The State Of The Lightning Network Behind The Curtains

“The State of Lightning” report shows how the Bitcoin layer-2 is evolving to become the native transaction rails of the internet.

- El Salvador bitcoin adoption, Twitter enabling BTC tipping through Lightning, and Paxful integrating Lightning, all in September, have propelled user adoption and payments activity in the network.

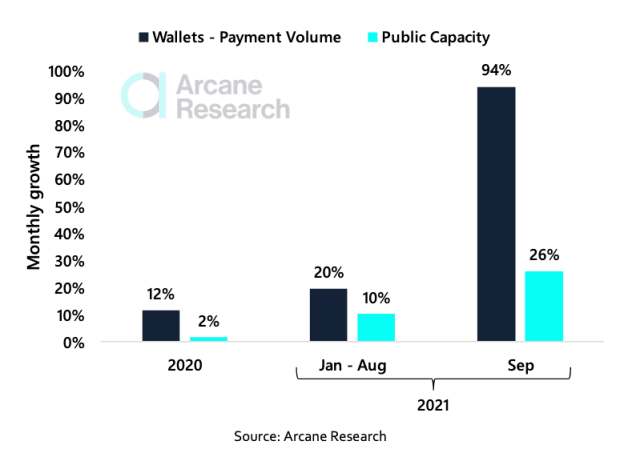

- Lightning payments volume doubled in September, while channel public capacity grew by 26%.

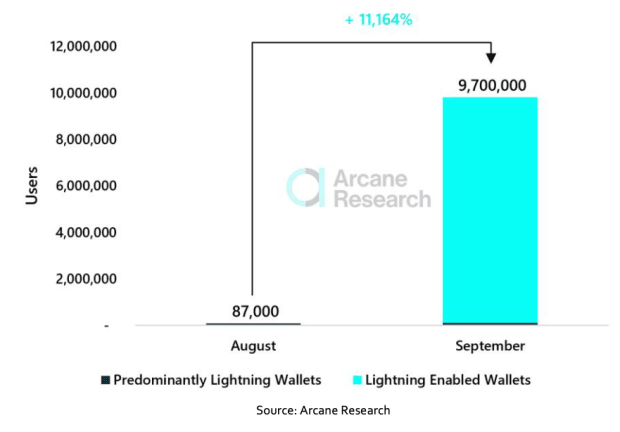

- The number of users with access to Lightning payments increased by 11,164% to 9.7 million users in September, compared to 87,000 in August.

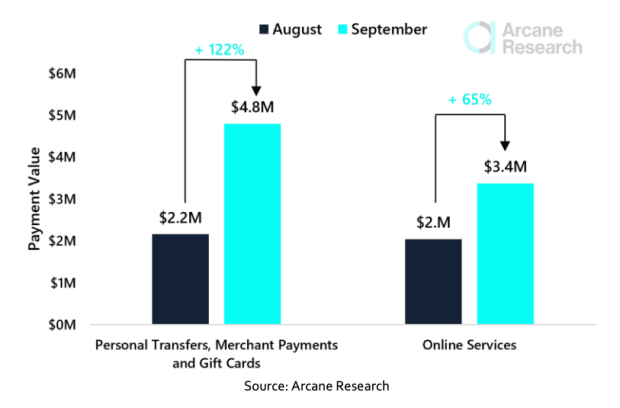

- Lightning usage for personal transfers, including merchant payments and gift cards, grew by 122% in one month, while online services increased by 65%.

Arcane Research published today a lengthy report on the state of the Lightning Network, evaluating the Bitcoin second-layer from within. The paper touches on channel capacity, wallet payment volume, everyday usage, and the ability to stream money. By getting a better understanding of how the network is changing industries worldwide, the reader might picture the direction the world is likely heading.

This article summarizes the report’s main points. All statistical data was pulled from Arcane’s paper, along with the images.

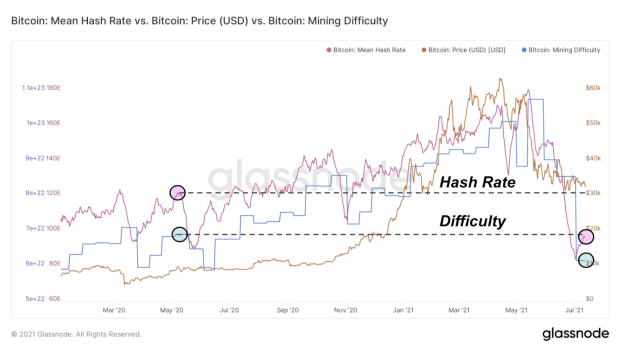

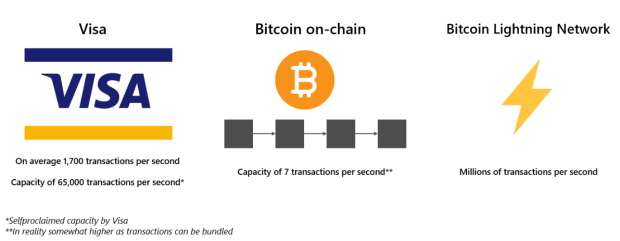

Bitcoin capacity in Lightning channels just crossed a major milestone, surpassing the 3,000 BTC mark. However, the report argues that Lightning public metrics like channel capacity do not show the true magnitude of usage growth. Instead, Arcane uses Lightning wallet payment volume to gauge adoption, which has increased far more than total bitcoin capacity in channels.

In September, when El Salvador made bitcoin a legal tender, Paxful integrated Lightning, and Twitter enabled BTC tips through Lightning, payment volume almost doubled, compared to only a 26% increase in public channel capacity.

Arcane showed that as more users have gotten access to Lightning, usage has shifted from predominantly payments to online services to typical everyday use like physical merchant payments and gift cards.

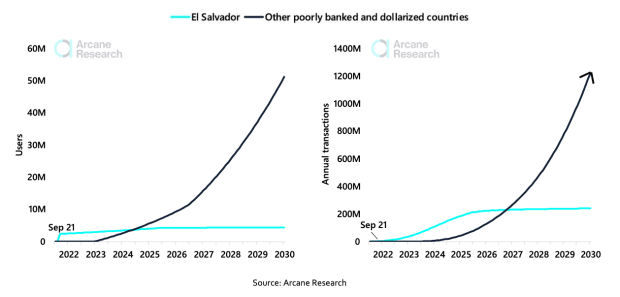

As Lightning passes the test of usage and adoption in El Salvador, other countries will emulate that approach. The clear advantages Bitcoin and Lightning have compared to precarious banking systems and hyperinflated national currencies will drive people and governments to adopt the sovereign monetary technology stack.

As a result, Lightning adoption might go parabolic in this decade. A possible scenario for Lightning usage from household expenditure and remittance payments in other poorly banked and dollarized countries until 2030.

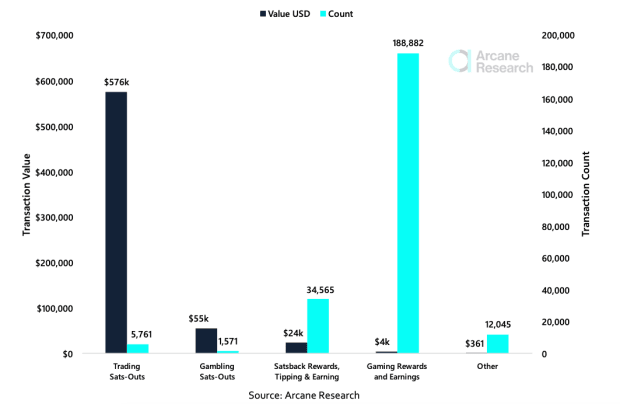

Lightning also has the potential to disrupt how services are offered. It enables micropayments for minor business transactions, as shown by the gaming industry, which has been using the network as a payment rail more frequently.

Gaming rewards and earnings only accounted for an estimated $4,000 of incoming transaction volume in August but did this on 189,000 transactions — an average transaction size of 2 cents. No other payment system would allow such small transactions to be settled instantly without counterparty risk.

By enabling micropayments with finality, Lightning will allow people to stream money for content. Indeed, this is already happening today, with services like Sphynx Chat enabling podcast listeners to stream sats while enjoying their favorite shows, effectively functioning as a tipping service.

“Why shouldn’t you be able to pay per minute you listen to songs on Spotify or per second you watch of a movie on Netflix? Why should you give away your credit card details to a content service if you could pay directly from your Lightning wallet without giving away any information about yourself?,” the report said.

Lightning has the potential to revolutionize the content industry as much as the internet did in the early 2000s.

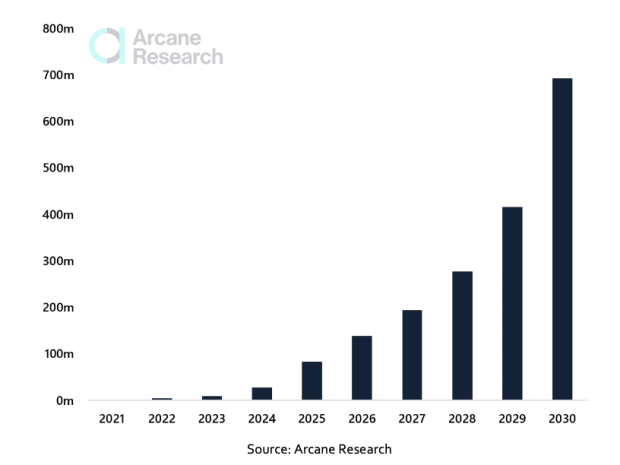

As users begin paying for their gaming, video, and audio content with bitcoin through the Lightning Network, the layer-2 solution will likely experience dramatic growth in users and activity throughout the decade.

“Based on a conservative estimate of 1 hour used per day on these services and an average of 25% of this time spent consuming services with Lightning payments, our estimate equals no less than 364 trillion Lightning transactions per year by 2030,” per the report.

Such predictions might seem absurd, but remember that many people said the same about the internet when it came to public attention.

“Many were skeptical of the internet and how it could be used to transfer files, emails, audio, and other content. These technical challenges were solved quicker than many expected,” Arcane said. “Today, 5 billion people use the Internet, we send more than 60 billion WhatsApp messages per day, and it’s estimated that we will send 376 billion emails per day by 2025.”

Similar to the internet, Bitcoin has the power and potential to disrupt many industries and human habits; however, it will be all about money instead.

“Bitcoin and the Lightning Network are also based on open-source protocols and software, in the same way as the Internet, making another Internet story much more likely, with innovation and contribution from all parts of the world,” the report said.

Lightning is just starting to scratch the surface of the endless possibilities that Bitcoin and its layered approach to sound money will have in society.