The Reality Behind the Crypto Banking Crackdown: ‘Operation Choke Point 2.0’ Is Here

The report follows a wave of bank shutdowns that some have alleged were triggered not just by financial stability concerns, but by the broader push to strangle cryptocurrency businesses – despite the lack of any authorizing legislation. Former U.S. Rep. Barney Frank has explicitly claimed the shutdown of Signature Bank was intended “to send a message to get people away from [banking] crypto.” Frank is a member of Signature’s board, so he is motivated to claim crypto, rather than mismanagement, was to blame for the bank’s failure.

Related Posts

First Mover: $1 Trillion of Cryptocurrencies Shows Booming ‘Asset Class’

Jan 7, 2021 at 2:28 p.m. UTCUpdated Jan 7, 2021 at 2:44 p.m. UTCBitcoin prices have shot to a fresh all-time high above $38,000. First Mover: $1 Trillion of Cryptocurrencies Shows Booming ‘Asset Class’Bitcoin (BTC) rose for a third straight day, pushing early Thursday to a new all-time high price above $38,000 and setting bullish…

France Says It Will Block Facebook Libra in Europe: Report

news The French finance minister has said the nation plans to block Facebook’s Libra cryptocurrency in the EU over concerns that it poses a threat to “monetary sovereignty.” According to The Independent newspaper on Thursday, Bruno Le Maire, Economy and Finance Minister of France, said: “I want to be absolutely clear: In these conditions, we cannot authorise the…

Asia Fund Picks Up Majority Stake in The Block, Buys Out Shares Tied to Sam Bankman-Fried Loan

Crypto news and data provider The Block today said Singapore-based fund Foresight Ventures had completed an acquisition of the majority of its shares, CEO Larry Cermak said in an X post.The raise was completed at a $70 million valuation and the company plans to “build out new exciting products” and expand into Asia and the

Square to Support Greener Bitcoin Mining as Part of Zero-Carbon Pledge

Dec 8, 2020 at 2:48 p.m. UTCUpdated Dec 8, 2020 at 3:13 p.m. UTCSquare to Support Greener Bitcoin Mining as Part of Zero-Carbon PledgeSquare intends to support the use of renewable energy in bitcoin mining with a new Bitcoin Clean Energy Investment Initiative, and it’s dedicating $10 million to the effort. Announced Tuesday, the company…

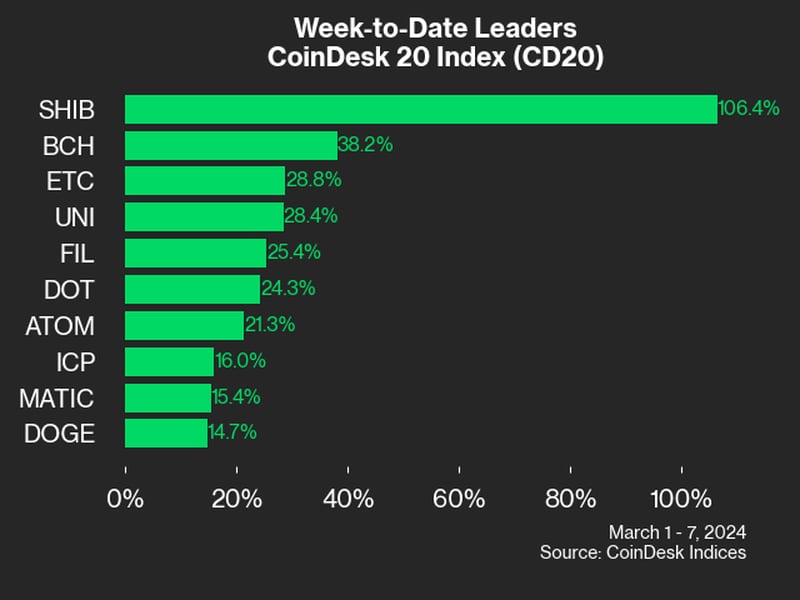

SHIB’s 106% Move Higher Led CoinDesk 20 Gainers Last Week: CoinDesk Indices Market Update

CoinDesk Indices (CDI) presents its bi-weekly market update, highlighting the performance of leaders and laggards in the benchmark CoinDesk 20 Index (CD20) and the broad CoinDesk Market Index (CMI).Meme coin shiba inu (SHIB) continues to see outsized gains among the CoinDesk 20, more than doubling in value so far this week and now up nearly

Bitcoin Miner Riot Platforms Ditches Bitfarms Takeover Bid, Seeks to Overhaul Board

Bitcoin miner Riot Platforms (RIOT) dropped its proposal to buy peer Bitfarms (BITF) and is looking to overhaul the board before engaging in further takeover attempts."Over the course of more than a year of attempting to engage constructively with the Bitfarms Board regarding a potential combination of Bitfarms and Riot, it has become evident to

What Facebook CEO Zuckerberg Said in His Defense of ‘Free Expression’

news Facebook CEO Mark Zuckerberg defended free expression in a speech at Georgetown University on Thursday. “[The internet] allows people to share things that wouldn’t have been possible to share before,” he said. However, “we’re seeing people across the spectrum try to define more speech as dangerous because it may lead to political outcomes that…

Axiom, Protocol for Historical Ethereum Data, Raises $20M, Led by Paradigm, Standard Crypto

Axiom, a protocol that allows smart contract developers to access historical data from Ethereum and then perform intensive computations off-chain, has raised $20 million in a Series A funding round led by Standard Crypto and Paradigm Ventures.The funding will go towards growing the team as well as developing their platform, according to a draft blog