The Most Populat Airdrops to Watch For in 2024

Whether you’re new or a seasoned DeFi user, chances are you have heard the term airdrops every now and then.

That’s because airdrops are a popular marketing strategy for DeFi protocols and crypto companies for several reasons:

- It allows protocols to reward their community members for their activity and engagement in their respective platforms, thus further incentivizing users to stay in the protocol.

- It helps projects drive awareness and new traffic to the brand and a product/service —especially if they’re releasing their native token.

As DeFi evolved through the years, so did the way protocols planned their airdrop campaigns. Crypto projects are constantly developing sophisticated airdrop strategies and better ways of delivering rewards, like gifting non-fungible tokens (NFTs) that grant users unique merchandise or access to exclusive content.

The following guide covers some of the hottest crypto airdrops for 2024 — potential, confirmed, and even recently distributed airdrops. You’ll soon notice that qualifying for them boils down to actively engaging with the protocols’ respective features, interacting with their testnets, creating new wallets, and referring friends to the protocol, among other activities.

Here are a couple of our guides on the topic that you might find interesting:

What Are Crypto Airdrops And How to Find the Next Major One?

Airdrops on Solana: The Most Popular Tokens Without a Token

Note that any airdrop or token launch, unless confirmed by the respective protocol, is speculative and not guaranteed.

Jupiter

Jupiter is a leading liquidity aggregator on the Solana blockchain, with over 1.2 million users actively swapping and trading assets on its platform. It handles between 60% and 70% of all the DEX volume on Solana.

Jupiter remained tokenless until the founding team unveiled their plan to launch the protocol’s native token, JUP, on January 31, accompanied by an official airdrop.

The airdrop itself was successful, and JUP is now one of the top 100 cryptocurrencies by market cap.

How did it work?

- Around 40% of the 10 billion JUP tokens are reserved for the community through airdrops.

- The tokens will distributed through four airdrop rounds, with the first happened January 31. Other dates will be disclosed.

- Half of the tokens will go to the community; 20% is vested for the Jupiter team.

- Token distribution is based on users’ past engagement with the platform, considering activities like trading volume on the site.

- The JUP token is designed to govern a future Jupiter DAO.

- Revenue sharing for the JUP token will only occur after Jupiter witnesses a tenfold increase in its user base, which is estimated to take two years.

This means you can still qualify for the future rounds airdrop. Here’s how:

- Visit the Jupiter website and connect your Solana wallet.

- Choose one of the many activities in Jupiter, such as Swaps.

- You can also check out their Perpetual trading section or leverage their bridge feature to perform cross-chain operations.

Since Jupiter is native to Solana, if you want to check out other top Solana protocols that are yet to launch a token, check out our video:

LayerZero

LayerZero is an Ethereum-based interoperability protocol that connects multiple blockchains, allowing dApps to communicate with different networks through a single relayer. For example, Stargate, a liquidity transfer protocol, uses LayerZero’s messaging system to enable cross-chain transfers.

The team behind LayerZero confirmed the plans to launch the protocol’s own token in the first half of 2024, leading to speculation about a potential airdrop.

While specific details of the airdrop terms may still be pending, crypto users are convinced that the token’s release will come with an airdrop. Others speculate that the token, similar to previous projects in the Ethereum ecosystem, will grant users governance rights., giving them control over LayerZero’s future.

How to qualify:

- The idea here is to interact with protocols that have integrated LayerZero.

- Stargate, Curve, Shrapnel, and Pendle are some popular options.

- For example, you can stake STG tokens on Stargate, provide liquidity to receive a passive income, or become an active user in its DAO community.

Marginfi

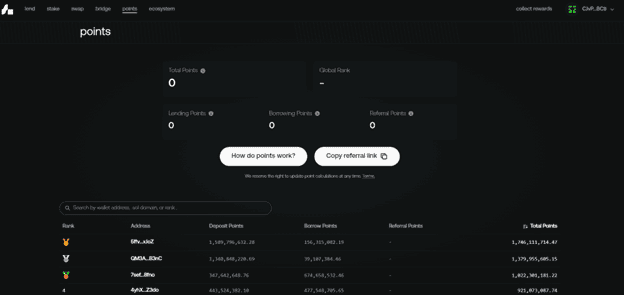

Marginfi is a decentralized lending protocol without a token currently, but speculation suggests a potential token launch in the future. The protocol offers advanced risk management in lending services, benefiting both lenders and borrowers.

While Marginfi hasn’t revealed any plans to launch a token, airdrop hunters are convinced otherwise, mainly because the protocol employs a points system and is backed by numerous investors and VCs.

Lending, borrowing, and referrals are just some ways users can accumulate points, potentially leading to eligibility for an airdrop.

Steps by step, the process to qualify might look like this:

- Visit the Marginfi website and connect a Solana wallet

- Staking, swapping, and bridging assets will help you qualify.

- However, lending, borrowing, and referring are the best ways to earn “mrgn points.”

- Users with current deposits earn points (1 point per day per dollar lent). More lending and longer duration result in more points.

- Borrowers receive more points than lenders (4 points per day for $1 borrowed). Collateral for borrowing also counts for lending points.

- Referring users earn 10%, and this continues down the referral tree as more users refer others.

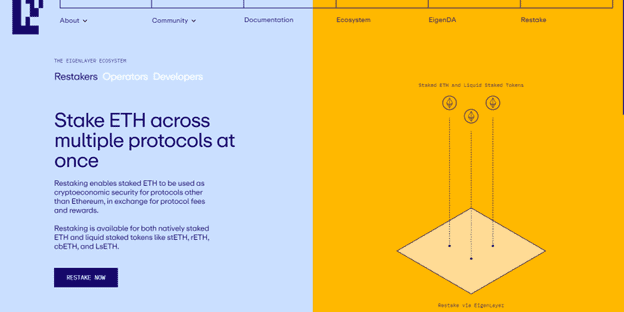

EigenLayer

EigenLayer, an Ethereum-based liquid staking protocol, has become the center of attention in crypto communities, especially for airdrop hunters.

EigenLayer has a feature called restaking — it allows ETH stakers to restake their coins on various Ethereum-based protocols, creating a robust blockchain ecosystem with pooled security using the restaked tokens.

The protocol has introduced several innovative features for yield farming and staking. The amount of active development and the points system that rewards its depositors has airdrop hunters carefully waiting for a potential token drop. Well, that and EigenLayer’s roadmap, which states that the team will launch the mainnet in Q3 of 2024, adding a payment and slashing systems.

How to qualify in case of a future airdrop:

- Go to the app and connect your wallet.

- Choose from any of the available pools

- Stake rETH or sETH

- Do this regularly to increase your chances to qualify

Base

Base, an Ethereum Layer 2 (L2) chain developed by Coinbase in collaboration with Optimism, offers a secure, cost-effective, and developer-friendly environment for on-chain applications.

There are speculations about a potential airdrop, mostly because Coinbase’s Chief Legal Officer has hinted at the possibility of a future token launch, so it’s not entirely ruled out.

Unsurprisingly, this statement sparked a wave of speculation, keeping airdrop farmers and Base users on alert for a possible airdrop anytime in 2024.

Early users may be eligible for an airdrop if they engage in regular transactions on the ecosystem using trusted protocols like the Rhino.fi bridge and trade on Dexes like Uniswap and Odos. Those are just some of the most popular apps on Base.

Risks & Security Practices to Consider Before Hunting Airdrops

Airdrops are becoming increasingly popular in the cryptocurrency industry, but just as their popularity grows, so does the number of risks that could endanger our financial positions and even sensible data.

- Wallets: having a crypto wallet is indispensable when participating in airdrops. Be sure to use a wallet with a robust algorithm to generate random seed phrases that are ultimately hard to crack by hackers.

- Tax Liability: airdrops are taxable in the US and other certain jurisdictions.

- Potential scams: not all airdrops are valuable, and some may be associated with scams or low-quality projects.

- DYOR: please do your research (DYOR) about a project, make sure you click on the correct links, double-check URLs, don’t sign anything unless you’re sure about its legitimacy, and exercise caution before participating in airdrops.

- Market Volatility: market volatility can cause airdrop tokens to experience chaotic price swings.

The post The Most Populat Airdrops to Watch For in 2024 appeared first on CryptoPotato.