The Handover Begins: TradFi Takes Center Stage in Crypto’s Next Phase

The great handover of crypto infrastructure from crypto natives to traditional finance is happening, but it is not driven by ideology, a newfound desire to “bank the unbanked,” or to promote an alternative financial system. Instead, it’s a function of both push and pull forces.

This post is part of Consensus Magazine’s Trading Week, presented by CME.

On one side, traditional institutions are pushing into crypto because they see a business opportunity and are jockeying for a share of this promising asset class. On the other, institutional investors are pulling them in because they lost trust in crypto native intermediaries.

Not only are institutions here, but they’re starting to eat the crypto-natives’ lunches.

Future futures

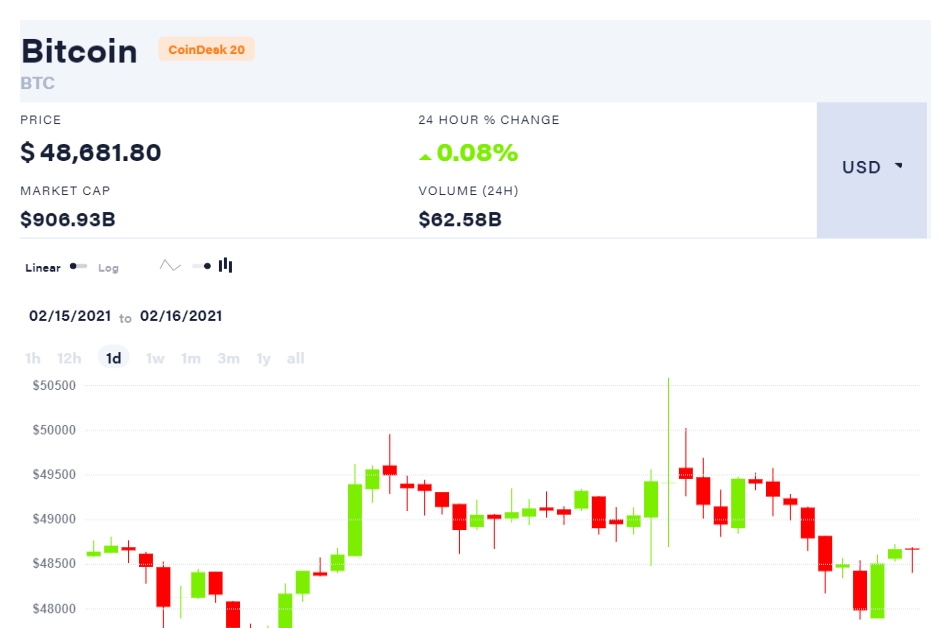

At the end of October, we saw headlines about CME was “on the cusp of replacing Binance as the top futures exchange.” This should come as no surprise (see table below). Binance (and its geographic entities) is opaque and lightly regulated. Imagine an investor or institution looking to short a crypto asset – say, for hedging purposes. Many will have a strong preference for expressing this view (shorting) with a traditional financial institution with a diversified balance sheet.

For some, carrying a large position in crypto with a crypto-only institution would be akin to buying CDS on Lehman from Bear Stearns, to make an extreme analogy. Operationally, the onboarding practices at large institutions are easily understood by their peers and have been fashioned over decades of securities law amendments (e.g. credit, KYC, and AML checks).

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/UCZ6ZI3MCFE23AQBSN4627FBTY.png)

Stablecoins

For centralized stablecoins, instant settlement and de-risking are no longer unique selling propositions. The market has moved on. Transparent and attested backing, openness around banking capabilities (rails and custody), liquidity and yield are now the most important elements.

It’s different for DeFi stablecoins, as it should be, as protocols try to carve out their own niches and look for competitive advantages. Even in the post-Terra world, DeFi continues to experiment with new constructs. Many of the first generation of stablecoin protocols, such as FRAX, were exploring ways to improve capital efficiency. But the latest batch is focused on passing through yield to users – in effect, importing “TradFi” returns into DeFi, mostly through U.S. Treasury yields (Frax, Ondo Finance, and Mountain Protocol for instance).

Can the dominance of USDT (Tether) and USDC (Circle) last forever? The only sure answer is that they will be challenged, both by DeFi importing outside yields, and by traditional institutions in jurisdictions that allow for regulated issuance. But, one way or another, the footprint of TradFi increases.

The rise of hybrid Institutions

The logical outcome is to expect institutions to “move to the center,” meaning crypto natives will become more TradFi-like, while TradFi institutions reinforce their operations in the space.

Consider the landscape: Coinbase is a crypto-native business that became a listed company. It is now offering futures to retail customers. FRAX, a DeFi stablecoin, has created a way to derive yield through investing in short-dated US treasury bills and repo agreements. JP Morgan created its own private blockchain to facilitate settlement and handles $1 billion daily. PayPal, with more than 400 million active users, has entered the stablecoin market through a partnership with NYDFS-regulated Paxos. Nomura and Standard Chartered have each invested in their own digital assets custody services (Komainu and Zodia respectively).

Then there are the spot Bitcoin ETF filings from BlackRock and Fidelity. In the U.K., we have noticed that industry stalwarts have registered as crypto-asset firms under the AML/CTF regime. Even regulators are adapting.

The institutional embrace of crypto is not a threat to the original vision of digital assets, but rather a catalyst for its further development and innovation. By bringing more legitimacy, liquidity, and diversity to the crypto space, institutions are helping to create a more robust and resilient ecosystem that can benefit all participants. The future of crypto is not a zero-sum game, but a collaborative and creative endeavor that can transform the world of finance.

Edited by Ben Schiller.