The Share of Aussie HODLers is Back to 2021 Levels (Study)

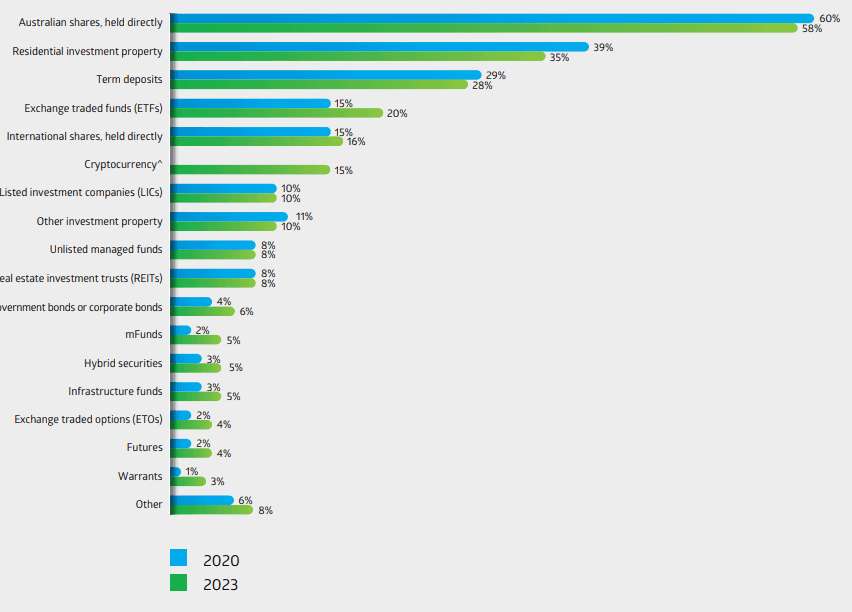

The latest ASX Australian Investor Study estimated that approximately 15% of Australians have invested some of their wealth in cryptocurrencies. The figure is somewhat similar to the 17% registered during the bull market in 2021.

The research further showed that young Aussies are more inclined towards the industry, with 31% being HODLers.

The Latest Trends in ‘The Land Down Under’

According to the analysis, roughly every seventh Australian has entered the cryptocurrency market, with males (69%) making the bigger share of investors. Most individuals have spent between $340 and $3,400 on digital currencies, while only 10% have invested over $67,000.

A closer look at the different demographic groups shows that youngsters are significantly more interested in the market than older generations. 31% of the so-called “next generation investors,” or those at an average age of 21, have bought Bitcoin or altcoins.

The company that conducted the study believes younger individuals are more “risk averse than their older counterparts,” which is why they are more likely to tolerate crypto’s volatility and enter its ecosystem.

“The majority understand the cyclical nature of investing, with 29% saying a fall of 20% in their portfolio balances is a risk they understand could happen and another 36% saying if this happened, they’d be concerned but would wait to see if the situation improved,” ASX stated.

It added that “next generation investors” are excited about new technologies and sometimes wish to get involved with things their parents would avoid.

High-value investors (HVIs) also find the sector attractive. 33% own digital currencies, while their median investment is nearly $88,000.

The next study’s overall figures could ascend should “intending investors” (around 1.33 million people) decide to hop on the bandwagon. That portion represents people who have not made any investments but consider doing so in the next 12 months. 29% of them admitted they would select cryptocurrencies above all other options.

Investing in shares and real estate remains the most common choice for Aussies. Term deposits, ETFs, and international shares round up the top 5, whereas crypto ranks sixth.

Last Year’s Numbers

It seems like the ongoing uncertainty in the crypto market has caused a severe investor outflow among Australians since Independent Research estimated in November 2022 that over 25% of the locals were HODLers.

Similar to ASX, last year’s analysis determined that youngsters are more likely to have bought digital assets. In comparison, only 10% of those above 65 years old have done so.

Crypto awareness was at a high level, with almost 90% knowing about Bitcoin’s existence. Nearly 43% had some knowledge about Ethereum (ETH), while Tether (USDT), Dogecoin (DOGE), Ripple (XRP), Solana (SOL), and Cardano (ADA) were also popular.

The post The Share of Aussie HODLers is Back to 2021 Levels (Study) appeared first on CryptoPotato.