The Salvation of Domain Ownership May Lie in Tokenization, and One Firm is Pressing Hard to Make This a Reality

Domains, the gateway to the internet, have been a fairly lucrative source of money making for almost half a century. However, these digital assets have a big problem: their lack of liquidity, which is why one company is trying to tackle this problem with the help of tokenization.

First, let’s rewind a bit and look at the history of arguably the oldest digital asset. Domain names are the atlas of the internet and a large part of what made the World Wide Web so accessible. Imagine the hassle of trying to surf the net if you had to type in IP addresses instead of website names.

This inherent utility of domains led to a wave of hoarding as people tried to cash in on this digital gold rush. But unlike other gold rushes, this one didn’t completely die down, because as the internet grew in size, value, and utility, so did the value of domains.

Now, with the advent of a new digital age, marked by the arrival of the third iteration of the internet, Web3, one of the predominant issues with domains may soon be resolved.

“Domains are a unique asset because they have a low carry cost,” Shayan Rostam, the chief commercial officer at D3, told CoinDesk during the recent Korea Blockchain Week. D3 is a firm founded by domain industry veterans that wants to modernize the domain market for web3.

Rostam, who has spent most of his career in the domain industry, explains that it may cost only $20 or so to hold a domain year-over-year, but the problem with holding these web addresses is that they remain illiquid until someone makes an offer.

In the coming years, there will be a massive transfer of property and assets from one generation to the next. With millennials and Gen Z set to inherit trillions of dollars worth of assets, there are bound to be a few domain names in that asset mix.

Unlike other assets, there’s no tool to get liquidity from domains, even though they have a low carry cost, unlike real estate, and may be worth millions. This is something D3 is looking to solve via tokenization.

Cheapcarinsurance.com

Before the era of search engines and the advent of search engine optimization, where people tried and optimize their websites to be better poised on search engine queries, people would simply add a .com to whatever they were looking for.

This spawned a gold rush for so-called premium domains, which are simple words that have a .com and the end of them. Think: wine.com, or cheapcarinsurance.com.

This led to speculators grabbing these words and combinations, before bigger businesses could and then putting ads on that page. These came to be known as ‘parking pages’.

“People registered longtail domains like cheapcarinsurance.com, paying around $20 a year. As long as they made more than $20 in revenue, they kept renewing the domain,” Rostam said.

Fred Hsu, D3’s CEO, who owns a patent on a form of optimization for these parking pages, explained that the leasing process for domains was slow and cumbersome, which is why many preferred putting up the parking pages for monetization. Auctions are also an option, but the process isn’t too different from auctioning off a horse or a painting, as this process hasn’t changed since the last century.

“Domain auctions are like traditional auctions, with paddles and excitement. But it’s still an analog process for digital assets,” Hsu, who’s been in the domain industry since the 1990s, said. “You could lease domain names, but it’s not a smooth process. There are issues with ownership and control.”

Through tokenization, owners of these domains would be able to sell off interest in the property, similar to tokenization of other real-world assets like real estate or rare liquor, building liquidity from something that otherwise just sits there.

For what it’s worth, cheapcarinsurance.com’s cousin, carinsurance.com, sold for $49.7 million in 2010. At the same time, a study found that there are 137 million .com domains registered, with a third in use, a third unused, and the remaining third for speculative purposes.

For example, beer.com is a parking page, while wine.com is an active e-commerce platform.

Working with the ‘UN’ of the Internet

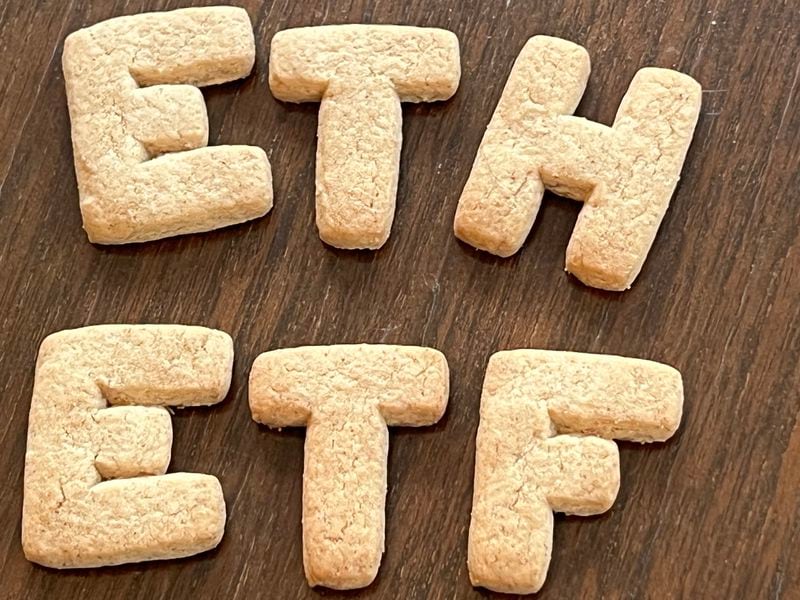

Certainly, D3 isn’t the first company to meld web3 and domain names. If you hop on to X (formerly known as Twitter), you will witness a plethora of crypto supporters with .eth domain attached to their profile. But the problem is, these aren’t real domain names. Type it into your browser and see what happens.

What makes a domain name real is when it’s registered with ICANN, or the Internet Corporation for Assigned Names and Numbers, the organization responsible for coordinating the global domain name system.

They are the “United Nations of the web,” Rostam explains.

You need to work with them to make the domain names real, and this is why D3 is also focussing on ICANN registration. The firm plans to register new crypto-themed top-level domains during ICANN’s next registration window, which may open next year.

And if D3’s plan for tokenization and registration works out, then you may soon see an actual .eth domain, which could make a lot of money for many, many years.

Edited by Parikshit Mishra.