The lowest Bitcoin volatility since May 2017: Is it time for a move? (Updated)

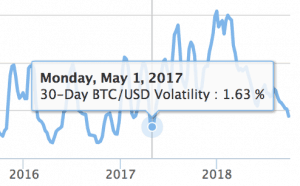

Volatility in the price of Bitcoin has hit its lowest point since May 2017. The 30-day estimate shows that Bitcoins volatility has only been 1.71%, while the 60-day estimate is 2.43%.

The larger trend shows that as the price has increased over the years, volatility has decreased

A Sign that investors are choosing to hold their BTC?

Low volatility is usually a sign that investors are simply holding onto their Bitcoins, as opposed to buying or selling. This may be due to the anticipation of an upcoming event, like a possible Bitcoin ETF approval on October 26th, or the fact that more investors are starting to see Bitcoin as a store of value like Gold. A more stable Bitcoin market could actually benefit the remaining ETF applications that the SEC has to review. The price of Bitcoin has traditionally experienced significant pumps and dumps around the time an ETF application was being reviewed. This has probably discouraged the SEC from approving a Bitcoin ETF because of the fear that the markets could be manipulated. If the Bitcoin price remains steady all the way to the end of October, the SEC may see this as a sign that the markets are operating with ‘good behavior’ and approve the ETF.

If manipulation has been occurring in the markets, the low volatility could be a sign that it is becoming more difficult for whales to manipulate the price of Bitcoin.

“The low volatility is also a statement that price manipulation has perhaps abated. After wild swings and roller coaster rides, Bitcoin looks to have settled into a long-term relationship with its investors, who are not speculating their days away and appear to be in it for the long haul.”

– Says FXEmpire financial expert Bob Mason

It could be the case that the traditional methods crypto whales use to manipulate the price of BTC have less of an effect on investors, who are now focused on longer time horizons, and are therefore unfazed if they lose or gain a few percentage points along the way.

Could there be a big move coming soon?

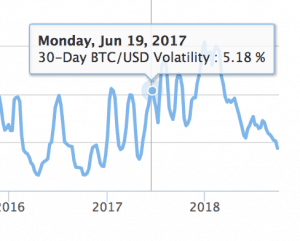

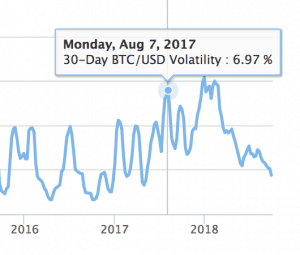

It should be noted that the 30-day volatility experienced on May 1st, 2017 (1.63%) was followed up by a volatility of 5.18% on June 19th and 6.97% on August 7th.

The data suggests that there may be a big move coming within the next month or so which could bring higher volatility back to the BTC price.

Ultimately, low volatility is a positive sign for long-term investors, but a negative to day traders, who make their profits off the extreme daily swings experienced in the crypto space. At this stage, it seems like an ETF approval is the only real catalyst that could push the price of Bitcoin high enough to bring back the same levels of volatility experienced during the earlier half of 2018. Until then, day traders and speculators will either have to trade the low volatility for smaller gains, or simply hold their position like everyone else.

Market Update October 12

Bitcoin finally experienced a hefty amount of volatility on October 11th, although perhaps not in the direction

most traders would have wanted: BTC dropped by about $300 (or 5%), and ETH lost 11% of its value.

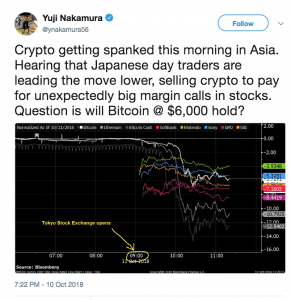

Although there is no clear reason for the price drops, some are speculating that traders in the Asian markets began selling their crypto in the early hours of the day to pay for unexpectedly big margin calls in the declining stock market.

Others have speculated that the recent suspension of fiat deposits on Bitfinex may have led to the crash.

Last week the exchange was reported to have moved their fiat funds from Noble Bank in Puerto Rico to HSBC. However, Bitfinex was actually banking with HSBC through a private account via Global Trading Solutions. It’s possible that HSBC was not aware of their banking relationship with Bitfinex, and upon finding out, may have suspended or even closed the account. These issues have also led to insolvency rumors being spread about the

exchange, creating further FUD that may have contributed to the decline.

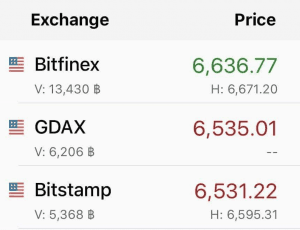

Yesterday the price of BTC on Bitfinex was $100 higher than on GDAX and Bitstamp. This price discrepancy was likely due to the lack of fiat deposits on the exchange.

Regardless of the reason, the return of volatility to the market should help create a sense of normalcy that was missing during the 2 weeks of consolidation, even though the overall sentiment still remains bearish.

The post The lowest Bitcoin volatility since May 2017: Is it time for a move? (Updated) appeared first on CryptoPotato.