The Roadmap For Banks Adopting Bitcoin

U.S. banking regulators are exploring how traditional banks can hold bitcoin for various purposes.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

In a major announcement yesterday, news broke that U.S. banking regulators are exploring a roadmap for traditional banks to hold bitcoin so that the asset can be used for client trading, as collateral for lending or just to exist on banks’ balance sheets. Even under the guise of increasing regulation, this is clear evidence that traditional banks and their clients are demanding more use of bitcoin which will further accelerate the growing financialization of bitcoin.

“I think that we need to allow banks in this space, while appropriately managing and mitigating risk,” FDIC chair Jelena McWilliams said. “If we don’t bring this activity inside the banks, it is going to develop outside of the banks…The federal regulators won’t be able to regulate it.”

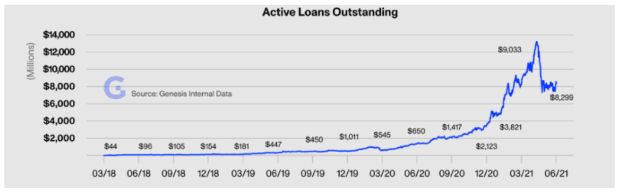

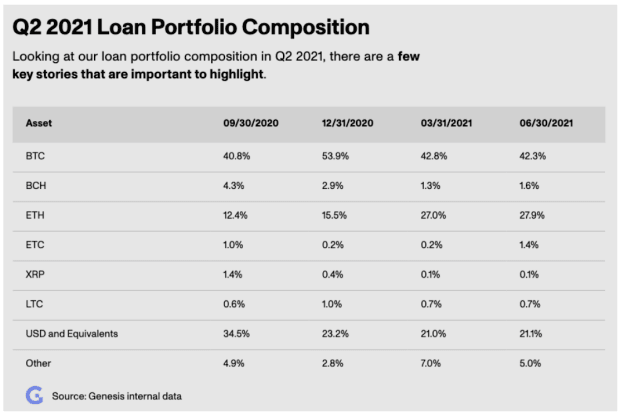

Outside of the traditional banking system, we’ve been seeing the increased level of demand for bitcoin-denominated loans and bitcoin as collateral for both trading and lending. One of the best places to see this action is in the rise of Genesis’s digital asset lending loan portfolio. As of their results in Q2, they have $8.3 billion in active loans outstanding with 42.3% of those loans denominated in bitcoin worth $3.5 billion.

Since the launch of their lending business in March 2018, cumulative loan originations have reached $66 billion indicating significant growth and demand for bitcoin loans.

BlockFi is another company where we can track market demand and with BlockFi sharing internal numbers with Arcane Research in this special report, we can see the 50-times and seven-timex growth in their retail loan bitcoin collateral demand over the last two years denominated in USD and BTC respectively.