The Secret for a $1 Trillion Crypto Market? Keep Building

Jim Radecki is the Global Head of Business Development at Cumberland, a subsidiary of DRW Company.

The following is an exclusive contribution to CoinDesk’s 2018 Year in Review.

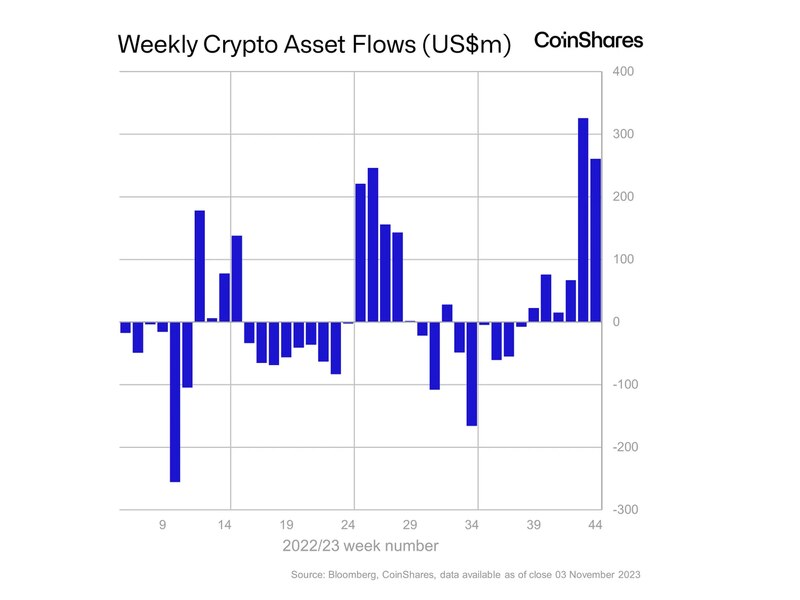

Earlier this year, the total value of all crypto assets reached an all-time high of over $800 billion, driven by a flood of retail customers looking to capture opportunities in a new market.

Although the ecosystem aimed to attract this influx of interest, in reality, it lacked the necessary infrastructure to sustain this magnitude of participation. The industry hit a critical point, where systems were stress-tested and it became clear that the existing model was not refined nor built to scale at such a rapid rate of adoption.

The industry wasn’t prepared, and while volumes have sharply declined, the work to develop the ecosystem over the last year has increased dramatically.

Within traditional capital markets, there are different systems in place that work together to enable these markets to operate efficiently. The required crypto asset infrastructure diverges from the more traditional model, which has created several pain points within the space.

These hurdles have made it challenging for investors – particularly on the institutional side – to enter these markets. While the industry is addressing these nuances, there are several key obstacles to overcome before it is prepared for the next wave of market participation.

Barriers to Entry

Crypto asset market structure is extremely fragmented; there are more than 200 unique exchanges and platforms, each offering their own set of products. Exchanges also operate out of different jurisdictions, which yield different rules, requirements and operational standards and guidelines.

In addition, there are still questions to be answered around qualified custodians. The solutions that exist are varied and nascent, each offering different services for different coins. There is simply no one-stop solution in place today.

The industry also lacks generally accepted standards or best practices around security controls, operations and research and valuation. You have to think about managing your operational risk in a completely different way than in traditional markets – this is the only market in the world where the operational risk is greater than the financial risk. And while research and methodologies continue to improve, people want access to more standardized metrics, analysis and price discovery to understand how to value these assets.

And perhaps most important, concerns around regulatory clarity remain as one of the greatest barriers to entry.

While regulators have taken important steps to understand these markets and have provided guidance in some cases — bitcoin classified as a commodity, not a security — we still need clearly defined rules of the road.

Anyone sitting on the sidelines today is likely waiting on clarity from regulators before even considering operating in these markets.

What’s next?

While these drawbacks may sound daunting, the pressure on these systems has prompted the industry to arise and to begin developing solutions at a much faster rate than if we hadn’t experienced the rush of market activity late last year. There has been a lot of work underway in 2018 to encourage regulatory clarity, streamline operations and continue building out the space.

There was a major shift this year as talent left big banks and financial institutions to apply their expertise to the development of the crypto ecosystem. There was also an uptick in the hiring of operational jobs as these obstacles came to light and businesses realized they needed the right talent to handle the buildout of new infrastructure.

On the regulatory front, we saw the introduction of new industry associations and SROs focused on protecting market participants, providing clear rules and standards and encouraging professionalism in the space, including the Blockchain Association, the Association for Digital Assets Management (ADAM) and the Virtual Commodity Association. The collaboration between these parties, organizations like the Chamber of Digital Commerce and government officials should pave the way for key developments in the year ahead.

So much of the attention today is focused on price, but there is strength in the work done this year to create real, tangible advancements. If you look at where the industry was two years ago today, before the dramatic run up on price, before the underdeveloped infrastructure issues were identified and before so many eyes were watching the space – we have come a long way, very quickly.

While there is still a lot of work ahead, there remains a strong base for optimism.

We expect that 2019 will look a lot like 2018, with more people diligently working behind the scenes, refining their strategies and preparing for the next wave of growth. At Cumberland, we are committed to helping the ecosystem grow and evolve in a responsible and sustainable way.

This year moved the industry closer to that future – and we were proud to be part of it.

Have an opinionated take on 2018? CoinDesk is seeking submissions for our 2018 in Review. Email news [at] coindesk.com to learn how to get involved.

Building blocks via Shutterstock