The Importance of Accurate On-Chain Data

Errors in the reporting of bitcoin’s on-chain data can drastically affect the volatility and price of the market.

Bitcoin market manipulation still exists:

The importance of on-chain analytics and blockchain data providers is rising in importance right alongside bitcoin’s price and overall adoption. However, with this increase of importance comes an increase of responsibility. Tens of thousands of traders now use popular on-chain data providers such as Glassnode, CryptoQuant and Coinmetrics. These traders are making instant reactions/decisions based on this data, trying to gain an edge over others. This incentive structure to be the first to act on the data creates a dangerous precedent for the influence of bad data on the market. These actions based on bad data can have serious outcomes for bitcoin’s price. Let’s take a look at a recent example from just two weeks ago.

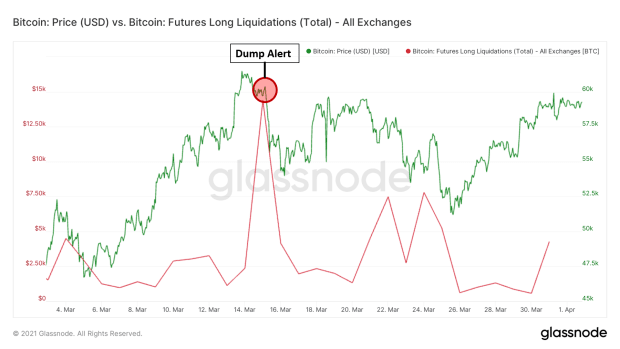

On March 14, 2021, an alert was sent out to over 28,000 traders subscribed to CryptoQuant’s telegram alert service saying $1 billion of bitcoin was transferred onto Gemini’s exchange, presumably to be sold. Within a minute, this immediately triggered a sell-off from traders, ultimately leading to a cascade of long liquidations totaling 14,396 BTC, or roughly $850,000,000. This was ultimately the catalyst for a massive drop in price and the several day consolidation that followed.

It turned out that the transfer was actually Blockfi transferring bitcoin into Gemini’s custody solution service, making the transaction actually bullish. This is a classic example of how misinformation can be the catalyst for a market dump. When funding levels go up and traders become increasingly bullish, more leverage naturally moves into the market.

You can think of this like a game of Jenga where you’re stacking pieces higher without a strong foundation. As the Jenga tower is built higher, it takes increasingly less of a push to collapse the entire thing. This is the same way leverage works in the bitcoin market. The more bullish speculative traders become, the more leverage is in the market, ultimately making it more fragile. A catalyst such as the bad data CryptoQuant put out is all that’s needed to initiate a cascade of liquidations. As one trader hits their stop loss, they have to sell (or liquidate) which pushes the price even further down, causing the next trader to hit their stop loss. This is what I am referring to as a “cascade of liquidations.”

I strongly encourage data providers to be warier of the information they are putting out, as, at the end of the day, they are manually labeling these wallet addresses. One mistake can cause the loss of massive sums of money. With this being said, I encourage traders to look at multiple data providers to get the most accurate picture of what’s going on in the market. Hopefully, as we move closer to hyperbitcoinization, new data providers will come about. This is ultimately bullish for the ecosystem and a net positive for traders, as information confirmed across 10 data providers is much more likely to be accurate than reported by just one. I also encourage the data providers that do exist currently to be more cautious and hesitant to put out information publicly without being absolutely sure that the data is accurate. Although a great deal of respect is due to these providers and the value that they are bringing to the space, we must keep them in check to get the most accurate information possible. After all, the mantra of Bitcoin is don’t trust; verify, and billions are on the line here.

This is a guest post by William Clemente III. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.

![[promoted] Hashtoro Propels Cryptocurrency Cloud Mining](https://www.lastcryptocurrency.com/wp-content/uploads/2018/09/3709/promoted-hashtoro-propels-cryptocurrency-cloud-mining.jpg)