The North American Bitcoin Mining Index

The NABMI studies the growing Bitcoin mining industry in the U.S. and Canada.

The North American Bitcoin Mining Index.

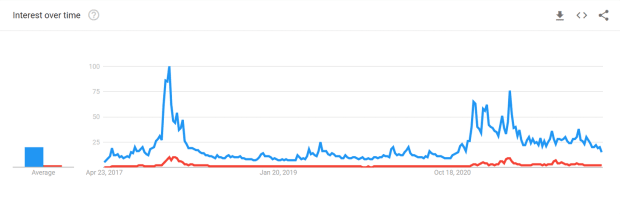

Chinese Bitcoin miners, exit stage left.

Five provinces including Inner Mongolia, Xinjiang, Qinghai, Yunnan and Sichuan have either outright banned the industry, or curtailed it to levels previously unseen through regulations. And now, for the first time since the advent of ASICs in 2013, the core of Bitcoin’s mining industry is looking for a new home.

North America in particular is waiting with open arms to welcome these migrating miners. Mature capital markets, renewable and mixed energy sources, and a cohort of young firms make the continent a natural location for a large percentage of hashrate exiting China.

In Compass Mining’s North American Bitcoin Mining Index, the growing Bitcoin mining industry in the U.S. and Canada is studied through data analysis, conversations with industry insiders and literature review to sketch a comprehensive summary of the region’s mining ecosystem.

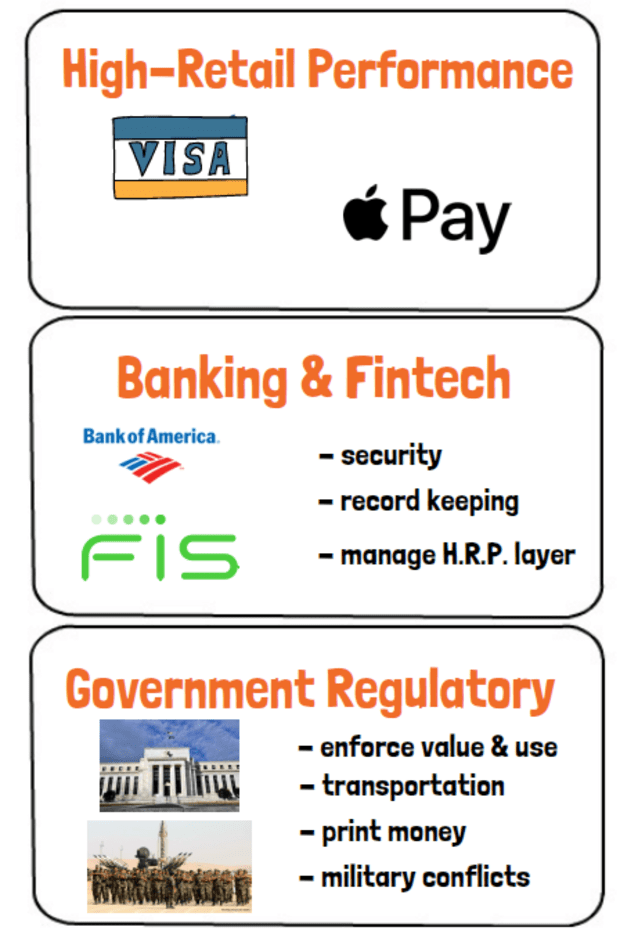

Chapter 1 begins with a review of jurisdictional and regulatory challenges in the U.S., finding that while U.S. regulations remain in a relatively undefined position, the process around creating and implementing regulations is both more transparent and stable than Chinese government practices. North American capital and energy markets are also reviewed, which both give significant advantages to U.S.-based mining companies compared to their Asian counterparts.

Chapter 2 asks if the U.S.-based mining industry can compete with China’s historic dominance in the Bitcoin mining industry. As Chinese officials force miners out of their country, U.S. miners have an opportunity to fill the newly-created void in Bitcoin’s hash power. Depreciation in hardware advances also indicates a significant weakening in the dominance of Chinese mining hardware manufacturers.

Chapter 3 focuses on Canada’s Bitcoin mining industry, which is marked by bureaucracy, cheap energy and weaker capital markets compared to the U.S. Tradeoffs between energy costs and regulatory overhead is a key dynamic of Canada’s relationship with the Bitcoin mining industry.

As Bitcoin mining ends its chapter as a China-dominated industry, a new era begins with North America being well positioned to become a new leader in Bitcoin’s global hash rate distribution. Migration, competition, and hopefully increased decentralization define the next phase of mining. In the North American Bitcoin Mining Index, all signs point to North America being home to a significant amount of Bitcoin hash rate for many years to come.

William Foxley

Editorial Director

Compass Mining

This is a guest post by Compass Mining. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.