The Price Of Bitcoin Surged To $40,000 Despite Headwinds

There are various things occurring that many may consider bearish; it appears that bitcoin just doesn’t care.

Last Week In Bitcoin is a series discussing the events of the previous week that occurred in the Bitcoin industry, covering all the important news and analysis.

Summary Of The Week

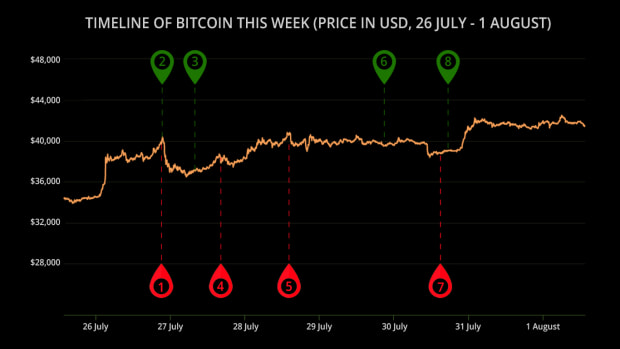

We’re back in the 40s, baby! Bitcoin spent most of the week hovering around $40,000, spurred by bullish news and unphased by the U.S. Senate’s planned attack on Bitcoin through their new infrastructure bill. There’s a lot to unpack from the week and we have a handy new timeline to show how different bits of news affected the price over the last week.

In short, Michael Saylor and MicroStrategy will keep HODLing, Amazon will not introduce bitcoin payments any time soon, large institutional investors are jumping on the bitcoin bandwagon and Kazakhstan is welcoming Bitcoin with open arms.

Highlights From Bitcoin Magazine Last Week

- Escrow Company Issues First-ever Bitcoin-backed Real Estate Loan

- First U.S. Bitcoin Mutual Fund Launched By $60 Billion Fund Manager

- One Of Germany’s Largest Asset Managers ‘considering’ Bitcoin Investment

- Congressman Warren Davidson On How The Last-minute Bitcoin Tax Bill Is Bad For America

- $41 Billion Hedge Fund Goldentree Has Added Bitcoin To Its Balance Sheet

Timeline Of Bitcoin News This Week

- Amazon Denies Report Of Accepting Bitcoin As Payment

- Bitcoin Briefly Tops $40,000 For First Time Since June As Cryptocurrency Rallies After Sell-off

- Kazakhstan Expand Its Bitcoin Mining to Global Market And Enable Users To Open Bank Accounts for Cryptocurrency

- Senator Warren: Crypto Puts Financial System in the Hands of ‘Shadowy Super-Coders’

- Senators Eye Cryptocurrency Taxes To Fund Infrastructure Plan

- MicroStrategy Pledges To Add More Bitcoin To Corporate Balance Sheet

- Bitcoin Mining Difficulty Rises For The First Time Since May

- $41 Billion Hedge Fund Goldentree Has Added Bitcoin To Its Balance Sheet

Bullish News

Let’s start with the bullish news. Just over a week after dipping below $30,000, bitcoin rallied past the $40,000 mark, briefly touching $42,000. The sudden surge was fueled by a report that Amazon would start accepting bitcoin payments. Amazon later denied the report, but it has remained steady around the $40,000 range.

Another big move this week that most in the mainstream media have brushed past is Kazakhstan moving towards very open Bitcoin legislation. Besides their efforts to draw bitcoin miners to their shores, they will allow their citizens to open bank accounts dedicated to cryptocurrencies such as bitcoin and spend it across the country. Not quite El Salvador-level adoption, but more countries may follow Kazakhstan’s more modest playbook over El Salvador’s.

MicroStrategy had their quarterly earning call this week where CEO and bitcoin aficionado Michael Saylor reiterated that the company will continue HODLing in the long term, despite seeing their holdings account for a material loss in value as bitcoin dipped during the reporting period. MicroStrategy remains one of the most important large scale HODLers and their confirmation is a good sign for market watchers.

Then there’s a bunch of financial institutions that have jumped on the bitcoin bandwagon over the last week, including GoldenTree, a $41 billion hedge fund. One of Germany’s largest asset managers, Dekabank, is also reportedly considering investment in bitcoin which could open up doors for further European adoption. Finally, ProFunds announced the launch of the first bitcoin mutual fund in the US which may pave the way for more in the near future.

Bearish News

Then there’s the bearish news. Last weekend a report emerged signalling that Amazon would allow bitcoin payments in the near future, sending bitcoin on a run. Tuesday, Amazon denied these rumours, which surprisingly didn’t affect bitcoin’s price as much as one would expect. Although bearish in the short term, it’s not completely outrageous to assume they would allow bitcoin payments eventually.

Senator Elizabeth Warren made waves this week as she noted bitcoin and other cryptocurrencies put financial control in the hands of “shadowy super coders.” Many of her remarks and misconceptions during the week proved misinformed and bearish. However, she did make sure to mention that crypto would pave the way to financial inclusion for the unbanked.

The U.S. Senate is currently busy trying to get their $1 trillion infrastructure bill passed which includes a provision to regulate and tax crypto. This may prove very bearish and a lot of Bitcoiners have been vocal against the bill. Hopefully the Senate comes to their senses, otherwise it will see Bitcoiners and companies focusing on Bitcoin exit the U.S. en masse.

Finally, although not necessarily bearish, Bitcoin mining difficulty increased for the first time since May as miners resettle in new territories after the Chinese crackdown. With countries like Kazakhstan, Paraguay and several U.S. states welcoming bitcoin miners with open arms and favourable regulations and incentives, it’s likely that mining will now be better spread throughout the globe. The slight downside here is that any increase in mining difficulty can push inefficient miners to sell some of their holdings.

Verdict

It’s been a good week for Bitcoin and the best is yet to come. The fact that bitcoin has remained steady around $40,000 is good news, despite the U.S. infrastructure bill’s planned regulation around bitcoin being the biggest factor to negatively affect its price and outlook in the short term.

If you bought the dip last week, then you’ve already seen a decent return. But the best is yet to come. Bitcoin is a long-term investment and the entire point of bitcoin isn’t short-term riches, but rather long-term financial freedom. If the U.S. does end up pushing through its “bear bill,” it won’t be the end of the world.

This is a guest post by Dion Guillaume. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.