The IEO Question: Revolutionary Fundraising or Exchange Token Pumps? BNB, HT, OKB and KCS Seen Enormous Gains

Major cryptocurrency exchanges such as Binance, KuCoin, Huobi, Bittrex, and OKEx have initiated what seems to be a new trend in cryptocurrency fundraising. Initial Exchange Offerings (IEOs) have proven to be massively successful for the projects aiming to raise money. The first to lead was Binance exchange with its Launchpad platform, but the others were quick to follow.

Now, we can identify a new trend within IEOs – the implementation of a minimum token holding requirement. In other words, users have to hold a predetermined amount of the exchange’s native tokens in order to be able to participate, for example, Binance requires holding BNB tokens to participate in their future IEOs.

The question is, whether this is the beginning of a revolutionary fundraising model or just a scheme to pump the price of the exchange tokens?

Binance Initiates the IEO Craze

Following the success of its first three IEOs (BitTorrent, Fetch.AI, Celer Network), Binance has decided to change the participation course. Users were unhappy. The demand to participate in these IEOs is enormous because of the massive returns they yield once the tokens start to trade on the market.

To curb the demand and give priority to Binance Coin (BNB) token holders, Binance decided to switch the model and moved to a lottery-like distribution mechanism. Users can purchase tickets based on the amount of BNB they’ve been holding for a selected period before the IEO. These tickets are then drawn randomly, allowing each ticket holder to buy a specified amount of tokens during the IEO.

Hence, their newest IEO will be held under this structure. Binance has already announced that they will initiate balance screenshots for the Matic Network token sale.

Less that 24 hours ⏰ remain until $BNB balance snapshots begin for the @maticnetwork token sale on #Binance Launchpad.

BNB will only be deducted from your account if you have a winning ticket(s) after the 20 day holding period.

More details here: https://t.co/CfPwLJcrTA pic.twitter.com/GKDS8ppaOo

— Binance (@binance) April 4, 2019

Other Exchanges Follow Up The 500 Rule

While Binance was the only exchange to implement a lottery-like distribution model for its IEOs, its move to announce a minimum token holding requirement was quickly picked up by other major exchanges.

Huobi, for instance, has a rule for participating on its Huobi Prime IEOs, which requires users to hold a minimum of 500 Huobi Tokens (HT) for at least 30 days before the IEO takes place.

Another exchange to follow and do the same thing is OKEx. Its first IEO will be held on April 10th, and users have to hold 500 OKB for seven consecutive days before the start to participate.

It’s also worth noting that all IEOs only allow participants to buy the tokens subject of the sale using the exchange’s native tokens. In other words, you can’t use any other cryptocurrency or fiat besides the native tokens of the exchange. Hence, they create demand for their token. This could remind the ICOs bubble of 2017 in regards to holding Ethereum in order to participate in ICOs.

Serious Pumping of Exchange Tokens

As pointed out above, the demand to participate in those IEOs is overwhelming. Hence, people are buying native exchange tokens at an unprecedented rate, causing almost all of them to skyrocket.

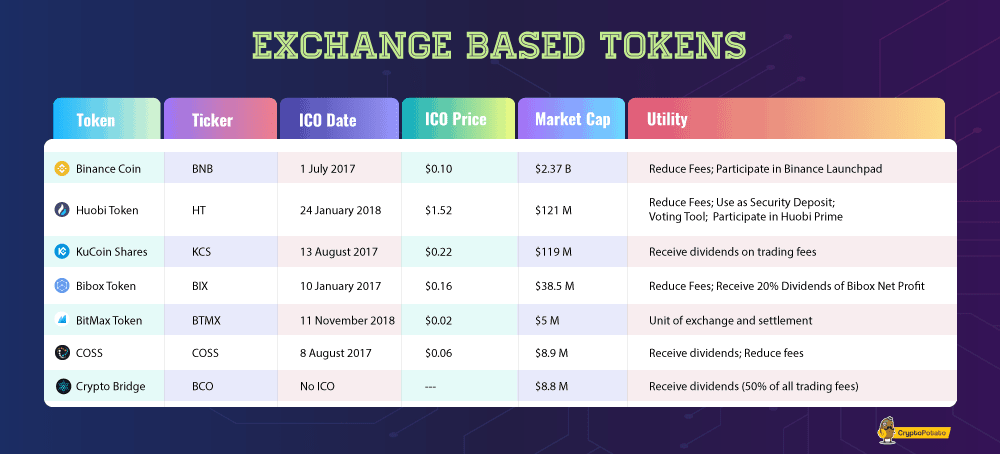

In the past three months, for example, Binance Coin (BNB) has more than tripled its price, reaching a high of $20 per coin. As shown above, BNB’s ICO price was $0.1, which is precisely 2000% ROI. Huobi Token (HT) is also marking gains upwards of 15 percent. Similar increases can be observed with OKEx’ OKB and KuCoin Shares (KCS).

It’s also worth noting that all of this happened before the implementation of the minimum holding requirement when users didn’t have to purchase, i.e., 500 BNB to be eligible to participate in Binance Launchpad based IEOs. At that time, they could buy smaller amounts to participate.

Final Words

Now that things have changed, it’s entirely possible that we might be seeing further increases in the prices of these native exchange tokens. Moreover, users are also required to be holding them over a certain period, which is also likely to curb the selling pressure.

Of course, high demand for IEOs can always be interpreted as a very positive signal for the industry, in general. The question is whether IEO investors are there for the projects themselves, or just for the relatively quick gains and the more important issue is how long will it last.

The post The IEO Question: Revolutionary Fundraising or Exchange Token Pumps? BNB, HT, OKB and KCS Seen Enormous Gains appeared first on CryptoPotato.