The Protocol: Polymarket Feeds Political Junkies, With Nate Silver

It’s hard enough keeping up with the twists and turns that have already happened in this year’s U.S. presidential race. To keep tabs on the political-news handicapping within the predictions-betting site Polymarket (built atop the Polygon blockchain) is to also keep up with what’s likely to happen in the future. Read on.

-

Crypto startup founder backed by Michael Novogratz’s Galaxy loses nearly $4M of company funds betting on bitcoin.

-

Blockchain privacy project “CarnationFM” succeeds in embedding secret, encrypted messages within music files.

-

Arthur Hayes’s family office backs grant program for open-source Bitcoin developers.

-

KYD Labs (built atop Aptos) inks ticketing deal with New York music venue Le Poisson Rouge.

-

$15M+ of blockchain project fundraisings: Mira, Bima, RECRD

-

Top picks from the past week’s

Protocol Village column

: Chromia, Polygon Labs, Waves, Pyth, Ava Protocol, EigenLayer.

Network news

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/ZR2EJSRWIVGDZNVDYIKJPP3ECU.jpg)

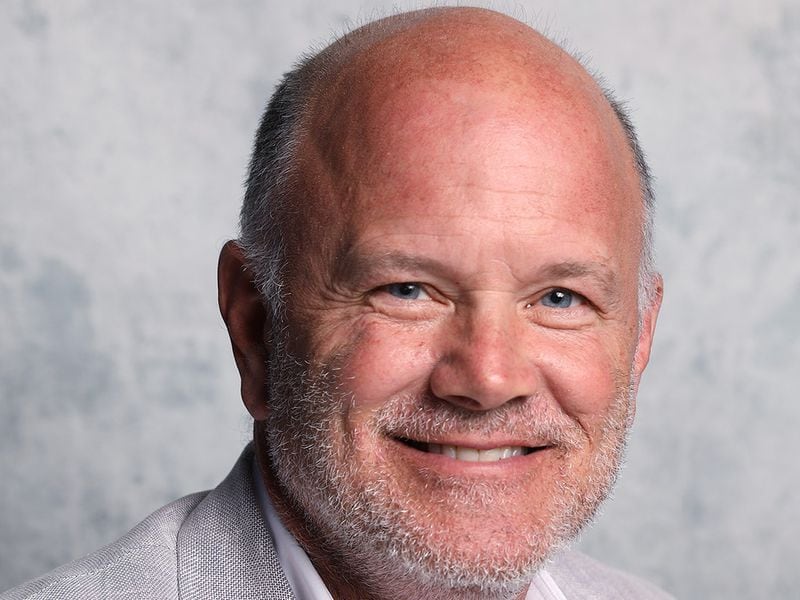

Polymarket CEO Shayne Coplan (Polymarket)

PLAYING POLITICS: When the predictions-betting site Polymarket raised $70 million in fresh funding in May, CEO Shayne Coplan tweeted that it was “most gratifying” seeing “widespread adoption” of the platform as an “alternative news source.” It was exactly the sort of deflection-flex one might expect from a startup executive enjoying his liquidity moment. But as this year’s U.S. presidential election lurches from one surprise to the next, Coplan’s assessment appears to be right on the money. Just over the past couple weeks, blockchain bettors have used the platform (built atop the Polygon blockchain) to: wager on President Joe Biden’s chances of winning reelection; gamble on Vice President Kamala Harris’s odds of replacing him as the Democratic nominee; handicap Biden’s performance during a press conference and ABC TV interview; bid up former President Donald Trump’s likelihood of victory following an attempted assassination; and assess the appeal of his vice president pick, Sen. J.D. Vance (R-Ohio). A new breed of crypto degenerates have popped up on the social-media site X, posting their winning betting slips, with one lucky soul claiming to have netted more than $400,000 on a single punt. It should be noted that none of this Polymarket gambling is legal in the U.S., since the project was barred in 2022 from doing business in the country under a settlement with the Commodity Futures Trading Commission that also came with a $1.4 million fine. Even so, there’s some speculation that prediction markets might get increasingly cited by news outlets whose political coverage previously relied on polls or pundits. To underscore the point, Axios broke the story this week that Polymarket had hired the widely followed statistician and journalist Nate Silver as an adviser. Silver told the publication in an interview that he expected “more of the investor class to leverage prediction markets to assess the risk of politics on their businesses.” Anyone care to bet?

SCOOP: Richard Kim, founder of crypto casino Zero Edge, who previously had served as an executive at Michael Novogratz’s Galaxy as well as the Wall Street banks JPMorgan and Goldman Sachs, has acknowledged losing at least $3.67 million of the company’s funds on bitcoin trades that went sour as the cryptocurrency’s price tumbled in June. (H/t to CoinDesk’s Sam Kessler for breaking the news.)

The Federal Reserve Bank of New York posted a job opening for a “digital assets market specialist,” at a mid-senior level with a pay range of $136,800 to $230,000 a year. Desired attributes include “familiarity with datasets relevant for digital asset markets” and “ability to convey complex subject matter to senior audiences.”

Larry Fink, CEO of BlackRock, the world’s largest money manager, said on CNBC that bitcoin is a “legitimate financial instrument” for “when you believe that countries are debasing their currency by excess deficits.” The comment was seen by commentators as a remarkable endorsement of the largest cryptocurrency, giving “boomer advisors comfort and cover to make the allocation.”

The Cambodian currency exchange and payments company Huione Pay received over $150,000 worth of crypto associated with the North Korean hacking outfit Lazarus, Reuters reported on Monday. According to two blockchain analysts, the wallet was “used by Lazarus hackers to deposit funds stolen from three crypto companies in June and July last year, mostly via phishing attacks,” the article said. Huione Pay’s board said it did not know it had “received funds indirectly” from the hacks.

Australian computer scientist and one-time Satoshi Nakamoto claimant Craig Wright has been forced to update his personal website with a legal notice declaring that he is not the inventor of Bitcoin, and that he is “not the author of the Bitcoin white paper.”

Protocol Village

Top picks of the past week from our Protocol Village column, highlighting key blockchain tech upgrades and news.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/C7DYZHHRFRGNRIFVYHFMVHRW7I.png)

Chromia’s architecture (Chromia)

1. Chromia, blockchain ecosystem that aims to avoid network congestion partly by giving every decentralized app (dapp) its own cluster of nodes and computational resources, has gone live on mainnet, “marking the beginning of the relational blockchain era,” according to the team: “The mainnet launch marks the genesis block of the new native CHR token and will enable the current CHR token, which was issued as ERC-20 and BEP-20, to be bridged to the MVP mainnet. The MVP Mainnet also includes staking delegation process, payment of network hosting fees and provider payouts.”

2. Polygon Labs, the main developer firm behind the layer-2 blockchain Polygon, released on Tuesday the latest version of its zero-knowledge proving system, “Plonky3” – designed to be more flexible than the previous model. Polygon Plonky3 is now available as open-source software under the popular MIT and Apache licenses, according to the company.

3. Waves blockchain ecosystem founder Sasha Ivanov has launched a fully functional testnet for Units.network, “an innovative ecosystem of interoperable blockchains built atop the Waves platform,” according to the team: “This significant development introduces a comprehensive Layer 2 solution, utilizing a re-staking approach to create a fully decentralized network that enables the seamless deployment of interconnected blockchains, all supported by existing Waves validators.

4. Pyth, a blockchain oracle protocol, has officially launched its newest product, Express Relay, on mainnet, according to the team: “The launch introduces a novel decentralized solution to the long-standing problem of MEV in processing liquidations and market-efficiency enhancing transactions in DeFi – once thought to be an inevitable characteristic of on-chain finance. The primitive connects DeFi protocols directly with a network of established searchers through protocol-controlled auctions for events like liquidations. Searchers who have already integrated include Flow Traders, Wintermute, Auros, Flowdesk, Caladan, Tokka Labs and Swaap Finance.”

5. Ava Protocol, recently renamed from OAK Network and describing itself as an “intent-based infrastructure that empowers private autonomous transactions,” has launched its mainnet on Ethereum as an EigenLayer AVS for smart contract automation, “enhancing Web3 transaction efficiency, privacy and composability,” according to the team: “This enables developers to integrate event-driven super-transactions without custom code, simplifying complex on-chain operations, offering advanced capabilities beyond the Ethereum Virtual Machine, supporting automated tasks like payments and dynamic NFT minting. This follows a successful testnet and leverages pooled security from Ethereum validators, positioning Ava Protocol to revolutionize smart contract automation.”

CarnationFM: A Decentralized Radio Playing Songs With Encrypted Hidden Messages

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/I2DUUTIW2BFTNGH3V32QT4CCGI.jpg)

A mix of volunteers and hackers playing music at EthBerlin in May. (Amitoj Singh/CoinDesk)

It might just sound like music.

But a group of programmers, working on a project known as “CarnationFM,” have devised a means of embedding a hidden encrypted message of up to 250 kilobytes a minute into music files.

The music is broadcast through Swarm, a decentralized data storage solution operating on the Ethereum blockchain.

“Anybody can listen to the music or the song,” said one of the collaborators, and “anybody can download it, but only the people that hold a public key can actually see the encrypted message.”

The project, winner of the Best Social Impact award at the EthBerlin conference in May, drew inspiration from Portugal’s so-called Carnation Revolution in 1974, which relied on a disc jockey’s song selection to signal the start of a coup that ultimately led to the overthrow of an authoritarian government.

Money Center

-

Mira, a decentralized AI infrastructure platform aiming to expand access to advanced AI resources, has announced the closing of a $9 million seed round led by Bitkraft Ventures and Framework Ventures, with participation from Accel, Crucible, Folius Ventures, Mechanism Capital, SALT Fund and notable angel investors.

-

Bima Labs, a developer of Bitcoin-backed stablecoins, closed its seed fundraising round, raising over $2.25 million. According to the team, the round was led by Portal Ventures, with participation from Draper Goren Blockchain, Sats Ventures, Luxor Technology, Delta Blockchain Fund, Halo Capital, CoreDAO and angels including DOMO (creator of BRC-20), Ryan Fang (Ankr), Paul Taylor, Brian Crain (Chorus One), Paul Kim (Notifi and ex-director of product at Circle), Jeffrey Feng (Sei Labs) and Smokey (Berachain).

-

SocialFi platform RECRD has emerged from stealth with an investment of $4 million, led by the Sui Foundation, according to the team. Other investors include Mitch Lowe, co-founding executive of Netflix; Mitch Richmond, six-time NBA All-Star; Jeffery Shoonover of Hollywood.com; Alphabit Fund and DNA Fund.

-

Maelstrom, a decentralization-focused venture firm managed by the family office of BitMEX co-founder Arthur Hayes, announced a new “Bitcoin Grant Program” to support developers working on the oldest blockchain. According to a post: “Bitcoin is the bedrock asset in the crypto space, and unlike other crypto projects, Bitcoin never conducted an offering to raise funds for its technical development. Maelstrom, like other companies in the space, indirectly relies on the work of open-source Bitcoin developers…. We are therefore keen to give back and donate to the Bitcoin technology, on which the crypto ecosystem depends. The objective of the program is to help with the technical development of Bitcoin and enhance its resilience, scalability, censorship resistance and privacy characteristics… A Grantee will be expected to contribute to Bitcoin’s technical development, potentially in the form of pull requests or review work for the Bitcoin Core software project.” The program is offering 12-month grants, with payments made monthly in BTC, USDC or USDT, with grants ranging from $50,000 to $150,000 per developer. Grant stacking is permitted with a cap at $250,000 a year. Applications are due prior to Aug. 25.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/3BD3SCKJZFHNDPKIEEQPJ5RJFQ.jpg)

Scene from New York’s Le Poisson Rouge, where tickets are bought via Aptos-based KYD (Julia Pagano)

-

KYD Labs, a live event ticketing platform powered by the Aptos blockchain, and New York’s Le Poisson Rouge (LPR) announced an exclusive, four-year ticketing partnership. According to the team, the project “is transforming the U.S. music industry during a time of notable dissatisfaction with traditional ticketing giants.