The Ripple Effects Of Change The Code’s Campaign Against Bitcoin

One does not simply change Bitcoin’s code, as the Change The Code campaign ridiculously requests.

Greenpeace USA and the Environmental Working Group (EWG), with $5 million in backing from Ripple Labs co-founder Chris Larsen, recently launched the Change The Code Campaign. This lobbying effort — steeped in misinformation and outright falsehoods — sensationalizes the climate impact of Bitcoin and promotes irrational moral panic. The campaign is underpinned by a widely debunked study and publicly pressures roughly 30 so-called influential people in the Bitcoin community to change its consensus mechanism from meritocratic proof-of-work to oligopolistic and plutocratic proof-of-stake.

The campaign reads like a real-life version of the “I just discovered Bitcoin and I’m here to fix it” meme, which pokes fun at newbies who don’t understand that Bitcoin is already hyper-optimized for immutability, censorship-resistance and is extremely difficult, if not impossible, to change.

Bitcoin Is Immutable

Bitcoin’s unique architecture of user-run full nodes ensures that so-called thought leaders in the Bitcoin community could not change the foundational properties of the protocol, even if they wanted to. Its immutable, backwards-compatible architecture is what attracts people to Bitcoin in the first place and is what makes Bitcoin the apex digital asset. For the campaign to suggest that these powerful individuals could force a change in the protocol is absurd and suggests that Larsen and his campaign’s collaborators do not grasp Bitcoin’s architecture, purpose and resilience. If not that, one might assume that there are perhaps nefarious motives behind the campaign. In a recent interview Larsen said:

“A big part of getting carbon neutral is, ‘Don’t use energy where you don’t need it.’ You don’t need energy to confirm the state of blockchains. So, make the damn code change! And I tell you, I just don’t think it’s going to happen voluntarily. Look, this is not some secret AI that runs Bitcoin. It’s about 20 to 30 very influential, very wealthy, people that are going to make that decision. Between the core developers, the exchanges and miners. By the way, there’s a fascinating book I’ve been reading called “The Blocksize War.” And it’s fascinating, because it kind of goes back to one of the big changes that was proposed to increase the block size and how that played out. And that was a very small group of people that prevented that. So, again, this is a small group of people—that are incredibly wealthy—that could make this change. But, they’re not going to do it voluntarily, because they’ve been making this pitch for ten years.” —Chris Larsen

Beyond the fact that Larsen’s plan involves forcefully coercing Bitcoin’s users into complying with his wishes, Larsen’s description of Bitcoin is factually incorrect; it is either deceptive or shows a fundamental lack of understanding for how Bitcoin works. A small group of people did not stop the block size from increasing and 20 to 30 wealthy individuals do not control Bitcoin, by any stretch of the imagination. The Blocksize War proved that miners and powerful individuals, with more than 80% of the global hashrate, were not able to control Bitcoin. The Blocksize War was won by many thousands of individual users, each running inexpensive and lightweight full nodes, who blackballed the small group of wealthy individuals that wanted to change the code.

It’s not clear if Larsen is incredibly confused or intentionally deceiving the general public. But let’s give him the benefit of the doubt for a moment, for a brief thought experiment.

Imagine for a moment that Larsen was somehow successful in convincing three dozen or so wealthy and influential individuals to change the code. By stating that this won’t come voluntarily, presumably he believes he can force a change on the network. How would that work? Suppose he is able to convince enough developers to create a new and improved version of Bitcoin Core. Even if the developers were to agree to implement the change, and even if the most influential miners and exchanges agreed to use that new upgraded version, Bitcoin would not change.

Why? If Larsen had read “The Blocksize War” more carefully, he would have understood that the Bitcoin network simply does not propagate unless the many thousands of full-node users agree to run the new software. Without full-node operators agreeing to run the software, the miners and exchanges would have no functional mempool or blockchain to interact with. In fact, one of the features of Bitcoin is your ability to choose which backwards-compatible version of the protocol you want to use. You, as an individual, make that choice—and you have no incentive to give up that individual power.

Even if miners and exchanges ran their own full nodes, users with full nodes would continue to interact with the Bitcoin network through the original backwards-compatible soft forks that guarantees each user’s freedom to reject an upgrade. This is why forks of Bitcoin, like Bitcoin Cash, are not Bitcoin — the overwhelming majority of user full nodes want nothing to do with them. Just like the Blocksize War, the miners and exchanges would be forced to follow the will of the node operators if they wanted to participate and profit off of the Bitcoin network and its users.

Bitcoin is a decentralized network where the users control the infrastructure and centralized companies that want to do business with the network have no choice but to support the backwards-compatible features that users collectively choose to run on that infrastructure. As the Blocksize Wars already proved, users will not install software that diminishes their rights or sovereignty. Bitcoin would not have its unique immutable properties if the code could be changed. Its decentralized infrastructure, controlled by users, is necessary for censorship-resistance and inflation-resistance. If Bitcoin users really want to cede their control over to wealthy individuals, running centralized servers with smaller energy footprints, they are free to sell their bitcoin and buy Ripple.

“The nature of bitcoin is such that once version 0.1 was released, the core design was set in stone for the rest of its lifetime.” —Satoshi Nakamoto

Bitcoin is simply not controlled by influential people. It’s controlled by the individual users who independently choose what version of Bitcoin core they want to run. Nobody is going to run a version that was radically “changed” by a small group of wealthy and influential people.

For Larsen to have spent $5 million dollars on a campaign to change Bitcoin’s code, without grasping the fact that Bitcoin and proof-of-work ensures that very wealthy individuals and influential developers cannot change it, is staggering. Larsen suggests that many other blockchains, such as Ethereum, are making the switch, but he fails to understand that the only way those blockchains are able to radically change their code is through coercive tactics, such as difficulty bombs, that force users to upgrade and demolish their unalienable rights.

Why We Prove The Work

Contrary to what the media and misleading campaigns will say, proof-of-work is exceedingly efficient. Doing the initial work is expensive and miners are fairly compensated for that work by the market. However, verifying a proof of that work is extremely inexpensive, and can be done with a cheap Raspberry Pi that draws only 5 volts. One could even verify a miner’s work with pencil and paper. This stark asymmetry in power is what allows users, and their full nodes, to be absolutely certain that the energy-intensive miners are following the rules.

Furthermore, proof-of-work ensures miners can collectively challenge bad miners — ensuring no one party can assert total control — while providing a meritocratic distribution of new coins. Proof-of-stake has no such ability, since it acts like a corporate security, where its founders pre-mine their unimpeachable control authority over users and the wealthiest holders maintain controlling voting power, while receiving compounding dividends that makes it impossible for smaller holders to overthrow them. Proof-of-stake is both oligopolistic and plutocratic. If Bitcoin were to migrate to proof-of-stake, then it would also be easily controlled by a small group of wealthy individuals.

Proof-of-stake users are, by definition, trusting founders not to commit denial-of-service (DoS) attacks against them. Conversely, in proof-of-work, miners buy energy on an open market to make DoS attacks too expensive. This is a key aspect of Bitcoin’s ability to protect minority user rights. Proof-of-work’s energy consumption and verification asymmetry is a feature, not a bug.

For Larsen to suggest that proof-of-stake is a more efficient consensus mechanism is quite literally an example of a billionaire promoting plutocratic authoritarianism as a more efficient kind of government. To equate proof-of-stake with proof-of-work entirely misses the point of how decentralization works and what it achieves. Without decentralization, there is no point in having a blockchain. Proof-of-stake is not and cannot be a substitute for proof-of-work — to claim otherwise is unethical and highly misleading.

Nefarious Motives?

While it would be easy to dismiss the campaign as another futile and uninformed take, the Change The Code campaign gives the appearance of being neither altruistic nor environmentalist. The campaign is effectively using disinformation to gaslight the public’s perception of Bitcoin into believing a small group of wealthy individuals can change its code, but are choosing not to. The media is helping it spread this falsehood, while the campaign itself returns the favor by purchasing ads in leading publications over the next month. This, in turn, is intended to elevate Ripple from a public relations perspective. If the campaign singles out people by name it will unfairly, and perhaps dangerously, target and effectively slander individuals who cannot do anything to change Bitcoin’s consensus mechanism even if they wanted to. This is nothing short of irresponsible.

As previously explained in “The Questionable Ethics of Bitcoin ESG Junk Science,” a common attack vector against Bitcoin has emerged where ethically conflicted parties, with ulterior motives, publish junk science in academic journals to entice the media into exaggerating Bitcoin’s environmental footprint — with presenter bias and incomplete comparisons — in order to provoke outrage and rake in profits. Once the tactic of moral panic is exposed for what it is, it becomes crystal clear that these kinds of campaigns are sinister efforts driven by powerful entities who are threatened by Bitcoin’s success.

Ripple’s Lawsuit With The SEC

It should be noted that the Securities and Exchange Commission (SEC) charged Ripple; Executive Chairman, co-founder and former CEO Christian Larsen; and Bradley Garlinghouse, the company’s current CEO, for allegedly raising over $1.3 billion through an unregistered and ongoing digital assets securities offering. Ripple’s technology is highly centralized and does not offer the decentralized features of Bitcoin. Bitcoin’s Lightning Network makes Ripple obsolete as a payments technology.

In an attempt to distance himself from his glaring conflict of interest, Larsen claims that his Change The Code campaign is independent of his connection to Ripple. This is dubious considering that Ripple was developed to replace Bitcoin, has funded environmental opposition research against Bitcoin miners and has taken steps to discourage mining with renewable energy.

Perhaps Larsen is unaware, but declaring one’s personal campaign to be magically independent of their own business and SEC lawsuit is not how ethics works. Even the appearance of a conflict of interest leaves people with the impression that ulterior motives are afoot. It’s not too dissimilar from a certain central bank employee who publishes anti-Bitcoin propaganda as a “hobby,” for the benefit of his employer.

Larsen’s personal legal conundrum is that the SEC views Ripple as a security — an investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others.

Conversely, the Commodities Futures Trading Commission (CFTC) has already publicly stated that Bitcoin is a commodity. Bitcoin’s ability to be treated as a commodity comes, in part, from the fact that proof-of-work ensures that wealthy plutocrats cannot control it.

Both Ripple and Larsen have a motive to confuse regulators into thinking that Bitcoin and Ripple are similarly structured, by fallaciously claiming Bitcoin could also be controlled by 30 wealthy influencers and developers — even if this is clearly not the case. It is for this reason that the Change The Code campaign looks not only to be a futile effort and a foolish misunderstanding of Bitcoin’s governance, but rather a full attack on Bitcoin to benefit Ripple.

Change The Code’s Widely Debunked Study

Change The Code’s website falsely claims that Bitcoin could single-handedly drive up global temperatures by 2ºC. This fallacious and sensationalist claim comes from a thrice-debunked study (Mora, et al., 2018) published in the journal Nature Climate Change.

The Mora et al. paper is complete nonsense and makes egregious errors with preposterous assumptions. In the same journal, three teams refuted the dubious methodology. One group wrote, “we argue that the Mora et al. scenarios are fundamentally flawed and should not be taken seriously by researchers, policymakers, or the public.” (Masanet, et al., 2019). For a comprehensive rebuttal of Mora et al., read Nic Carter’s thorough debunking of the paper.

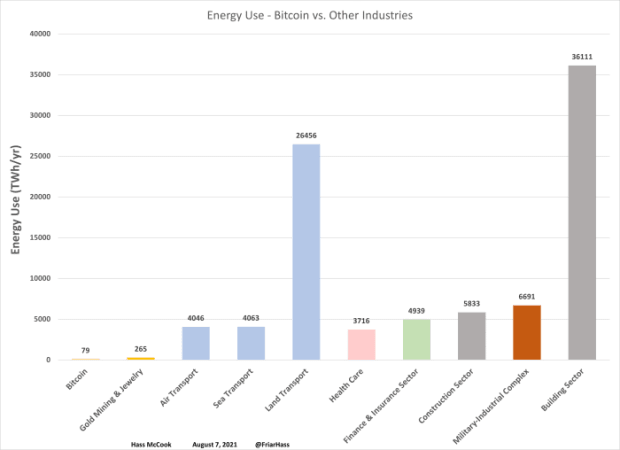

The reality is that Bitcoin has a tiny environmental footprint. In fact, it’s so tiny that it pales in comparison with other industries.

For perspective, the $500B global sports industry has been estimated to produce three times the emissions of Bitcoin, for far less value.

The deceptive tactics used by the Change The Code campaign implies that environmentalism is not its true goal. Millions of dollars from a conflicted billionaire and a slew of articles in the mainstream media — scrutinizing a tiny fraction of a percent of global emissions — suggest that moral panic is being promoted for ulterior motives. One would have to have seriously misaligned priorities to think that this campaign was a good use of time and money, when changing Bitcoin’s code will have no meaningful impact on the climate. Climate researchers who are doing serious work should be disheartened by such pointless and disingenuous endeavors.

A Better Solution

There are better ways to responsibly green Bitcoin, without resorting to coercive changes that would put Bitcoin’s immutability and censorship-resistance at risk. Troy Cross and Andrew M. Bailey have authored a paper on “incentive offsets,” a way for investors to make bitcoin holdings carbon neutral by voluntarily investing just 0.5% of their holdings in green bitcoin mining operations. Their approach preserves the fungibility of bitcoin and costs nothing, while providing a return and promoting human progress. The concept was discussed, in-depth, on an episode of “What Bitcoin Did” and during a follow-up conversation with Nic Carter.

Environmentalist Sellouts

Ironically, Greenpeace should know a thing or two by now about the value of immutable savings and the need for uncensorable money that can’t be controlled by powerful individuals. Internal documents have shown evidence of Greenpeace’s own financial mismanagement and disarray. In 2015, the government of India froze the environmental group’s funds, something Bitcoin would have prevented thanks to proof-of-work.

By selling out to Larsen’s campaign, which would benefit Ripple’s case with the SEC, Greenpeace has irreparably damaged its reputation. In this heartfelt thread by Daniel Batten, a supporter of Greenpeace for over four decades, expresses his disgust over Greenpeace’s actions:

The EWG is also no stranger to scare-mongering tactics and junk science. It has a long history of exaggerating concerns and cherry-picking data for its own self-interest.

Change The Code is advised by Michael Brune, the former Executive Director of the Sierra Club who resigned last year amid allegations that the organization’s culture tolerated race, gender and sexual abuses. It is unclear if the campaign’s participants actually understand how Bitcoin’s governance works and seek to intentionally misleading the public, or if they are genuinely confused and unwitting useful idiots.

The most disappointing aspect of the Change The Code campaign is not that it’s a pointless and futile attempt to attack Bitcoin while confusing the general public and the US legal system. Rather, it’s that the campaign makes it painfully obvious that organizations like Greenpeace and EWG are willing to funnel millions of dollars into moral panic and fake environmental causes that slander individuals, when that money, time and effort could be better spent on solving actual problems that could make a real difference in society. It’s campaigns like this one that leads people to lose trust in major organizations and institutions. And that, in turn, causes people to lose faith in environmental causes.

Bitcoin will not and cannot be changed by powerful individuals. Not by Ripple, not by Greenpeace, not by EWG and certainly not by the dozens of influential people Larsen attempts to target with his misinformation campaign. Bitcoin incentivizes human flourishing and abundance, and its users have no interest in changing the code.

It’s time to plug in your full node and secure your unalienable rights — we have real work to do.

This is a guest post by Level39. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.