The Government Shutting Down Isn’t Great for Crypto

I was out sick yesterday and so instead of anything resembling a proper newsletter, I have a few thoughts on salient issues of our time, like how an impending government shutdown is probably Not Good News for crypto’s D.C. hopes.

On a trial-related note, you received preview copies of The SBF Trial, a newsletter we launched last week to keep readers up to speed on Sam Bankman-Fried’s time in court. The trial kicks off next Tuesday. Want to keep receiving the newsletter? Sign up here.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

Wait, I’ve Seen This One Before

The narrative

The last time the U.S. government shut down, it delayed several approvals for companies and slowed down what many in the industry hoped would be greater regulatory acceptance of crypto.

Why it matters

Well, here we are again. But this shutdown looks to be much weirder than the last one.

Breaking it down

There’s a very strong possibility the federal government will be shut down by the time you receive the next edition of this newsletter.

The House of Representatives does not look particularly close to a deal on keeping the federal government running in the short term, with House Speaker Kevin McCarthy facing dissatisfaction from his right flank, decreasing the chances of a continuing resolution that would keep federal employees paid.

During the last shutdown in 2018 and 2019, companies like Bakkt and ErisX (now a part of Cboe) saw much-needed approvals pushed weeks behind. A bitcoin exchange-traded fund application was withdrawn, with one of the executives at the company behind the product explicitly blaming the shutdown.

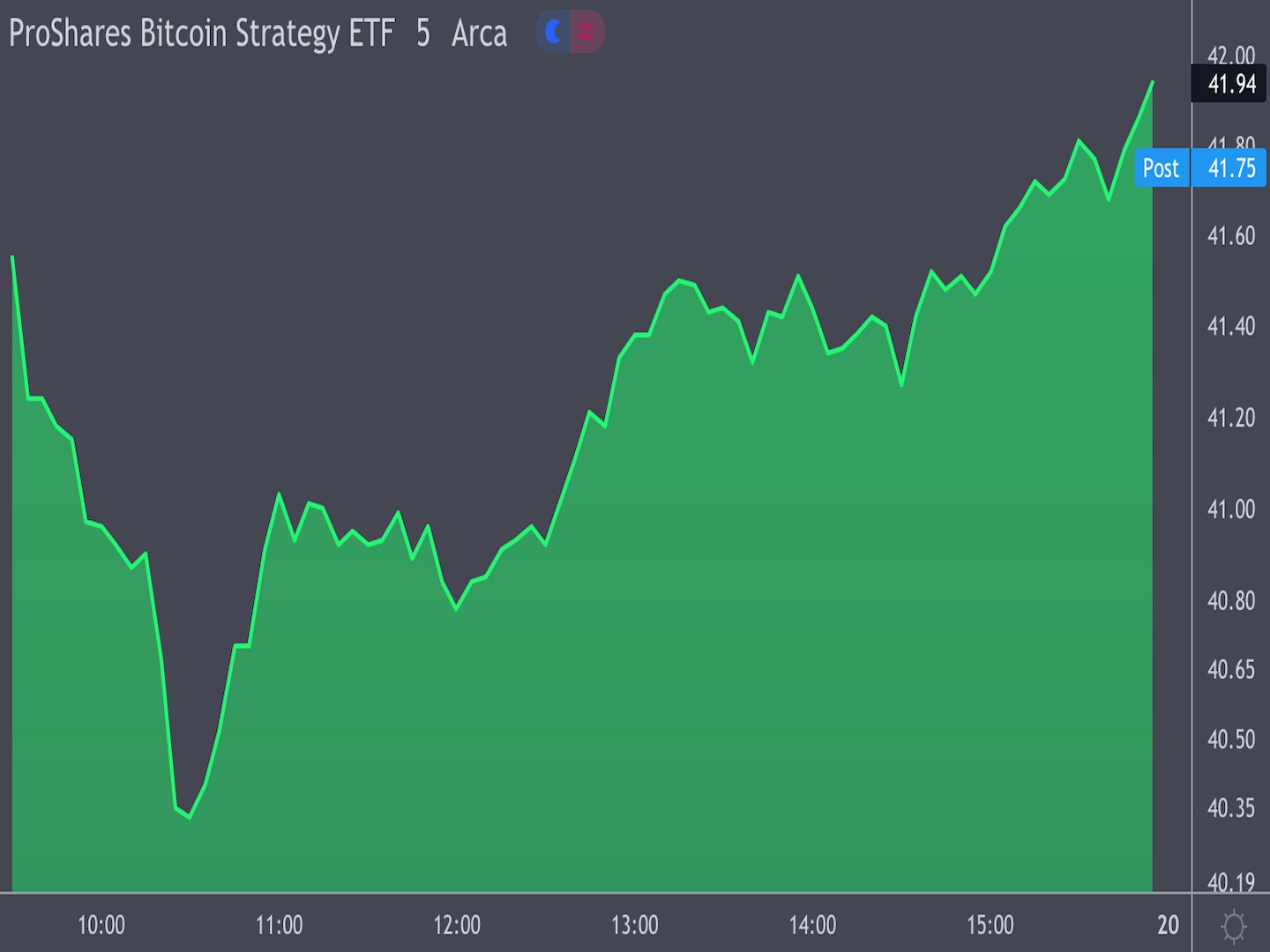

We’re already seeing the SEC preemptively delay bitcoin ETF applications. Coinbase is also currently looking at an Oct. 11 deadline for a response from the SEC to its Mandamus petition.

My colleague Jesse Hamilton dug into this yesterday for CoinDesk, finding that the shutdown won’t quite be a death knell for crypto projects.

One big concern may be for civil and bankruptcy court cases after the first few weeks, when the courts themselves start to slow down. The SEC may also have a limited litigation team during the time period.

Crypto legislation is also likely to be slowed or halted entirely (though these bills have a limited chance anyway), Jesse wrote.

Stories you may have missed

This week

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/SLVNMR4I5ZFUBMRLFSBAVURSD4.png)

-

18:00 UTC (2:00 p.m. EDT) Creditors for Prime Trust met.

-

14:00 UTC (10:00 a.m. EDT) The House Financial Services Committee will hold a hearing with Securities and Exchange Commission Chair Gary Gensler.

-

I completely forgot to note that there was a House Financial Services Committee markup on certain central bank digital currency bills last week. Catch up on what happened here.

Elsewhere:

-

(USCPSC) The U.S. Consumer Product Safety Commission released an album. Like, a musical album. Unironically, this rules.

-

(Techdirt) Mike Masnick over at Techdirt analyzes what recent statements on the former bird site by proprietor Elon Musk might mean for its usage.

-

(NJ.com) U.S. Senator Robert Menendez (D-N.J.), was indicted on corruption charges last week.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/RAMJ2UZMCFFVZBVXKRND6TXMOE.png)

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at nik@coindesk.com or find me on Twitter @nikhileshde.

You can also join the group conversation on Telegram.