The Great Reset And The Rise Of Bitcoin

A documentary that explores the current state of our economy and the impact a new monetary system like Bitcoin can have on the world.

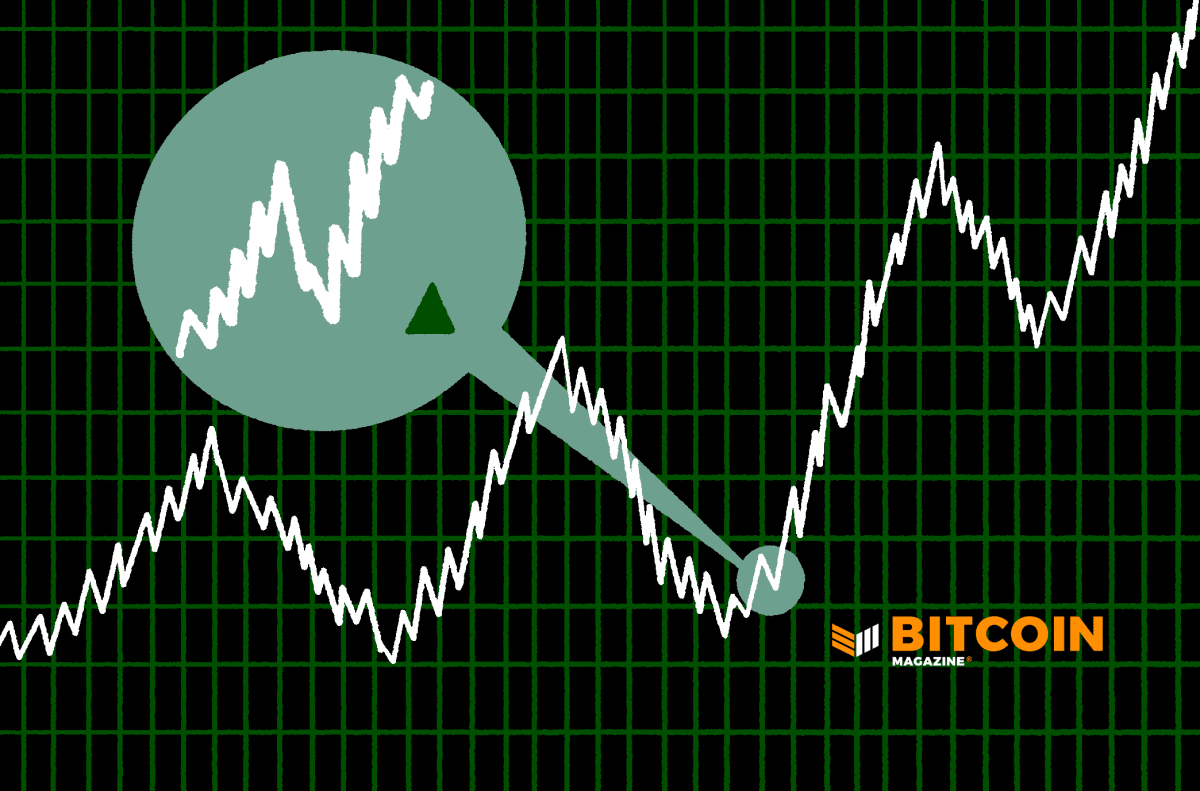

While our economy is known for working in cycles of growth and decline, we know that this is a phenomenon that started only in the last century. Before that point, our economy didn’t work with a system that relied entirely on debt. It is this new reliance on debt leading to growth that started these cycles. As Dylan LeClair says in his article, “The Conclusion Of The Long-Term Debt Cycle And The Rise of Bitcoin”: “Although productivity is the most important aspect of an economic system over the long term, not productivity but the forces of debt/credit are the main driving forces in volatile economic swings.”

At the beginning of the last century, major economies left the gold standard and started the practice of printing money without any assets backing it. This gave governments the power of infinite money. A power that has been abused in the past, and to this day, is used in the name of “saving the economy” through actions which, in fact, devalues our currencies and leads to the impoverishment of citizens in the long term. Or so it used to be — nowadays, the economy has been “saved” time and time again, using the same instruments, increasing debt, increasing the money supply, leading governments and central banks to a point of no return, where they have only one option left: continue printing. This impoverishment of the population that used to be a long-term effect of our system is now becoming a short-term effect, thanks to governments like the U.S. government increasing the money supply by over 40% in less than two years.

The film dives deep into the details of central bank actions and the current state of the effects these actions have, looking at numbers and indicators that are impacted by them: interest rates, quantitative easing (money printing) and welfare spending.

Although this acceleration seems obvious now, some have been observing this from the sidelines and have taken action. It is not governments, not universities or think tanks that came up with the solution. It all started from a post on an internet forum written by a person under the alias Satoshi Nakamoto. Putting together pre-existing computer science concepts, a new form of money was created by this person (or persons) and shared with the world. Its power, community, decentralization and scaling potential did the rest. Fast-forward over a decade and we now have an asset that has a valuation of approximately $1 trillion that no one can shut down.

It is money that has hard rules that cannot be changed, with a maximum supply of 21 million bitcoin. These two factors make it the hardest form of money in existence and, essentially, the better form of money. The film explains the details of how Bitcoin works, how mining works and the existing scaling options, such as the Lightning Network, that unlock bitcoin’s potential for growth and global adoption as a currency.

Open networks benefit from network effects for scaling, and counterintuitively, many of the actions taken against Bitcoin can also strengthen the network: Countries in which governments have banned Bitcoin have seen an increase in the price because people rushed to buy some, understanding its importance. Governments working on their central bank digital currencies (CBDC) will lead to the same result.

Additionally, these CBDCs eliminate the middleman that commercial banks have always been between central banks and their citizens. On one hand, central banks no longer need commercial banks in order to interact with the money in circulation, on the other hand, bitcoin eliminates the need citizens have for commercial banks. In such a context, commercial banks are forced to start pushing the adoption of bitcoin by offering services around the asset in order to remain attractive to their customers.

Taking the points above into consideration, there is an increasing number of money managers that are either considering entering the space or already have. It is considered an inflation hedge, a protection against governments and an investment in the future of finance.

In the current context, with financial markets around the world at all-time highs and many data points showing that we are at the end of our cycle, we can only expect the markets to start dropping eventually. In such events, the money is pulled out of the markets to hold cash or to buy bonds. In a scenario of high inflation and bonds yielding low or negative interest rates, none of these options make sense. At the same time, an entirely new financial market is now reaching a point of maturity in terms of institutional acceptance and available investment instruments. Additionally, it is the fastest growing financial asset in history, with an average price increase of 200% per year since its creation. It currently is one of the best trades available.

In the film, “The Great Reset and the Rise of Bitcoin,” we have tried to put together all the important details about our economic context — central bank actions, history, bitcoin and more — in order for viewers to get a good level of understanding on our current situation and be able to make educated decisions on the future of the financial world they want to live in.

The film premieres on January 5, 2021, and is available for streaming for free on the official website — www.thegreatresetfilm.com — where you can also find the film in article format, extracts of the film, all data sources and more.

Watch the trailer below, visit our website and make sure you watch the film.

This is a guest post by Pierre Corbin. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.