The Protocol: The Impact of Telegram CEO’s Arrest on TON Blockchain

In this week’s issue of CoinDesk’s weekly newsletter on blockchain technology: Fresh SEC charges hit the OpenSea NFT-trading platform, the arrest of Telegram CEO Pavel Durov impacts the TON blockchain, and crypto twitter erupts over Ethereum co-founder Vitalik Buterin’s antipathy toward DeFi.

-

Binance once again hunts for a home.

-

Cardano heads toward biggest upgrade in two years.

-

Babylon launch sends Bitcoin fees soaring.

-

Top picks from the past week’s Protocol Village column: Tonkeeper, Sony, Startale, Optimism, Bluwhale, Starknet, SwapKit, BitPay, THORChain.

-

$60M+ of blockchain project fundraisings.

Network News

TON OF TROUBLE. With Telegram CEO Pavel Durov set to appear in a French court on Wednesday, blockchain analysts are weighing the possible impact on the closely affiliated TON blockchain, officially called The Open Network. Alex Thorn, Galaxy Digital’s head of research, reminded investors in a report that the value of the TON blockchain and its native token, toncoin (TON), are “substantially dependent” on the project’s integration with Telegram. The TON price tumbled after the news that Durov was arrested on Saturday – detained as part of an investigation into crimes allegedly planned or broadcasted on Telegram. The TON blockchain has more than 350 validators globally, but it is unclear how many of these Telegram operates, if any, according to the Galaxy report. (A source told The Protocol that Telegram doesn’t operate any of them, although our attempts to reach the supporting TON Foundation for comment were unsuccessful.) It’s not clear “how resilient TON can be in the case that France or any other major governments attempt to attack it or to take it down as part of Durov’s arrest,” Thorn wrote. The TON Society, describing itself as a community organization affiliated with TON, circulated an open letter condemning Durov’s arrest and calling upon France to release him. In a very crypto-style interlude to the saga, the TON blockchain suffered a near-six-hour outage on Wednesday, caused by a surge in network traffic – and possibly linked to the recent airdrop of a TON-based memecoin called DOGS. In a post on X, the TON blockchain team explained that “Several validators are unable to clean the database of old transactions, which has led to losing the consensus,” assuring that “no cryptocurrency assets will be lost due to the issue.”

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/HWS34IJCAVF7NFZGONBZVJ3SNQ.jpg)

Kain Warwick, founder of the DeFi projects Infinex and Synthetix, appeared on the Steady Lads podcast (Steady Lads/YouTube)

VITALIK VS. DEFI? In a series of trending posts on X, advocates of decentralized finance (DeFi) questioned whether Ethereum co-founder Vitalik Buterin was a fellow fan or a critic. It’s a fair question, given there’s some $50 billion of DeFi collateral locked into protocols on Ethereum, more than five times runner-up Tron’s – making DeFi one of the biggest success stories on Ethereum. And the stakes are high, with a research report last week projecting that a key DeFi metric could surpass the 2021 peak by next year.

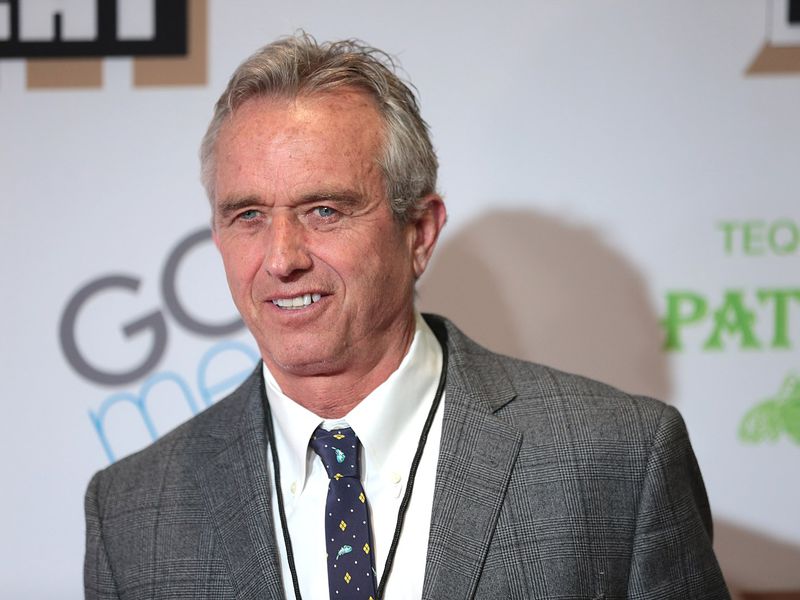

The chatter dates back to a post several weeks ago, when Kain Warwick (pictured above), founder of the very-much-DeFi projects Infinex and Synthetix, wrote that, “If the only thing propping up your chain for the last five years is DeFi, and the best you can muster is begrudgingly tolerating it, you are anti-DeFi.” He didn’t mention the Ethereum co-founder by name, but a few days ago, Warwick appeared on the Steady Lads podcast to clarify that he is not a “Vitalik maxi,” asserting that the “importance of DeFi” is “one of the most critical things” that Buterin has gotten wrong over the last five years. “He keeps trying to meme non-DeFi things into existence,” Warwick added. On Saturday, the conversation spilled over to X after user @llamaonthebrink wrote that, “I can’t read Vitalik’s mind so I don’t know what he really thinks. I just find it hard to believe that his views of defi are really that pitiful.”

Buterin himself responded – not disagreeing with the premise, per se, but listing categories of use cases he enjoys: decentralized exchanges, decentralized stablecoins, the Polymarket predictions-betting site, even the centralized stablecoin USDC. Buterin went on, however, to note that he has “no excitement toward the 2021-era liquidity farming craze” and acknowledged he is often skeptical when he hears claims that users can “get good yield by parking your coins here.” He added that there are “sooooo many centralization points” in today’s technology – from political attacks on encrypted messaging to social-media censorship, to name a couple – that just decentralizing finance “isn’t enough.”

Split Capital’s Zaheer Ebitkar wrote that “Vitalik’s poor judgement [sic] on DeFi” could be taken as a source of “optimism,” since it meant that the “asset isn’t so dependent on its founders.” The user @DeFiSurfer808 chimed in, “DeFi is the whole point of eth lmao.” Stani Kulechov, founder of Aave, the biggest DeFi lending protocol, might have dropped the mic when he wrote, “Establishing resilient finance can solve many other challenges where resilience is required to empower people, and we are very far from wide adoption.”

-

Binance CEO Richard Teng, a former financial regulator in his native Singapore as well as the United Arab Emirates, said in an

interview with CoinDesk

that Binance is looking for a headquarters but that the question is “very complex.” The crypto exchange’s Chinese-Canadian founder, Changpeng “CZ” Zhao, was

famously evasive

about the question, perhaps because the company was so nomadic – reportedly founded in Shanghai and later based in Japan, Malta and

unspecified

, but with European operations based in France and Middle Eastern headquarters in Dubai.

-

Nigeria’s money laundering case against crypto exchange Binance, detained executive Tigran Gambaryan and fugitive Nadeem Anjarwalla

will resume on Sept. 2

, a month earlier than planned, after defense lawyers asked for the trial to be brought forward, Gambaryan’s family said.

-

Michelle Bond, who once ran a Washington-based crypto advocacy group and had served as a U.S. Securities and Exchange Commission lawyer, was

indicted in federal court

for taking illegal campaign contributions during her 2022 run for Congress, and court documents detail how a river of cash came through her former FTX executive boyfriend, Ryan Salame.

Cardano Blockchain Heads for ‘Chang Hard Fork,’ Biggest Upgrade in Two Years

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/WRYNKTEH7ZFQDMNWVBZVIWBK6A.jpg)

Cardano founder Charles Hoskinson speaks last week on a video posted to X. (@IOHK_Charles/X)

Cardano, launched in 2017 by Ethereum co-founder Charles Hoskinson, is pushing toward its biggest upgrade in two years, with major changes to the structure of its main network, introducing mechanisms for users to participate in on-chain governance.

The upgrade, known as the “Chang hard fork,” is a major milestone in Cardano’s roadmap, punctuated by the much-awaited addition of smart contract functionality in 2021. The Chang hard fork was initially set to go through this week, but Hoskinson announced on Friday that it had been pushed back to Sept. 1 so some exchanges, including Binance, could prepare their systems.

“The magic of deadlines is that people who aren’t taking upgrades seriously suddenly say damn we got to get moving,” Hoskinson wrote on X.

The main feature of the latest upgrade is to give Cardano the ability to introduce on-chain governance features. Those that hold ADA, Cardano’s native token, will be able to elect representatives (called Delegate Representatives, or dReps) and vote on improvement proposals as well as future technical changes to the blockchain.

Protocol Village

Top picks of the past week from our Protocol Village column, highlighting key blockchain tech upgrades and news.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/IY4XANQAEZGMLLS5HUEBPMP3VM.jpg)

Photo of Tonkeeper dApp browser on smartphone (Tonkeeper)

-

Tonkeeper, a wallet for the TON blockchain, announced the launch of its dApp browser in Telegram. According to the team: “Integrated into the Tonkeeper wallet, the browser provides a gateway to exploring the best decentralized applications available within the growing TON ecosystem.”

-

Sony Group’s blockchain joint venture with Startale Labs, Sony Block Solutions Labs (Sony BSL), launched the “Soneium Minato” public testnet, alongside a developer incubation program, “Soneium Spark.” According to the team: “This dual initiative marks a significant milestone in Sony Group’s entry in Web3, poised to catalyze ecosystem growth and accelerate adoption by leveraging its vast global reach and technological expertise across entertainment, gaming and consumer electronics sectors.” The move comes a week after the pioneering electronics giant unveiled the plans to erect a layer-2 network atop Ethereum called Soneium, using technology from Optimism’s OP Stack.

-

Bluwhale

, an AI Web3 start-up connecting enterprises to consenting wallet holders and enabling digital profile monetization, announced the launch of a mobile web app “for a vastly simplified process of contributing/verifying data and even operating nodes.” According to the team, the app “enables one-click node sale and operation, giving retail users access to the wave of node sales as well as all the benefits of node sale participation.” (Demo video

here

.)

-

Starknet said that parallel execution has arrived with the ‘Bolt’ upgrade, expanding the Ethereum layer-2 blockchain’s capacity “by enabling independent transactions to be executed simultaneously,” according to the team: “The network is the first layer 2 to have ‘megastore capabilities,’ with the sequencer now able to execute multiple transactions in parallel. The introduction of Parallel Execution is part of the network’s upgrade to version 13.2, which also includes Block Packing, a feature that makes use of every last bit of block space and will reduce confirmation time to two seconds.”

-

SwapKit.dev

, a provider of cross-chain infrastructure solutions, announced an integration with BitPay, the Bitcoin and cryptocurrency payment processor. According to the team: “This integration will empower BitPay users to unlock a wider range of digital assets, leveraging SwapKit to access cross-chain liquidity via THORChain for seamless in-wallet exchange of diverse cryptocurrencies. This partnership will provide significant benefits for Bitpay users, including: expanded blockchain support, ERC-20 asset support, reduced friction and enhanced user experience.

Money Center

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/SUBDKOV7BJEOJO5YFIX3SWKMQY.jpg)

Space and Time co-founders Scott Dykstra (left) and Nate Holiday (Space and Time)

-

Space and Time (SxT), a blockchain-native data warehouse that incorporates artificial intelligence (AI) tools to build applications using its data, has raised $20 million in Series A funding.

-

Sorella Labs, an Ethereum-focused developer that says it’s “building tools to protect DeFi liquidity providers from the multi-billion dollar arbitrage and extraction industry and create a fairer and more efficient trading environment,” announced a $7.5 million seed round led by Paradigm.

-

SatLayer has raised $8 million in pre-seed funding, led by Hack VC and Castle Island Ventures, “to expand Bitcoin as a universal security layer,” according to the team.

-

OTHER NOTABLES (Details in

Protocol Village

): (Gameplay Galaxy, $11M; Credbull, $5.2M; Stork Network, $4.705M; Ark Labs, $2.5M; Legion, $2M; SOON, unspecified co-builder round)

Regulatory, Policy and Legal

Babylon Blitz Briefly Overwhelms Bitcoin

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/DUUPWYJWUNGZRNNWXJ34KOIFRQ.png)

Chart showing the spike in Bitcoin fees (expressed in sats/vByte) as the staking platform Babylon went live. (Mempool.space)

The Bitcoin-focused staking project Babylon went live last week, and a rush by users and projects to get in caused so much congestion on the blockchain that it briefly sent transaction fees spiking to their highest levels since June.

The project had established a 1,000 BTC cap for the first phase, so there was limited space. And it took just 74 minutes for the allotment to fill up, with participants motivated by the prospect of bragging and marketing rights, not to mention the ostensible motivation to qualify for eventual rewards. Fees for an individual block shot as high as 15.5 BTC (nearly $1 million), versus the more typical level of 0.1 BTC or less, according to the data site Mempool.space. One project, Lombard Finance, managed to squeeze in as a “Day 1 Babylon staker” but dialed back from the 250 BTC it had lined up because leaders “just couldn’t justify paying miners nearly 3/4th of a $million,” according to a tweet.

Babylon is somewhat similar in concept to the Ethereum restaking protocol EigenLayer, but for Bitcoin; users “stake” deposits on the platform, and that essentially serves as the security collateral to safeguard additional protocols and networks. For bitcoin holders, the project offers a chance to earn extra return beyond price appreciation on a $1.3 trillion asset with no native yield. The planned “shared security” marketplace allowing stakers to earn rewards won’t come until a subsequent launch phase. “If successful, Babylon can potentially unlock massive value in BTC,” Presto Research wrote in a report.

Calendar

-

Nov. 10:

OP_NEXT

Bitcoin scaling conference, Boston.

-

Jan. 21-25:

WAGMI

conference, Miami.

Edited by Sam Kessler.