The Inherent Greed Of The Fiat System

The current monetary system of the world exposes the poor and disadvantaged to continuous debasement of value.

Think back to the first time you were given a dollar. You were four, maybe five years old. It is a powerful first for a child: the first time you buy something with your own money. You handed the clerk your dollar and he exchanged with you an ice cream, a candy bar, or a toy. It likely made you feel powerful, sophisticated, independent. The act of exchanging something you want less for something you want much more is an intoxicating feeling for a human in development.

My mother had a story from the early 90s about a friend who gave her five-year old daughter a dollar. The friend lived very well as several of her neighbors were Los Angeles Lakers at the time. The girl had everything she could ask for in life. Yet when she was given a dollar (likely not for the first time) she was insistent to a tantrum that she shall spend it on the only option available to her: a bottle of water from a vendor in a park. The mother said, “Sweetie, we have water at home and we will be there in five minutes.” The child yelled, “I WANT TO SPEND MY DOLLAR!” To squelch further public embarrassment, she let the girl have her way and bought a 12-ounce bottle of Crystal Geyser at a premium while minutes away from relatively free water.

Fast forward 30 or so years and I still remember listening to my mom tell this story like it was yesterday.. It was funny to think that the girl did not have foresight and patience enough to pocket the dollar and save it for a more opportune time. There are many studies on behavioral science that could answer this in depth and even the woman who was a psychiatrist may have her own theories to the actions of her own daughter. Sometimes, the simple answer is the most profound. I believe this is a classic case of greed, and this sin is a pandemic to our society.

“For from the least to the greatest of them,

everyone is greedy for unjust gain;

and from prophet to priest,

everyone deals falsely.” – Jeremiah 6:13

When I say “society,” I do not mean simply the rich. Like this Old Testament passage states, all people can be convicted of the sin of greed. Even still, many people will strongly deny this and discard it as the sin of someone else. It’s hard to catch yourself in the middle of being “greedy.” Generally speaking, we internally justify every desire as appropriate. It is an unwelcome chore to validate your desire for fear of being overruled by logic, your parents, or your spouse.

Despair In The Dependence On The Dollar

Our interaction with external forces result in specific reactions. The more we understand those, the better control we have over the events in our life. For me (and likely others), sugar elicits hyperactivity, “League of Legends” elicits stress, and the beach elicits relaxation. And when it comes to our interaction with forms of money, we are not numb to its effects on us.

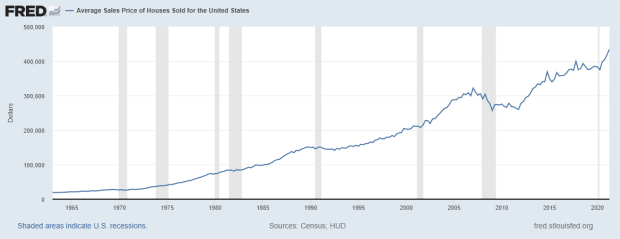

Why does an individual feel like they need to spend all their money immediately? This dynamic can come from the nature of the money being used. A fiat currency note is designed to place consumers in an urgent state: consume or risk losing that specific opportunity. This is not far removed from a predatory used-car dealer that will not let you leave the building without the deal currently being offered. For people that are primarily consumers (most of the world’s population), this is equivalent to an “economic death row.” There is a perpetual negative-feedback loop where a decision to defer purchases is penalized with price increases. Buying anything immediately in this world’s economy is a better choice than buying nothing; even if that something is a low-quality, consumable good. Assets like homes and land in America are escaping the reach of the common worker and the mainstream media is trying to soften up the population to that harsh new reality.

Holding your value in fiat currency is a type of investment. Because of its perpetual loss of purchasing power over time, an investment in this asset is most appropriate only to prepare for the most near term of purchases. If you make the decision to hold large amounts of fiat currency, your preference is to position yourself to buy as much as you possibly can today. This is the epitome of instant gratification; greed to its core.

“There is treasure to be desired and oil in the dwelling of the wise; but a foolish man spendeth it up.” – Proverbs 21:20

What is left to buy when your five-year plan to save for a home is miscalculated due to inflationary events that feel like a 2000s apocalypse movie? A money that knows no bottom is a money that must purchase the nearest available good or service. Plans for honest asset accumulation must be scuttled for consumerism. Coupled with media palliation, major investment firms purchasing massive amounts of residentials on loans that regular people cannot obtain, and media pressure assaulting the single-family home urban zones will exponentially increase the premium on land in America where only the ultra wealthy can even think about owning it.

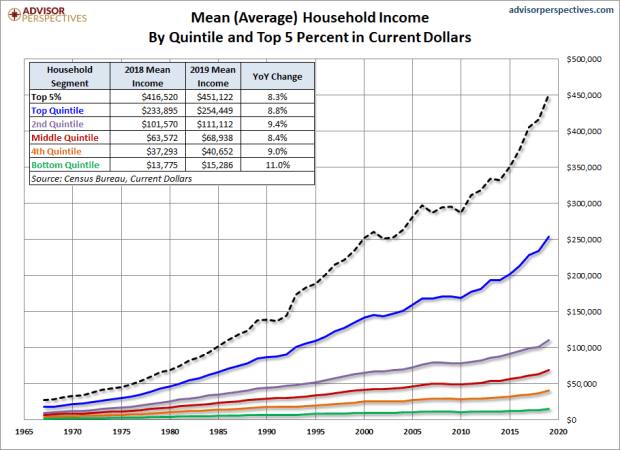

By its nature of greed, fiat currency unceasingly redistributes wealth to the highest of classes. Comparing household income by quintile to the median price of a home paints a clear picture:

Image source

Image source

In the late 1960s, the average salary in the bottom 20% in America could purchase a median-priced home. In 2019 (2020 numbers to update in September), only the average salary in the top 5% in America could purchase a median-priced home. In the 50 years since the world monetary system has removed itself from a gold standard, a system where a hard working citizen has the prospect for property ownership has been eroded to a system closer to some plutocratic-socialist mix: the rich control, the rest contend. This problem could only be worse in other parts of the world.

Benevolent Benefit Of Bitcoin

As the dollar lends itself to greed, so bitcoin lends itself to contentment, or fulfillment. Doubting “no-coiners” claim that the Bitcoin system is full of gamblers who became lucky and do not deserve the gains attained. While many gamblers may have come to bitcoin for a quick dollar, the mentality and movement of the network is the reason people stay. Gamblers can never be loyal to what bitcoin can do for the world: a means of property rights for every person on the planet. Speculators can never care about what bitcoin means to the world financial system: an asymmetric alternative to fiat debasement and centralized theft in every country of the world (except El Salvador — for now). Narrow-minded people that only care about the price of bitcoin do not see or care for the important technology it is: a peer-to-peer settlement network not controlled by an entity beholden to any government or institution that wishes to censor or monopolize exchange and commerce.

These factors, along with the prospect that others will also grow to see the same embedded truth of bitcoin, is what keeps people around. To narrow the focus to a household, if a person is to set aside wealth and security for offspring and older relatives for their own benefit, there is no greater gift than bitcoin itself. For years, it has proven to be a true product of network effect and central bank failures, resulting in continual appreciation against alternative investment vehicles. A wise benefactor would have enough foresight to understand this precondition is not changing anytime soon and establish a nest egg primarily in bitcoin, with any other asset being secondary. Contrarily, choosing to save any sort of fund for a loved one primarily made of any form of fiat currency would be a relative curse. Does 13%-28% annual devaluation sound like a good long-term gift to any rational thinker?

Being drawn to bitcoin has a passive effect of removing greed or covetousness from your life. Some people would argue that real estate or equities share in a similar low-time preference. This is true to a degree, yet the non-fungibility of a piece of real estate will naturally benefit from detriment to another piece of property. The most based desire for your real estate is that yours is better than others. Bitcoin is inclusive, separated only by quantity, where the only incentive for all parties in the network is working to increase bitcoin value for the betterment of all stakeholders. There is less reason to desire your neighbor’s possessions.

Even investing in a socially conscious company may induce a feeling of alignment with a good cause. But no publicly-traded company can compete with Bitcoin’s ability to confer property rights for all who participate. Bitcoin is empowering to unbanked and persecuted people around the world through permissionless blockchain transactions. If rulers block their people from basic human needs to increase their power, how does an organization efficiently assist the people? If it is not through bitcoin, they are hemorrhaging potential impact. Additionally, any company can dilute your current stake thereby making the very company invested a counterparty risk to the investor. Bitcoin? 21 million coins of reliably-capped supply.

Bitcoin’s hardness returns an increased feeling of reliability leading to less greedy sentiment than any dollar-based asset could ever achieve. A balloon with a leak must keep on adding more air to maintain its current buoyancy; forget about flying higher. A perfectly-sealed balloon is like anti-inflation money. It does not need more mass to maintain its state of being. The balloon is naturally content with its allotment. To grow is nice, but to grow is not necessary for survival. Jeff Booth’s writings on the path to abundance makes this perfectly clear. If we allow technology to be the deflationary force it is meant to be, the cost to survive becomes a much smaller effort. Food, shelter, and property are made more accessible because a Bitcoin standard makes it impossible to artificially reallocate resources through debasement. Bitcoin makes honoring the 10th commandment so much easier,

“You shall not covet your neighbor’s house; you shall not covet your neighbor’s wife, or his male servant, or his female servant, or his ox, or his donkey, or anything that is your neighbor’s.” – Exodus 20:17

Further from a biblical perspective, the parable of the talents (Matthew 25:14-29) epitomizes the virtues of economic principles. Here, Jesus describes a story of a master who has entrusted his three servants with different amounts of “talents” or assets while he is away. The two faithful servants engaged in fruitful business or investments with their allotment and returned double what they were given. However, the third servant made illogical excuses for his lackluster work of simply burying his allotment in the ground — what sounds a lot like fiat in a bank. The master celebrated the effort of the first two and punished the third. Biblical scripture taught that productivity was a good thing. The dollars we use today are inherently counterproductive where even with some work, the currency tools we use lead us down the path of the third servant. That is a path where the Bible says there is “weeping and gnashing of teeth” unless we change the way we perceive money.

Call To Action

Combining the liquidity of a fiat currency, the scarcity factor of a precious metal, the accessibility of the internet, and the security of astronomical proportions, bitcoin presents itself as a solution to asset ownership for the entire world. It is impossible to be priced out of bitcoin because of its divisible nature of satoshis (surprising how many people I come across in 2021 that do not realize this). By simply existing in and of itself as an asset and a network it increases in adoption and value. There is no reason for an asset this rich in attributes that define this age of technological growth to be ignored or scorned.

In my lifetime alone, sending a text message, “Hello World” from Harbor City, Califonia to Voronezh, Russia went from “impractically burdensome” to “click, click boom.” The digitization of communication broke up some monopolies so that we can speak to whomever we want instantly. The digitization of money has the potential to also disrupt the monopolistic consortium of finances to the benefit of billions worldwide. Our world has become complacent in relying on the government and centralized entities to provide services in a grossly inefficient way. One of those is the monetary exchange system. Just as democracy has replaced monarchy as the most appropriate form of government, our next mission as a world should be to divest our governments and their private agencies of unnecessary services so that technology and greater liberty may take their place.

We are living in an intensely special time; like a gold rush with a search engine. With bitcoin, we know where to get it, how much is out there, how much the world values it, and when people use it or hide it away. In closing, continue to share the vision of financial inclusion to those in the mental clutches of the legacy system. This fight must dematerialize a shroud of greed over this world through the sharing of truth in love and kindness. I implore you, Bitcoiners, to help the world understand the “digital steel vessel” for their earned value and why it is necessary to combat the poison fiat money we are forced to use today.

“Who is wise and understanding among you? By his good conduct let him show his works in the meekness of wisdom. But if you have bitter jealousy and selfish ambition in your hearts, do not boast and be false to the truth.” – James 3:13,14

This is a guest post by Ulric Pattillo. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.

![[promoted] Equity Trust Builds New Frontier Of Crypto-Based Retirement Accounts](https://www.lastcryptocurrency.com/wp-content/uploads/2018/09/3587/promoted-equity-trust-builds-new-frontier-of-crypto-based-retirement-accounts.jpg)