The ICO’s Comeback? IEOs Raised $262 Million In 6 Months

CoinGecko published its crypto market report for Q2 2019. The document reveals that Initial Exchange Offerings (IEOs) are on the rise with 72 projects raising a total of $262 million in the first half of 2019.

Binance’s Initial Exchange Offering Platform, Binance Launchpad, started the “IEO frenzy” in January 2019, raising $7.2 million in 14 minutes for Bittorrent.

‘IEOs Seem To Have a Ceiling of $20 million’

While the average amount that Initial Exchange Offerings raised in H1 2019 was $3.7 million, the report revealed that the sums varied severely from project to project.

The smart contract platform WaykiChain collected the largest sum, raising $18.5 million, followed by Lambda ($16.4 million), Poata Token ($15.4 million), Blockcloud ($15 million), and Top Network ($15 million).

Only these projects managed to get funding above $10 million through their IEOs, representing 31% of the amount raised in the first half of 2019.

“IEO projects seem to have a ceiling of $20 million in amount raised,” the report reads.

Upcoming and Recent IEOs

| Name | Status | Date | |

|---|---|---|---|

Binance Launchpad Elrond Network |

finished | 01/07/19 | More Infromation |

IEO on Bitforex IEO on Bitforex

Blockium |

finished | 20/06/19 | More Infromation |

IEO on Probit IEO on Probit

Guider |

finished | 01/06/19 | More Infromation |

IEO on Crypton IEO on Crypton

Crypton |

finished | 30/05/19 | More Infromation |

Binance Launchpad Harmony |

finished | 27/05/19 | More Infromation |

Binance, Gate.io Lead The Way

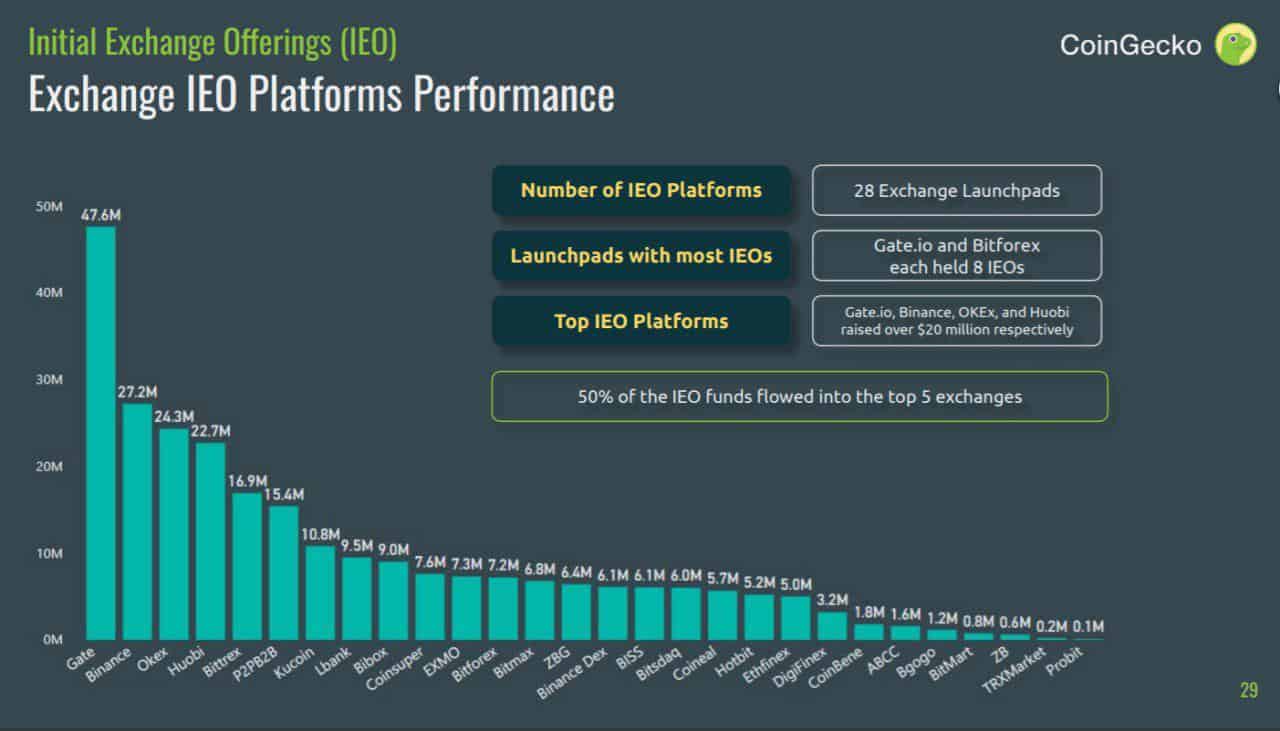

CoinGecko’s research shows that the amount raised in IEOs not only differs by the project but by the exchange were the token sale was hosted.

According to the study, approximately 50% of the IEO funds have flowed into the top five crypto exchanges with Gate.io, Binance, Okex, Huobi, and Bittrex leading the way raising $47.6 million, $27.2 million, $24.3 million, $22.7 million, and $16.9 million respectively.

The researchers have compared how different crypto exchanges have performed based on the ROI of the IEOs launched on their platforms.

Surprisingly, the cryptocurrency exchanges ZBG and ZB are in the lead (with an ROI of 820% and 553%) with Binance (513%), Gate.io (505%), and Hotbit (320%) following them.

Despite their high-performance IEOs, both ZBG and ZB had only launched one IEO project, the researchers explain. Therefore, CoinGecko considers Binance and Gate.io as the top crypto exchanges for IEOs.

An interesting fact about IEOs is related to the Bitforex crypto exchange that launched eight IEOs on its platform – the same number as Gate.io. Despite having the most Initial Exchange Offerings among all exchanges, Bitforex’s ROI is in the negative with the average Return on Investment being -37%.

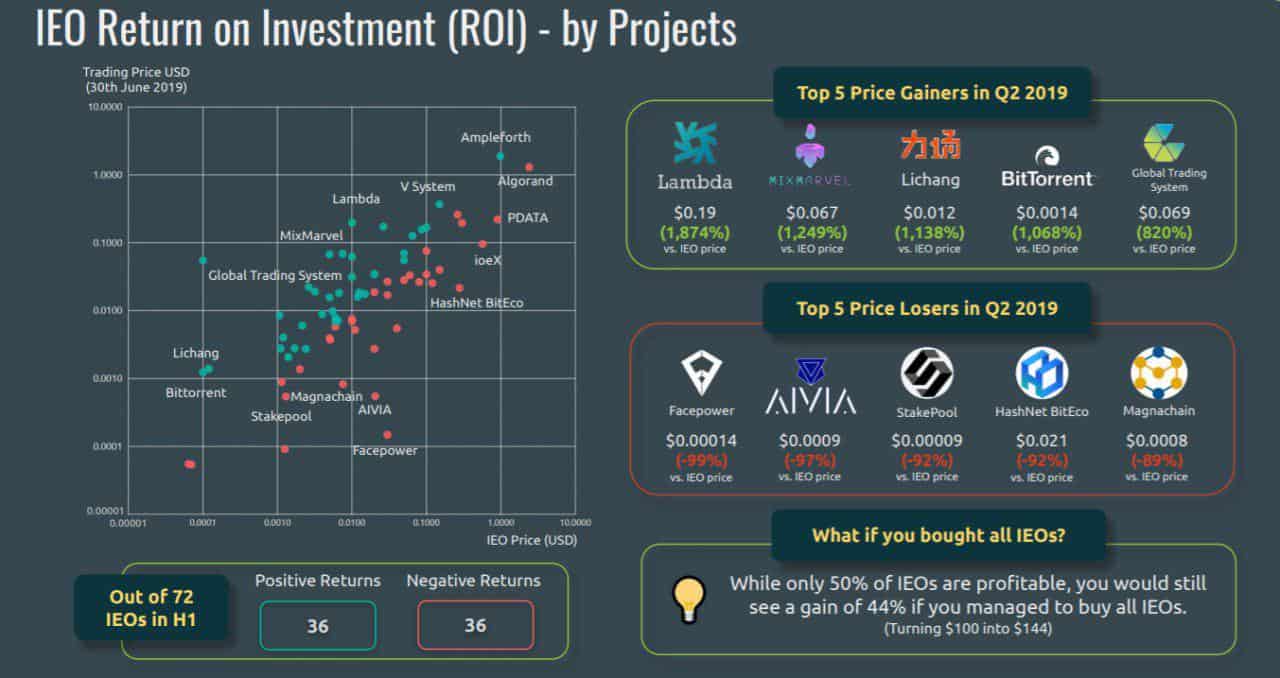

Top Winner Gained 1,800%, Loser Lost Over 90%

Despite the fact that only half of the IEO projects are profitable, if one managed to invest in all of them, he would still gain 44% ROI.

The top gainers include Lambda (1,874%), Mixmarvel (1,249%), Lichang (1,138%), Bittorent (1,068%), and Global Trading System (820%) while the coins of IEO projects like Facepower and Aivia have lost over 90% of their value since their token sales.

The post The ICO’s Comeback? IEOs Raised $262 Million In 6 Months appeared first on CryptoPotato.