The Protocol: Which Ethereum Layer-2 Project ISN’T Competing to Land Celo?

It’s hard to cover blockchain tech without considering the impact of crypto winter. In this week’s issue of The Protocol, we highlight layoffs hitting key firms as well, and how blockchain projects are competing for new mandates – specifically big Ethereum layer-2 developers like OP Labs, Polygon and Matter Labs vying to provide the technology for the Celo blockchain’s new network; there’s only so many customers to go around.

This week’s feature by Camomile Shumba looks at how the crypto firms Chainlink Labs and Ripple are finding comfort in the idea that the future of finance end up as a hybrid of crypto and traditional finance, rather than total disruption or winner-takes-all.

You’re reading The Protocol, CoinDesk’s weekly newsletter that explores the tech behind crypto, one block at a time. Subscribe here to get it every week.

Network news

BLOCKCHAIN BAKE-OFF! In July, when the smart-contracts blockchain Celo proposed to ditch its independent “layer-1” status in favor of becoming a layer 2 network atop Ethereum, the people behind the project may have had little inkling of just how popular they would become. Now there’s suddenly a burst of competition among veteran layer-2 teams to supply the technology for Celo’s new system. The migration initially was supposed to rely on Optimism’s OP Stack software kit, which served as the template not only for Coinbase’s new Base blockchain but also the Binance-incubated BNB Chain’s new opBNB network. Then last month, Polygon injected itself into the mix, offering up its Polygon Chain Development Kit, known as Polygon CDK, as an alternative. As of last week, there’s yet another suitor to host Celo: Matter Labs, the creators of another rollup, zkSync, as well as the ZK Stack open-source software, which can be used to create new “hyperchains” on Ethereum. “The modular and open-sourced ZK Stack is the optimal L2 stack for Celo’s transition to Ethereum,” according to the Matter Labs proposal. “We hope to trigger an honest, open discussion amongst the Celo and zkSync communities regarding the tradeoffs between the ZK Stack, the OP Stack, Polygon CDK and other options.” Coming in the depths of crypto winter, the episode offers a reminder of the intensity of the consolidation trend, with the various networks scrambling to find fresh business.

PROOF-OF-PROOF: The crypto developer OP Labs rolled out software a year ago making it easy for companies to spin up their own distributed networks atop the Ethereum blockchain. But the option quickly became so popular that it attracted the likes of the big U.S. crypto exchange Coinbase, which used the platform to build its new blockchain, Base. As these things go, success leads to greater scrutiny, and in recent months, technical experts homed in on a crucial deficiency of the setup: Networks based on the OP Labs software were missing an element known as “fault proofs” that theoretically sit at the very core of their inherent “optimistic rollup” design; the lack of the security feature was likened to driving a fast car without airbags. OP Labs officials got the message, and recently had insisted that getting fault proofs into operation was a top priority – so much so that the project even had its own name, “Cannon.” On Tuesday, OP Labs finally delivered – or at least took its first step toward addressing the concerns, launching fault proofs on a test network known as OP Goerli Testnet. Such progress might keep critics at bay, at least for a while.

COLD CRYPTO: Transaction volumes across the crypto industry have slowed dramatically, and the signs of retrenchment are ubiquitous. Chia Network, founded by BitTorrent inventor Bram Cohen, laid off 26 employees, a third of its staff, and might now consider selling off some of 2.6 million unencumbered XCH tokens ($70 million worth) to raise funds. Chainalysis, the blockchain analytics firm, cut 15% of staff, out of an employee base said to be around 900. On Wednesday, the DeFi lending project Yield Protocol announced plans to wind down by the end of the year, “because there is currently not sustainable demand for fixed-rate borrowing.”

BAD BLOOD IN BSV: Christen Ager-Hanssen, the former CEO of nChain, which is focused on the Bitcoin SV (BSV) blockchain, posted on X that he had departed, adding that he was “convinced that Dr. Craig Wright is NOT Satoshi” and is “persuaded he will lose all his legal battles.” Calvin Ayre, a patron of the BSV ecosystem, wrote on X that “Christen is a grifter… He had no real plans for nChain other than stealing the silverware.” Wright posted: “Sorry to disappoint my anti-fans. I haven’t gone anywhere.”

TO ENSHRINE OR NOT TO ENSHRINE? Ethereum co-founder Vitalik Buterin was once an advocate for the proliferation of layer-2 networks, under a “minimal-enshrinement philosophy” – essentially keeping the main blockchain network as a “simple, beautiful protocol that tried to do as little as possible.” Now, however, he writes that “enshrining certain features in the protocol might be worth considering.”

Ethereum developers prove successful in second attempt at Holesky test network launch.

Monday’s highly anticipated launch of no fewer than nine exchange-traded funds or ETFs offering exposure to ether (ETH) futures proved spectacularly unimpressive; one analyst described the whole affair as “meh.”

Protocol Village

Highlighting blockchain tech upgrades and developments.

1. Nomic, a layer-1 blockchain with a decentralized, non-custodial Bitcoin bridge, said its nBTC Interchain Upgrade “empowers users” to bring native bitcoin (BTC) to anywhere within the Cosmos ecosystem.

2. Chainlink, the blockchain data oracle provider, has launched “Data Streams,” a new product designed to reduce network latency.

3. Polybase, a state zk-rollup protocol that natively supports modular data storage and indexing, has launched Polylang, a programming language described as “TypeScript for Zero Knowledge.”

4. Babylon unveiled at Cosmoverse its “Bitcoin Staking Protocol MVP.”

5. Namada, a layer-1 protocol specializing in multi-chain privacy, said it plans an “incentivized testnet” and an airdrop of NAM tokens to ATOM holders.

Money Center

-

Matter Labs, the developer team behind Ethereum layer-2 zkSync Era, announced a competitive audit contest focused on Web3 with Code4rena, a smart-contract security marketplace, with 1.1 million USDC available to participants and a minimum of $330,000 to be distributed. The 21-day event runs Oct. 2-23.

-

Vechain, an enterprise-grade layer-1 public blockchain, “will host a hackathon at Harvard in partnership with Boston Consulting Group and Web3 educational mobile app, EasyA” on Oct. 7-8, according to a press release.

-

Fireblocks, a crypto custody tech company, has acquired tokenization firm BlockFold, a “smart-contract development and consulting firm specializing in advanced tokenization projects for financial institutions,” according to an emailed announcement.

-

The XRP token price soared after a U.S. judge denied the Securities and Exchange Commission’s motion to appeal a July court loss in its case against Ripple Labs.

-

In 2021, many FTX employees were set to become fabulously rich because their holdings of Serum’s SRM tokens had shot up in value, author Michael Lewis writes in his new book, “Going Infinite.” Then-FTX CEO Sam Bankman-Fried (now on trial) got worried that the employees might not stay so committed to working hard, according to Lewis. So Bankman-Fried changed the rules of the token allocations, locking up the SRM tokens so employees would have to wait longer to sell. The rest is history: After the FTX bankruptcy in November 2022, the SRM tokens plunged in digital asset markets, and are now down 99% from their all-time high price.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/XUEGJXVQNRHWDAHQKPWBGUGEXE.png)

Yet Another FTX Spectacle – Not in Court, but On-Chain

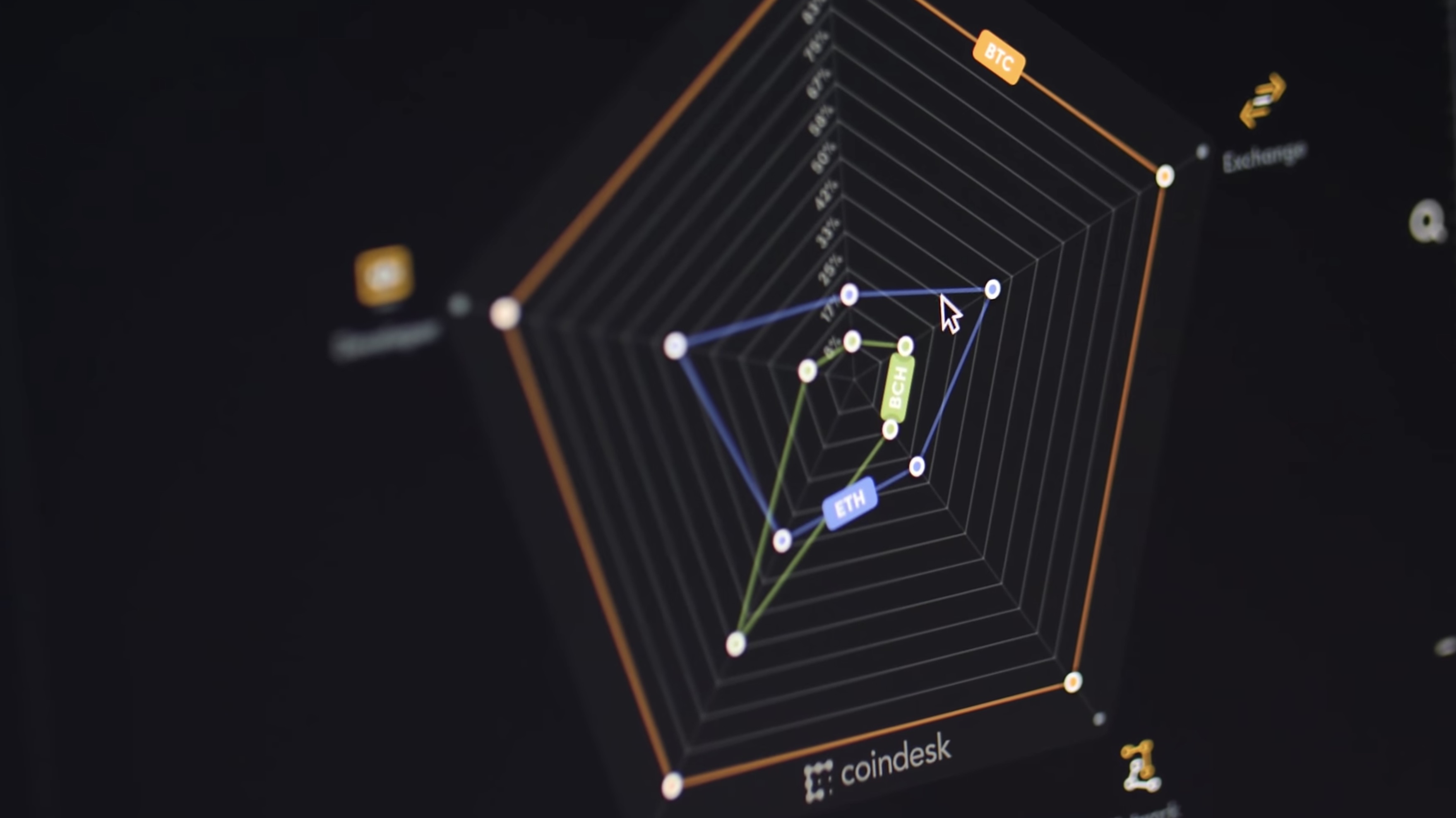

In the chaos that followed the collapse of Sam Bankman-Fried’s FTX crypto exchange, a still-unknown party drained affiliated wallets of as much as $600 million. Until this past week, some $26 million of ether (ETH) had sat in a single wallet tagged “FTX Exploiter” by blockchain sleuths. But in the wee hours of Saturday, Sept. 30, just days before Bankman-Fried’s criminal trial was set to commence in New York, the blockchain account suddenly sprung into action, and the funds started moving – flowing quickly through a series of wallets that appeared to have no other purpose but as intermediary accounts; routing through Railgun, a privacy-enhancing protocol; and ultimately ending up at Thorchain, a decentralized cross-chain swap protocol; or reaching a smart contract labeled, “Metamask: Swap Router.” Using blockchain explorers, we traced the flow that one batch of 2,500 ETH took out of the long-dormant wallet. Here’s that visualization:

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/WI5IBODDJNEPRGJW4RYUA5IMLQ.png)

Calendar

Edited by Bradley Keoun.