The Real Scaling Solution For Bitcoin

Forget Lightning, there is an entirely different approach to Bitcoin scaling that fiat money has obscured.

This is an opinion editorial by Knut Svanholm, author of “Bitcoin: Sovereignty Through Mathematics.”

Bitcoin skeptics often claim that bitcoin doesn’t scale. They say that bitcoin’s on-chain transaction capacity of about seven transactions per second is too low, especially compared to the most common credit and debit card networks. These networks are centralized databases capable of more than a hundred thousand transactions per second. The standard Bitcoiner reply is that these critics haven’t heard about Layer 2 solutions to the scaling problem, such as the Lightning Network. While it’s true that Layer 2 will probably solve the problem eventually, it is not a rapid enough solution in the event of a quick hyperbitcoinization. After all, if all base layer transactions are new Lightning nodes, only seven new nodes can be fired up per second, right? In truth, the critics and most Bitcoiners do not see the bigger picture here. Both groups are missing the forest for all the trees. Let us think this through.

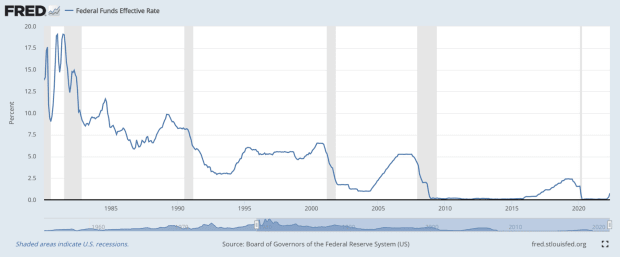

We live in a world where fiat money dominates the world economy. Every country on Earth has a national currency or uses one minted (printed) in another country, such as the euro or the U.S. dollar. These currencies have in common that they’re all inflationary, meaning that there are central authorities that have the right to issue new units of them. As those who have studied bitcoin or economics know, prices denominated in these currencies continually rise over time. Bitcoin is often compared to gold, as the cost of mining gold is relatively unaffected by changes in the price of gold. But this analogy is wrong. Bitcoin is not gold. The cost of mining bitcoin does correlate with the price of bitcoin, but the issuance rate of new bitcoin does not. This fixed issuance rate is an entirely new phenomenon and only exists in bitcoin. No other commodity behaves this way. Prices rise over time on a fiat money standard, but transactions are fast. Prices were relatively stable during the gold standard, but gold was very costly to transport. Bitcoin is cheap to transport and absolutely finite, meaning that prices denominated in bitcoin will continue to decrease over time.

As technology advances faster and faster, prices ought to decline. The only reason they don’t is money printing or “monetary policy,” as those with access to the printers call it. Nothing about bitcoin allows for this to happen. The long-term implications of absolute scarcity in money are very hard to understand for people who have only ever known fiat economies. We simply can’t wrap our heads around ever-declining prices. No one can imagine what such a society will look like. But one thing is sure — transactions per second is a metric important to the old system, not the new.

The “Zeitgeist” movies from about a decade ago were attempts at describing what a future without money might look like. They explained how flawed our old institutions are, from religious institutions to political and juridical institutions and, perhaps most importantly, the fractional reserve banking system. Then they somewhat naively proposed that if the world stopped using money, we’d usher in a new era of peace and prosperity. These movies lacked an explanation of how to get there, however. They missed that there is no difference between voluntary interactions and monetary transactions, given that the money is honest. A sound money, free market society is a voluntary society. The path to the utopian “Venus Project” cities described in these movies is bitcoin.

The brilliant Canadian serial entrepreneur Jeff Booth has often described bitcoin as a “bridge to the other side.” Almost all Bitcoiners agree that our current system is flawed, and we need a way out. Bitcoin is that way out. But what’s on the other side of the bridge? That is the more profound question here. When you think long and hard about it, you realize that the world on the other side of the bridge is the real scaling solution. With truthfulness in the base layer of society, the need for monetary transactions will go down, not up.

Every good is a service. Every human interaction is a transaction. We don’t crave money; we want what we think it will buy us. We don’t want the sofa; we want the ability to sit on a couch whenever we feel like doing so. To put it another way, we want access to the abundance technological progress enables. Inflationary money is a force in the opposite direction. It necessitates higher prices and thus less access to the riches that technology unlocks. It creates an elite class that gets richer over time at the expense of everyone else. Deflationary money will do the opposite. It will give everyone a reason to save rather than overconsume, giving more people access to whatever they want over time because of the falling prices. If you postpone your spending, your bitcoin will buy you more in the future. In other words, fewer transactions. Quality before quantity. The necessity for transactions per second will diminish.

Now think about how you interact with your family and friends. You rarely use money, right? Remember, every voluntary interaction is a transaction. You exchange information and share experiences with your loved ones all the time, all without ever exchanging a single satoshi. The Bitcoin community is like this too. Everyone is very generous with their time and effort. You notice this when you spend time with so-called toxic Bitcoin maximalists. We don’t care about making money. We care about making the world a better place. I’ve received boundless help from other Bitcoiners in the forms of proofreading, translations, art, website building and many different things, all for free. All I had to do was provide something of value back. Like in my family and with my friends, there was mutual trust; thus, no money was needed.

After all, the only reason societies need cash in the first place is to enable transactions between people that don’t know or trust each other. Sadly, everyone seems to have forgotten this in fiat land. All Bitcoiners benefit from the success and ever-increasing purchasing power of bitcoin. Therefore, every Bitcoiner is incentivized to help one another. When hyperbitcoinization is upon us, everyone will be a Bitcoiner. Everyone will have this incentive. Ironically, “Don’t trust, verify,” somehow unlocked an ability to trust each other on a scale never before known to man. The kicker is that we had this ability all along. Bitcoin is a private key to our hearts, so we can wear them on our sleeves in public. The real scaling solution is honesty. When we have that, the division of labor happens automatically.

By running the mathematical experiment called Bitcoin in the back of our heads at all times, we unlock the true power of human cooperation. The need for smaller transactions disappears as everyone’s time preference is lowered and our ability to love our neighbor increases. You won’t pay for your coffee in the future. You’ll get it for free. Only significant, essential investments that provide enough value to humanity will be worth making since simply holding on to your bitcoin will be a better strategy in most cases. The ability to make micropayments fast and cheap to anyone worldwide will still be there because of Layer 2 scaling solutions, but people won’t need to use it very often. Bitcoin culture is the opposite of fiat culture. We have a bright orange future; the faster we embrace it, the better off we’ll be.

This is a guest post by Knut Svanholm. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.