The President of Brazil’s Central Bank Has a Meeting With Brian Brooks and Jeremy Allaire

The president of the Central Bank of Brazil is clearly serious about cryptocurrencies, and it seems that the country is becoming more and more interested in exploring blockchain solutions to increase the efficiency of its financial system.

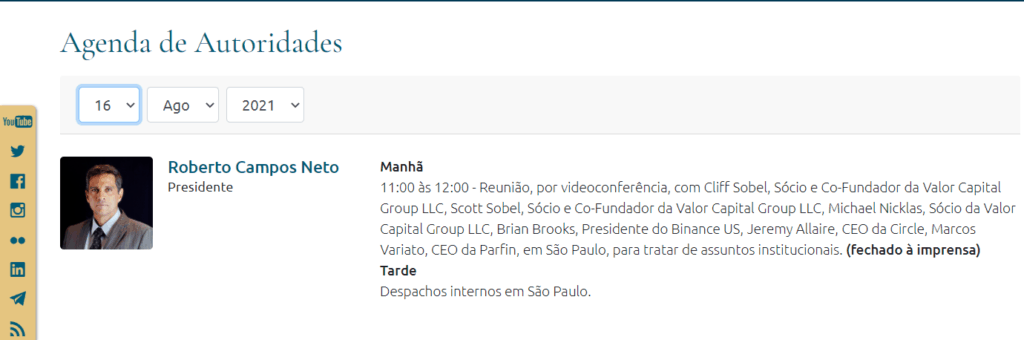

According to the Official Schedule of the Central Bank’s Authorities, Roberto Campos Neto, the head of the Central Bank, held a videoconference with Brian Brooks and Jeremy Allaire on August 16 at 11 a.m.

Also participating were the co-founders of Valor Capital Group LLC, a venture capital firm that has invested heavily in the development of several Brazilian startups.

Brazil Wants To Win The Crypto Race

The Central Bank did not disclose further details. The agenda explicitly states that the meeting was closed to the press, making its content confidential. The only thing that was mentioned is that they discussed institutional matters.

Brazil is the most advanced country in South America in terms of cryptocurrency ETFs. It currently holds 2 Bitcoin ETFs, an Ethereum ETF, and another ETF that tracks a basket of cryptocurrencies. In addition, the contry is experimenting with blockchain technologies under a regulatory sandbox that started in 2020.

Earlier this year, Brazil developed the PIX system, a new interbank payment infrastructure, which supports free 24/7 transactions amongst different banking institutions. Following its launch, the president of Brazil’s Central Bank stated that issuing a CBDC could be the next logical step on Brazil’s path towards an evolution of its banking system.

What Did They Talked About?

Considering the above, it is possible to make some assumptions about what was discussed at the meeting. It is possible that a proof-of-concept of this theoretical CBDC may have been under discussion.

Circle is the lead company behind USDC, a dollar-backed stablecoin that enjoys an excellent reputation in the United States, mainly because it is backed by Coinbase.

On the other hand, Brian Brooks comes from running the North American branch of Binance and leading the legal team for Coinbase and the U.S. Office of the Comptroller of the Currency. His opinions could be of great utility in clarifying certain legal concepts and international scenarios associated with the issuance of a CBDC. However, given his recent resignation, it is likely that the videoconference involved a third party acting on his behalf, considering that he may have been invited because of his position as a CEO of Binance.US.

This third party could be Joshua Sroge, the CFO of Binance.US since January 2020, who was recently appointed as the new interim the company’s new interim CEO.

It is also likely that some points regarding the current state of the cryptocurrency ecosystem in the country were being discussed, considering the investors involved.

However, it is still too early for speculation. The President of the Central Bank has not issued any statement, so there is the possibility that it was all an exploratory meeting before further approaches, something widespread in the Brazilian administration.