The Protocol: Bitcoin NFT Debacle, Vitalik’s 30th, Farcaster Frames, ‘Private Mempools’

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

Ok, sure, humans invented blockchains. But why do they have to mess it all up?

In this week’s issue of The Protocol newsletter, we’ve got lots of humans doing things in blockchain – some quite impressive, not all so successful. There was the messy-and-ultimately-suspended sale by Taproot Wizards of its inaugural “NFTs-on-Bitcoin” collection “Quantum Cats,” and Wednesday brought news of a reported hack at Ripple.

Our Sam Kessler writes about the “private mempools” that Ethereum users are relying on to keep transactions from getting picked off by front-running “MEV” bots, and Margaux Nijkerk reports on the growing use of “councils” – call them blockchain boards – that projects are creating to provide adult supervision over still-quite-adolescent networks.

PLUS – January’s leaders and laggards among the CoinDesk 20 digital assets.

This article is featured in the latest issue of The Protocol, our weekly newsletter exploring the tech behind crypto, one block at a time. Sign up here to get it in your inbox every Wednesday. Also please check out our weekly The Protocol podcast.

Network news

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/4LQZWDCSRZG7JH4X2QNZOEMJNA.jpg)

ME-OUCH! With robust development and NFT minting atop once-sleepy Bitcoin tipped to be one of blockchain’s hottest trends, this week’s sale of the “Quantum Cats” digital-art series from the Ordinals inscriptions project Taproot Wizards was supposed to be the cat’s meow. After all, it was only a couple months ago when Taproot Wizards, led by Udi Wertheimer and Eric Wall, raised $7.5 million from investors amid a wave of euphoria over “NFTs on Bitcoin.” And earlier this month, the first-in-series “Genesis Cat” fetched a fur-fluffing $254,000 at the venerable auction house Sotheby’s. Remaining Quantum Cats were set for a fixed sale price of 0.1 BTC, or about $4,300 at the current bitcoin market price. But when the Taproot Wizards minting website opened on Monday to whitelisted buyers, there was more sour milk than catnip. Frustrated claimants filled up the Taproot Wizards Discord channel with screenshots showing web glitches and hung transactions. “This has got to be one of the worst mint experiences I’ve ever seen,” one user wrote. Taproot Wizards suspended the process after about 1,000 of the 3,000 images were sold, according to project officials, delaying the remainder until Tuesday, and then subsequently delaying it again until Thursday. “We didn’t live up to your expectations of us and to our expectations of ourselves,” Wertheimer posted on X. At this point nobody’s talking about purr-fection.

BLOCKCHAIN BOARDS: “Trust the humans” might be the new mantra for Ethereum’s top layer-2 projects. As our Margaux Nijkerk reported this week, that principle stands at the core of a new trend in the blockchain industry, where overseers of various networks are establishing groups of people to help steer protocol changes and ensure security. The goal of these “protocol councils,” sometimes called “security councils,” is to nudge the nascent networks toward increasing decentralization, by gradually removing them from under the control of their original developers. Before cutting the cord completely, where the networks essentially run automatically, or subject to some sort of democratic process, the thinking is that a panel of well-meaning humans can serve as the ultimate guardians – able to step in quickly when emergencies arise, or providing the final sign-off on major protocol changes. Polygon, the Ethereum layer-2 network, has a 13-person “Protocol Council.” Arbitrum, another major Ethereum-focused layer-2, has a “Security Council,” while Optimism also has a “Security Council.” A member of the Polygon council, Mehdi Zerouali, who is the director of Sigma Prime, a blockchain security firm, told CoinDesk that “This is a necessary evil.”

-

The XRP token dropped 5% after report of a potential $112M hack at Ripple. Chris Larsen, Ripple’s executive chairman, later clarified in a post on X (formerly Twitter) that there had been a breach to his “personal XRP accounts,” but not to Ripple itself. (Link)

-

The Ethereum blockchain’s biggest upgrade since early 2023 went

live on the second of three test networks

, bringing the much-anticipated “Dencun” project and its “proto-danksharding” feature a step closer to reality.

-

Speaking of Ethereum, co-founder Vitalik Buterin wrote in a new post that developers should “tread carefully” before mixing crypto and AI. (

Link

) (Also, by the way, it’s his

30th birthday

.)

-

Worldcoin, the blockchain-based identity project backed by OpenAI’s Sam Altman, might change the shape of its

Black Mirror

-esque Orb to make the eyeball-scanning device look “more friendly.” (

TechCrunch

)

-

Police in Germany have provisionally seized 50,000 BTC worth $2.17 billion, calling the action its largest cryptocurrency seizure ever, according to a

police statement

. (

Link

)

-

Alleged crypto Ponzi scheme “HyperVerse” raked in nearly $2B, hired actor as fake CEO, U.S. authorities alleged. (

Link

)

-

Jack Dorsey’s Block Inc. begins layoffs under previously disclosed plan to cut staff by 10%. (

Link

)

-

Heather “Razzlekhan” Morgan, who along with her husband was charged in 2022 with conspiracy related to a heist of billions of dollars worth of bitcoin, is the subject of a new feature film being developed by Amazon MGM Studio. (

Decrypt

)

Protocol Village

Top picks of the past week from our Protocol Village column, highlighting key blockchain tech upgrades and news.

-

Farcaster, the decentralized social media platform on Ethereum where Vitalik Buterin sometimes posts, has introduced a new feature called “Farcaster Frames.” In a Jan. 26 post on X, Farcaster co-founder Dan Romero noted that Frames “make it easy to ship an MVP, no app install required,” adding that they’re “mobile first, feed first, distribution first.” The Spindl blog described the experience as, “a new Web 3 primitive that Web 2 could never really power: an easy way to run app X while a user is still inside app Y, with little coordination between X and Y.”

-

Anza, a new software development firm focused on the Solana blockchain ecosystem and founded by a group of executives and core engineers from Solana Labs,

announced its launch in a blog post

: “It will build a forked version of the Solana Labs validator client called Agave, as well as contribute to other major protocols within the Solana ecosystem.”

-

Stellar Development Foundation published a blog post on Tuesday revealing a new target date of Feb. 20 for the Protocol 20 upgrade that will introduce smart contracts to the Stellar blockchain as part of the “Soroban” project. The upgrade was delayed from the originally targeted Jan. 30 after a bug was found.

-

Immunefi, a bug bounty and security services platform for Web3, published its “

Crypto Losses in January 2024

” report, revealing that the ecosystem lost $126 million of funds due to hacks and scams. According to the team: “This represents a 6x increase when compared with January 2023 at $21 million.”

-

Linera

, a layer-1 blockchain protocol pioneering microchains to give users their own blockspace, announced deployment of its Devnet, “a significant stride in its mission to redefine Web3 scalability,” according to the team: “With its unique blockchain model, the company is enhancing user experiences for projects that require support for a vast number of active users and real-time interactions.” The project is led by Mathieu Baudet, a veteran of the former Meta/Facebook/Novi crypto program.

Inside the ‘Private Mempools’ Where Ethereum Traders Hide From Front-Running Bots

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2FMTIL2XIRF2VII3UGBLXARUW4.jpg)

Ethereum is swarming with bots that are programmed to front-run transactions. The bots exploit the brief window of time between when transactions are submitted, and when they’re officially finalized, to copy trades from other users, quickly execute them, and in doing so eat into any would-be profits.

It’s a practice called maximal extractable value (MEV), and it’s a huge nuisance to novice crypto traders and to veterans alike.

But Ethereum’s transaction pipeline has undergone a quiet shift over the past two years as more of the chain’s users have embraced “private mempools” to execute their trades – bypassing the blockchain’s “public” transaction lobby to avoid broadcasting trades to the whole world before they’re finalized. This helps to prevent MEV and help users get better settlement for their transactions.

While there are obvious benefits to this stealthier mode of using Ethereum, experts say private mempools carry risks of their own.

“I think most everyone, including myself, expects there to be more private transactions moving forward, not less,” Matt Cutler, CEO of MEV firm Blocknative, told CoinDesk. “I think the big question in my mind is, would more private transactions be a good thing or a bad thing for the network?”

Money Center

-

Portal, a San Francisco-based fintech provider, raised $34 million to support the development of its bitcoin-based decentralized exchange (DEX), which exited stealth mode on Tuesday. Investors in the round included Coinbase Ventures, Arrington Capital, OKX Ventures and Gate.io, according to an announcement.

-

ZkLink a multi-Chain ZK Rollup and layer-3 protocol, has successfully completed a $4.68 million sale on CoinList in its latest Community Token Sale.

-

Ithaca Protocol, a composable option protocol, raised $2.5 million in a pre-seed funding round, co-led by Cumberland and Wintermute Ventures, according to the team.

-

BBO Exchange, a decentralized exchange for trading perpetual contracts, has raised a pre-seed funding round of $2.7M leaded by Hashed and Arrington Capital, alongside participants like Consensys and CMS Holdings.

-

Colosseum has emerged from the Solana Foundation as a new, independent organization that will run future Solana Foundation online hackathons, an accelerator program and venture fund to invest in Solana builders, according to the team: “Founded by Matt Taylor, Clay Robbins and Nate Levine, Colosseum will be a new arena for the next wave of Solana projects. Hackathon winners who are accepted into Colosseum’s Accelerator Program will receive $250,000 in pre-seed capital. The inaugural event starts on March 4,2024 and interested builders can sign up here.”

-

The foundation supporting decentralized crypto exchange dYdX has requested $30 million in funding from the project’s governing decentralized autonomous organization (DAO) to be spent over the next three years.”

-

Nym Technologies

, a privacy-focused project, announced the first recipients of grants from the Nym Innovation Fund, according to the team. They include “three privacy-preserving technologies utilizing the Nym mixnet: StarShell wallet for the Secret Network, Nodies DLB for privacy-enhanced RPC networks and PasteNym for private text drops.”

-

Bitcoin Miner GRIID Shares Extend Drop After Nasdaq Listing

CoinDesk 20 Slid 2.9% in January, Though Bitcoin Eked Out Gain

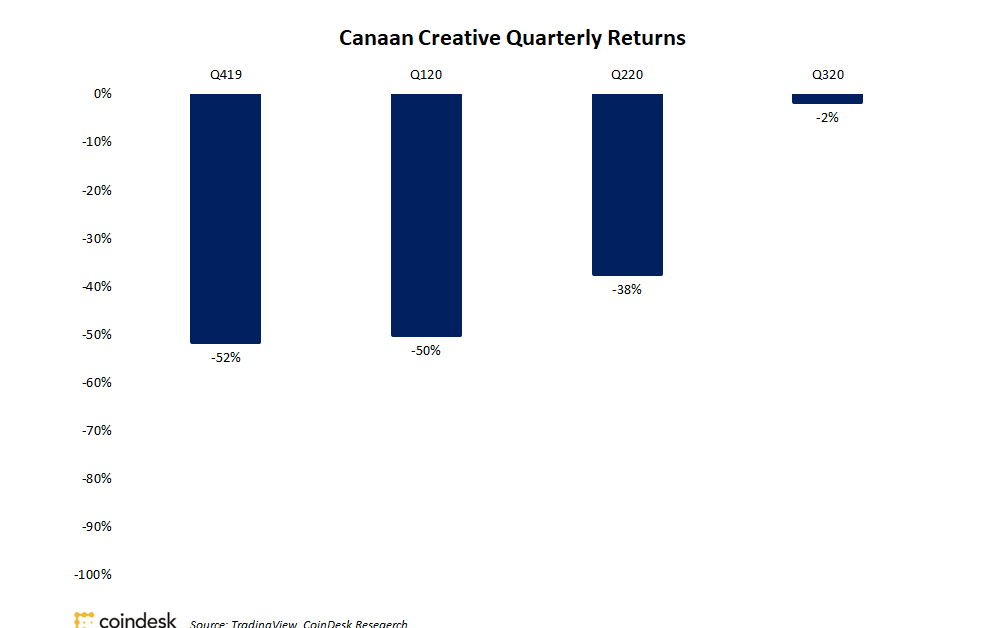

Our colleagues at CoinDesk Indices earlier this month unveiled a new “CoinDesk 20” index, positioned as the new benchmark for crypto-markets performance – the blockchain industry’s version of the Dow Jones Industrial Average. It’s a market-capitalization-weighted selection of the biggest digital assets in the CoinDesk Market Index (CMI).

Through the first 30 days of January, the CoinDesk 20 slid 5.1%, underperforming the Standard & Poor’s 500 Index, a benchmark for the stock market:

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/5SM4XPN7UNA4ZI5AUZ4S6F4I5E.png)

Luckily for The Protocol readers, we can track the leaders and laggards in the CoinDesk 20 each month to monitor who’s up and who’s down among the biggest blockchain projects, at least in the eyes of crypto traders.

Big losers in January included XRP, which tumbled 18%; Polygon’s MATIC, down 16%; and Filecoin’s FIL, off 16%. The big winner was the proof-of-work blockchain Ethereum Classic’s ETC, which gained 14% despite the project being a bit of an afterthought in crypto developer circles. Bitcoin (BTC), by far the biggest member of CD20, with an $854 billion market cap that’s roughly equivalent to all other blockchains combined, managed to eke out a gain, its fifth-straight month in the green. So did Ethereum’s native cryptocurrency, ether (ETH):

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/GUNFP7GDTJBPFHXFUGC6LEKXGQ.png)

Calendar

-

March 12-13:

Sub0 Asia

, Polkadot developer conference, Bangkok.

-

June 11-13:

Apex

, the XRP Ledger Developer Summit, Amsterdam.

-

July 8-11:

EthCC

, Brussels.

Edited by Bradley Keoun.