they are all long-term debts the citizens will have to pay to the friends of Erdoğan.

Who Are These Friends?

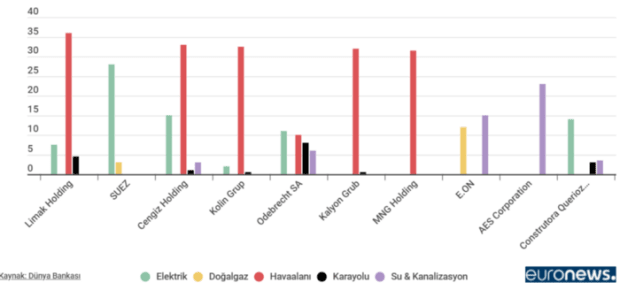

The chart below shows the data for the top-10 companies in the world that received government tenders in dollar terms between the year 1990 and July 2018. Five of these 10 companies are Turkish companies. Limak, Cengiz Holding, Kolin Grup, MGN Holding, and Kalyon Holding made to the list thanks to the Turkish Treasury guaranteed projects.

Image source

In 2020, the Minister of Commerce Ruhsar Pekcan also told the senate that between 2010–2020 these companies had a lot of tax deductions.

In a span of 10 years,

Kolin Grup’s taxes were deducted 36 times.

Cengiz Holding had deductions 30 times.

Kalyon Holding and Limak had 19 tax deductions.

In 2016 alone, Cengiz Holding’s tax liabilities of $148 million that occurred between the fiscal years of 2009–2015 were canceled. Cengiz Holding also had their name listed for tax evasion in the recent Pandora Papers.

What Next?

Erdoğan is pushing forward for another mega project. This time it is called Kanal Istanbul. The project will be handled by the crony companies mentioned above.

The image above is an image of Istanbul. The strait you see on the right side of the map is the Bosphorus. It is a natural strait that connects the Black Sea and the Mediterranean Sea. Erdoğan wants to create a secondary strait that is 45 km long, 275 meters wide, and 20.75 meters deep. They are also planning 11 bridges across this canal and housing to inhabit 500,000 more people. Istanbul is already one of the most crowded cities in the world with a population of over 15.5 million people. The city is already too populated and is on the brink of water shortages. The channel will be built on top of the agricultural land and underground water basins of Istanbul. On top of all these things, Istanbul is located in an earthquake zone. In fact, not too long ago, on August 17, 1999, an earthquake near Istanbul caused the deaths of 17,480 people and damaged 285,000 houses.

The project requires an investment of between $30–40 billion. Turkey does not have the sort of money to finance the project. Some sources say that the financing of the project will be provided by China.

Nevertheless, considering all the above data, someone with a sense of logic would not go for this project. Erdoğan, on the other hand, says that he will complete the project no matter what, even if it’s against the people’s will.

Why So Stubborn About Kanal Istanbul?

The land that the Kanal Istanbul will take place on is already bought by the insiders for very cheap. The project was first announced in 2011. Between 2011–2019, 30 km² of land were traded. To understand how big this land is, Paris sits on an area of 105 km². Some of the landowners there include middle-school friends of president Erdoğan, ex-minister Erdoğan Bayraktar, the Emir of Qatar Sheikh Tamim bin Hamad Thani’s mom, members of Ak Parti (Erdoğan’s party) and Mhp (political party close to Erdoğan), and three companies from Kuwait, U.A.E. and Saudi Arabia own 0.3 km² of the land.

How Does Bitcoin Fix This?

In a world where money is not controlled by someone (the president of Turkey in this case), it is much harder to fund these projects by printing money and diluting people’s savings and earnings. Bitcoin, in this case, would be very beneficial for the majority of Turkish people who want to opt out of this craziness. People would prefer to store their wealth in a sound money that can’t be diluted instead of one printed to support these otherwise zombie companies and government cronies. As mentioned at the beginning of the article, this is a war between Bitcoin — a mathematically backed software that only aims to deliver immutable blocks every 10 minutes — versus a mathematically illiterate tribe that does as many malinvestments as possible to sustain their Ponzi-like business.

This is a guest post by Stackmore.hodl.Sucre. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.